Current trend

Shares of the American telecommunications company Verizon Communications Inc. are trading in a corrective trend near the 41.00 mark.

Yesterday, a message appeared on the company's website that the Mindful by Medallia callback scheduling service, which includes electronic queue management and voice calls, has become available for purchase by California government agencies.

Forecasts for the financial results of Verizon Communications Inc., which will be published on April 22, assume revenue of 33.35 billion dollars, which is slightly lower than the 35.10 billion dollars shown in the previous quarter. Earnings per share (EPS) are expected to reach 1.12 dollars after 1.08 dollars a quarter earlier. The dividends based on the results of the report have already been determined: the payment will take place on May 1, and the closing of the register of shareholders for the purchase of shares is scheduled for April 9. The payout amount will be 0.665 dollars, which is equivalent to a high yield of 6.51% per quarter, attracting investors to the asset.

Support and resistance

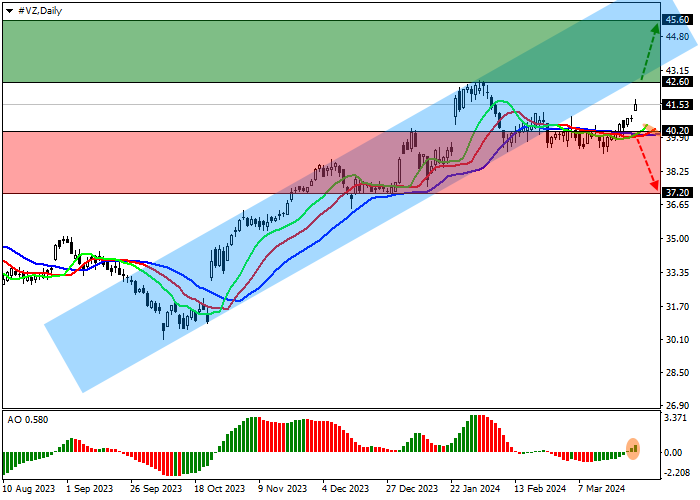

On the D1 chart, quotes are adjusted, holding below the support line of the ascending channel with dynamic borders of 45.00–42.00.

Technical indicators retain the buy signal, which has begun to actively strengthen: the range of EMAs fluctuations on the Alligator indicator is expanding, and the AO histogram forms bars with a downtrend, remaining above the transition level.

Support levels: 40.20, 37.20.

Resistance levels: 42.60, 45.60.

Trading tips

In the event of a reversal and continued corrective growth of the asset, as well as price consolidation above the resistance level of 42.60, buy positions with the target of 45.60 maybe opened. Stop-loss – 41.60. Implementation time: 7 days and more.

In the event of a reversal and continued decline of the asset, as well as price consolidation below the support level of 40.20, one can open sell positions with the target of 37.20 and stop-loss of 41.00.

Hot

No comment on record. Start new comment.