Current trend

Brent Crude Oil prices are retreating from recent highs, trading at 86.25 ahead of the release of US gross domestic product (GDP) data for the fourth quarter of 2023.

After reaching the high of 87.89, the price corrected downwards, falling against rising US oil inventories. According to the US Department of Energy’s Energy Information Administration (EIA), the figure increased by 3.165M barrels over the past week. However, by the end of Wednesday, the instrument added 0.47%. Today, market participants will pay attention to GDP statistics: according to preliminary estimates, the value will be 3.2% QoQ, which can support the asset, contributing to the growth in oil demand.

Last week, according to the US Commodity Futures Trading Commission (CFTC), net speculative positions in WTI Crude Oil increased from 233.8K to 277.8K. As for the dynamics, the balance of the “bulls” amounted to 304.597K versus 342.115K for the “bears.” Last week, buyers closed 1.272K transactions, while sellers formed 4.181K new positions.

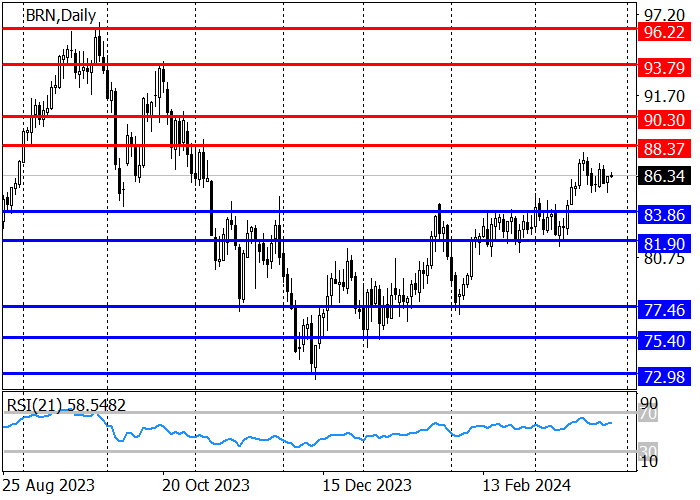

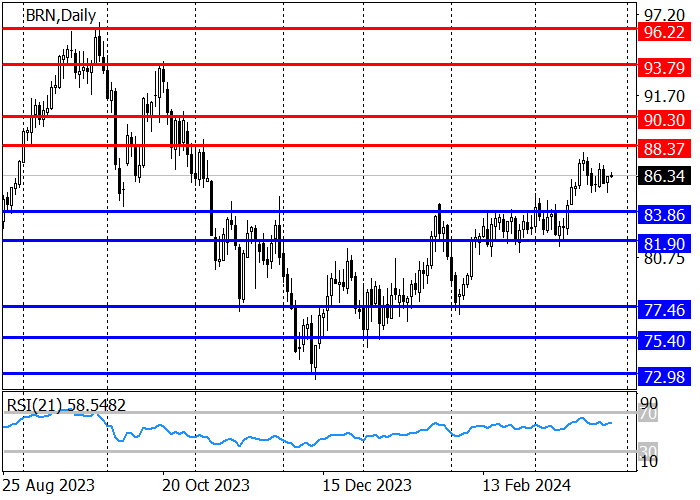

The long-term trend is upwards: after consolidating above the support level of 83.86, the price reached 87.89 and went into a downward correction. If it continues, the price may reach the support level, where long positions with the target at 88.37 and then 90.30 become relevant.

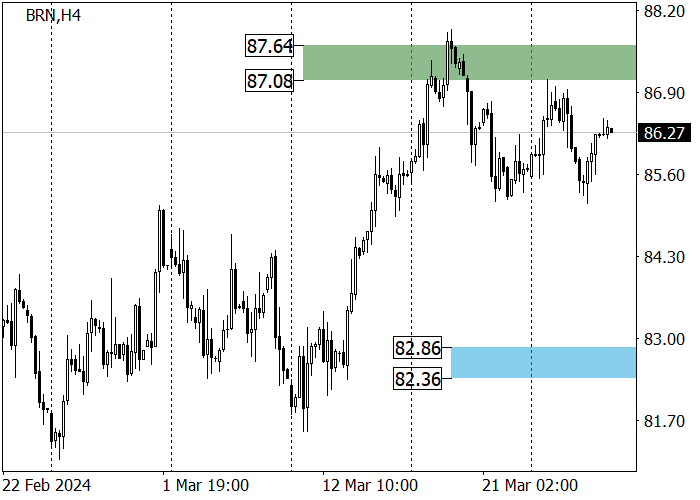

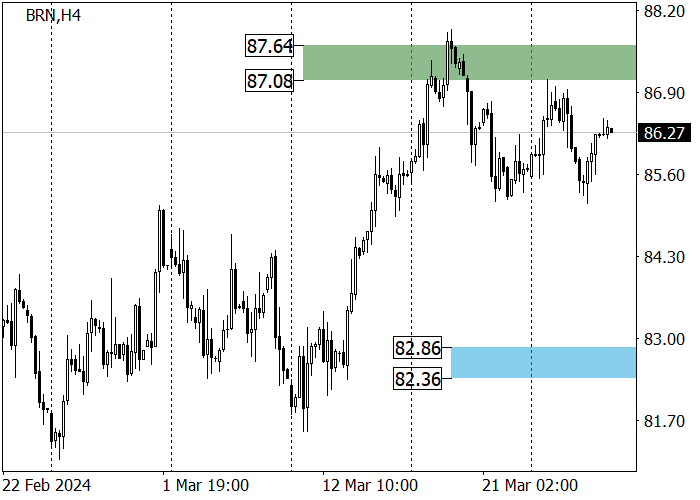

The medium-term trend is upward: as part of last week’s growth, the quotes rose to the zone 87.64–87.08, where they began a correction to the key trend support area of 82.86–82.36, where long positions with the target in the zone 87.64–87.08 and then with the target in the zone 2 (93.19–92.63) become relevant.

Resistance levels: 88.37, 90.30.

Support levels: 83.86, 81.90, 77.46.

Trading tips

Long positions may be opened from 83.86, with the target at 88.37 and stop loss around 82.30. Implementation time: 9–12 days.

Short positions may be opened below 82.30, with the target at 77.46 and stop loss around 84.30.

Hot

No comment on record. Start new comment.