Current trend

The leading index of the Frankfurt Stock Exchange DAX 40 is trading at 18546.0, strengthening its growth against the background of a correction in the bond market and the publication of macroeconomic reports.

Retail sales in Germany decreased by 1.9% in February, turning out to be worse than the projected growth of 0.4% and -0.4% a month earlier, while YoY, the downtrend accelerated from -1.4% to -2.7%, also being much lower than preliminary estimates of -0.8%. In addition, data on the labor market were published today: as expected by analysts, the unemployment rate remained at 5.9%, which was facilitated by a slight increase in the number of unemployed by 4.0 thousand in March after an increase of 11.0 thousand in February.

Since the beginning of last week, there has been a downtrend in the domestic bond market, which provides serious support to the index: for example, the most popular 10-year German bonds are trading at a rate of 2.290%, which is significantly lower than last week's figure of 2.367%, while 20-year securities today are trading at a rate of 2.487%, significantly below 2.599% a week earlier.

Among the growth leaders are: Zalando SE ( 4.46%), Bayer AG ( 4.05%), Deutsche Bank ( 2.68%), Siemens Healthineers AG ( 1.95%).

Among the companies showing downward dynamics are: Rheinmetall AG (-1.80%), Sartorius AG (-1.75%) and Vonovia SE (-0.98%).

Support and resistance

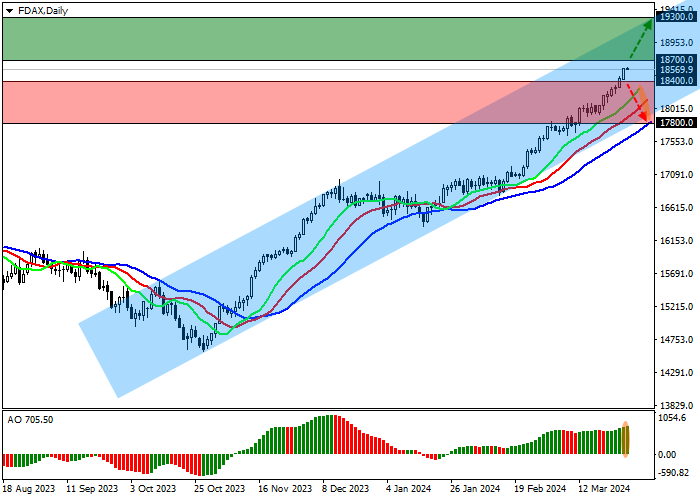

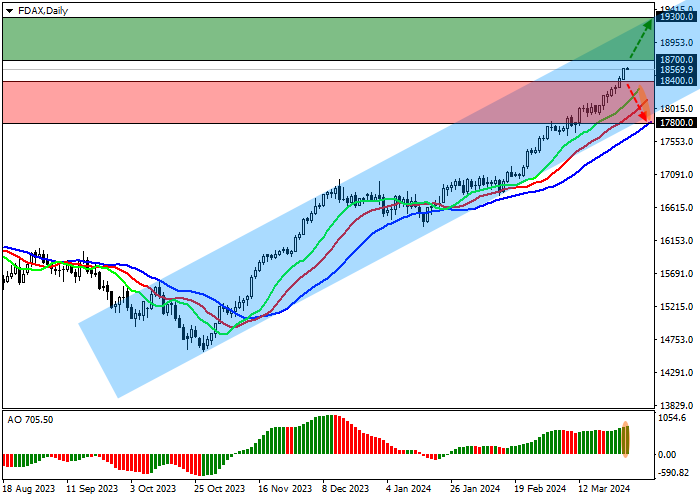

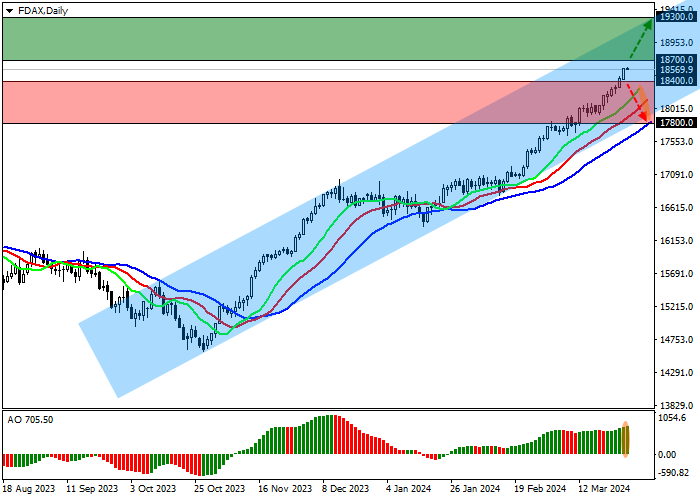

On the D1 chart, the asset is trading in an uptrend and is approaching the resistance line of the ascending channel with dynamic borders of 19300.0–18000.0.

Technical indicators stably hold the buy signal and expand the range of fluctuations: fast EMAs on the Alligator indicator continue to move away from the signal line, and the AO histogram, being in the buy zone, continues to form ascending bars.

Support levels: 18400.0, 17800.0.

Resistance levels: 18700.0, 19300.0.

Trading tips

If the local growth of the asset continues and the price consolidates above the resistance level of 18700.0, one may open long positions with the target of 19300.0 and stop-loss of 17500.0. Implementation time: 7 days and more.

In the event of a reversal and decline of the asset, as well as price consolidation below the support level of 18400.0, one can open short positions with the target of 17800.0 and

Hot

No comment on record. Start new comment.