Current trend

The EUR/USD pair is moving in a corrective trend, trading at 1.0823.

Market activity has remained subdued over the past few days as many investors choose not to open new positions ahead of the Easter holidays despite positive macroeconomic data. Thus, the March consumer price index in Spain increased from 0.4% to 0.8% MoM and from 2.8% to 3.2% YoY. The increase in the EU-harmonized indicator was 1.3% MoM, the highest since June 2022, accelerating the value from 2.9% to 3.2% YoY. The EU consumer confidence index corrected from –14.9 points to –15.5 points, the index of expected selling prices – from 3.9 to 5.6 points, and the index of expectations in the service sector – from 6.0 points to 6.3 points. Sentiment is improving due to expectations that European Central Bank (ECB) officials will soon begin cutting interest rates. Thus, today, the head of the Bank of Italy, Piero Cipollone, said that the authorities’ confidence that inflation will return to the target of 2.0% by mid–2025 is increasing as wage growth is slowing, which is the basis for adjusting monetary policy.

The American dollar is holding at 104.00 points in USDX. The 30-year mortgage rate fell from 6.97% to 6.93%, remaining quite high. The index of mortgage applications was 145.7 points, down from 146.0 points previously, and the mortgage market index changed from 198.2 points to 196.8 points. On Friday at 14:30 (GMT 2), the price index of personal consumption expenditures will be published. According to preliminary estimates, the February indicator will increase from 0.3% to 0.4% MoM and from 2.4% to 2.5% YoY and the core value will decrease from 0.4% to 0.3% MoM and remain at 2.8% YoY. This indicator is actively used by the US Federal Reserve when calculating average inflation in the country and may significantly affect interest rate forecasts.

Support and resistance

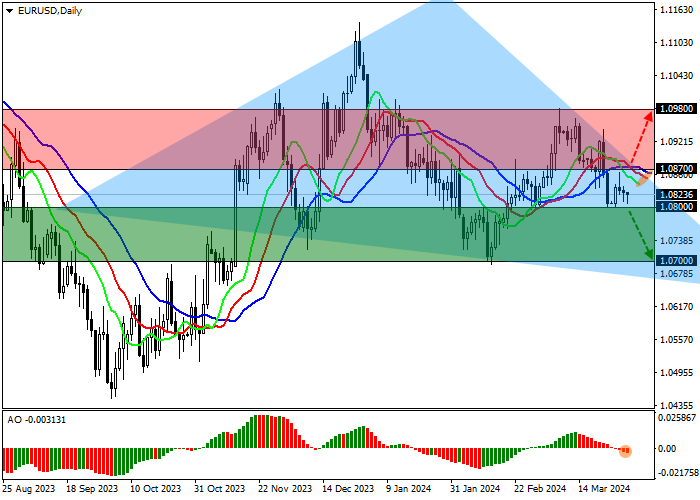

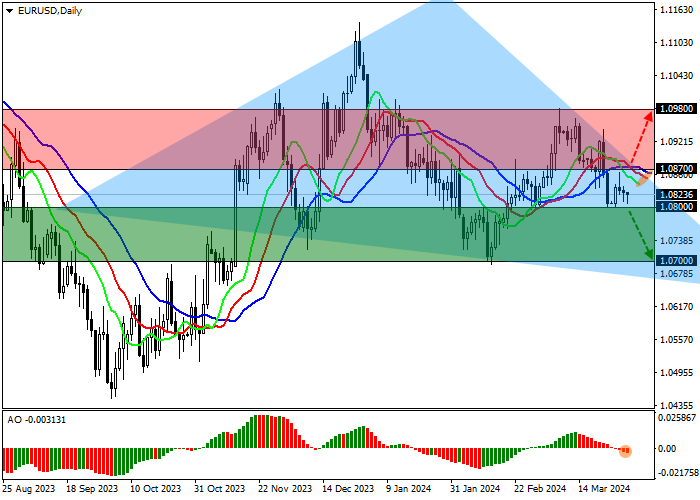

On the daily chart, the trading instrument is declining, completing the formation of the second Shoulder of the global Head and shoulders pattern with the Neckline at 1.0650.

Technical indicators hold a sell signal: fast EMAs on the Alligator indicator move away from the signal line, expanding the range of fluctuations, and the AO histogram forms downward bars, falling in the sales zone.

Resistance levels: 1.0870, 1.0980.

Support levels: 1.0800, 1.0700.

Trading tips

Short positions may be opened after the price declines and consolidates below 1.0800, with the target at 1.0700. Stop loss is around 1.0850. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 1.0870, with the target around 1.0980. Stop loss – 1.0810.

Hot

No comment on record. Start new comment.