Current trend

The GBP/USD pair has been declining for the third week. During the last few sessions, it has been trading around 1.2634 (Murrey level [3/8]) but today, the pound came under pressure again after the publication of data on the country’s gross domestic product (GDP).

Thus, in the fourth quarter, the British economy shrank by 0.3% and by 0.2% YoY, confirming a recession. These data, combined with a cooling labor market and a continued decline in inflation, increase the likelihood that the Bank of England will soon begin easing monetary policy. In January, unemployment reached 3.9%, the average level of wages with bonuses adjusted from 5.8% to 5.6%, and the February consumer price index – from 4.0% to 3.4%.

Today, data on US Q4 2023 GDP will be published: according to preliminary estimates, the growth of the American economy will be 3.2%, slightly less than 4.9% previously. The national economic recovery may be much faster than the British one, creating additional pressure on the GBP/USD pair.

Support and resistance

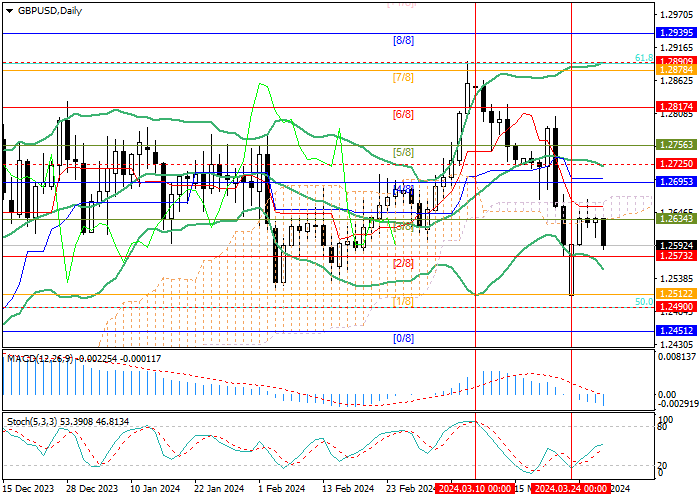

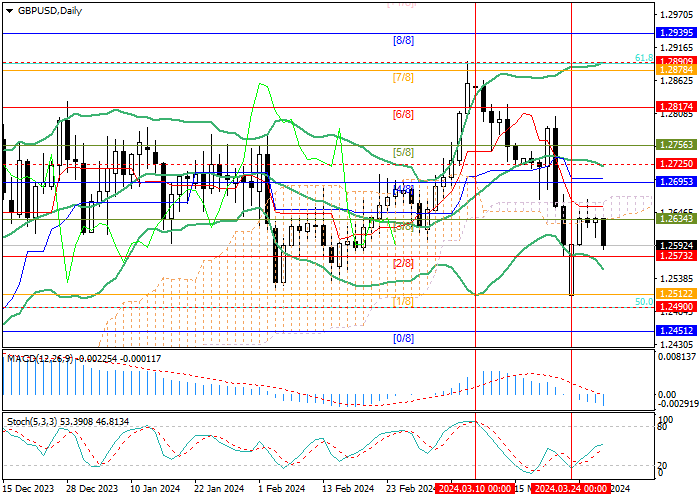

The trading instrument is close to 1.2573 (Murrey level [2/8]), a breakdown of which will allow it to fall to the area of 1.2490 (Fibonacci correction 50.0%), 1.2451 (Murrey level [0/8]). In case of consolidation above the key “bullish” support zone of 1.2695–1.2725 (Murrey level [4/8], middle line of Bollinger bands), the quotes will return to the area of 1.2817 (Murrey level [6/8]) and 1.2890 (Fibonacci correction 61.8 %).

Technical indicators record the formation of a downward trend: Bollinger bands reverse downwards, the MACD histogram is increasing in the negative zone but Stochastic is directed upwards, not excluding growth.

Resistance levels: 1.2725, 1.2817, 1.2890.

Support levels: 1.2573, 1.2490, 1.2451.

Trading tips

Short positions can be placed below 1.2573, with the targets at 1.2490, 1.2451, and stop loss 1.2630. Implementation time: 5–7 days.

Long positions may be opened above 1.2725, with the targets at 1.2817, 1.2890 and stop loss 1.2660.

Hot

No comment on record. Start new comment.