Current trend

During the Asian session, the USD/TRY pair developed a “bullish” trend in the short term and tested the level of 32.3060 for a breakout as investors await the release of key macroeconomic statistics on consumer inflation in the United States.

On Friday at 14:30 (GMT 2), the personal consumption expenditures price index will be published. According to preliminary estimates, the February indicator will increase from 0.3% to 0.4% MoM and from 2.4% to 2.5% YoY, and the core value will decrease from 0.4% to 0.3% MoM and remain at 2.8% YoY. Any changes in the indicator could affect expectations of a transition to the “dovish” US Fed course. The main scenario assumes the first interest rate cut by 25 basis points during the June meeting, and a total of no less than three reductions in borrowing costs are forecast this year.

The lira is weakening amid internal economic problems in the country. Last week, the Central Bank of the Republic of Turkey raised its key interest rate by 500 basis points to 50.0%, although analysts expected either a rise of 250 basis points or the rate remaining unchanged. Official forecasts regarding inflation remain virtually unchanged: officials believe that at the end of the year, the figure will be 36.0%, and in 2025 – 14.0%. The start of the tourism season is helping the economy recover slightly, with the number of foreign travelers rising from 2.10% to 22.68% in February to 2.3M, with 1.3M visiting Istanbul, the country’s largest city. Earlier, Turkish President Recep Tayyip Erdogan said the country plans to welcome 60.0M tourists this year, receiving industry revenues of 60.0B dollars. Thus, in 2023, 56.7M tourists visited the country, which is 12.0% more than a year earlier, and revenues amounted to 54.3B dollars, an increase of 16.9%.

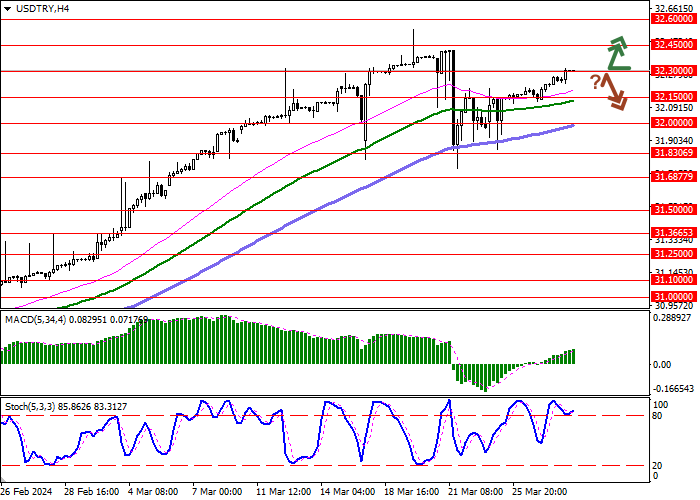

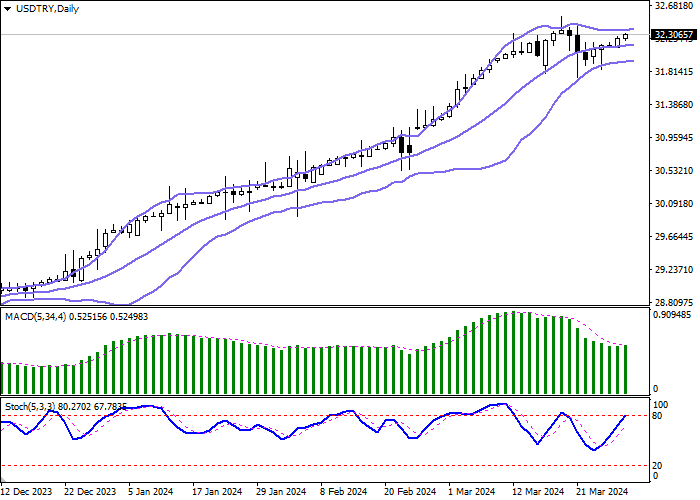

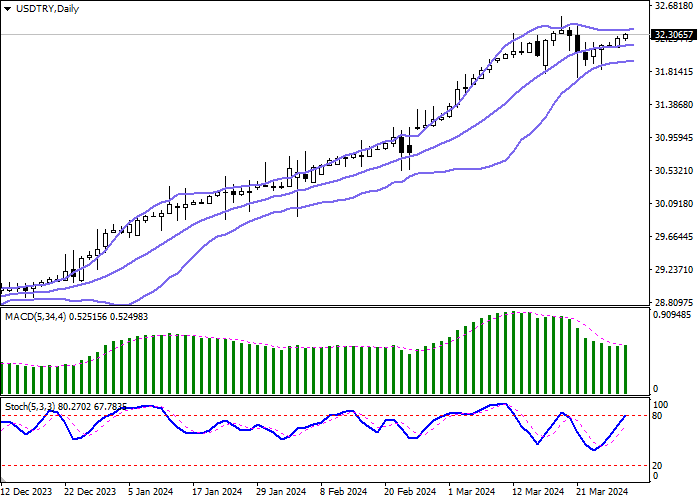

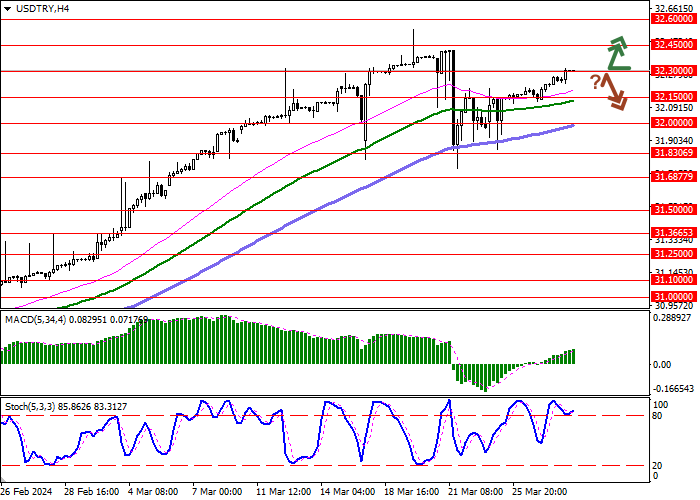

Support and resistance

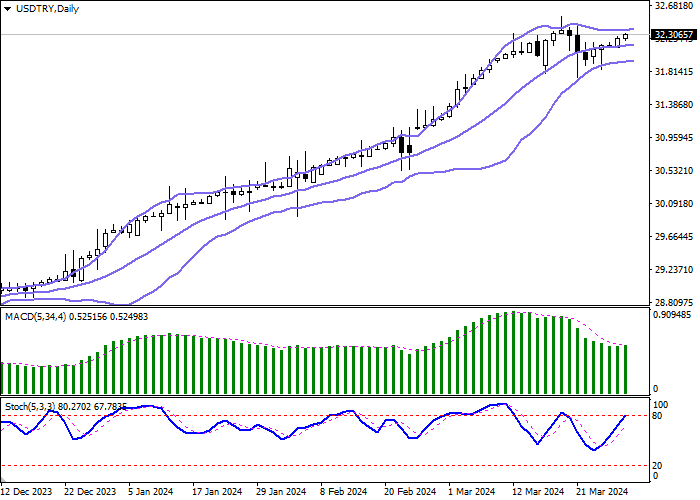

On the daily chart, Bollinger Bands are moving flat: the price range changes slightly, remaining wide enough for the current level of activity in the market. The MACD indicator reverses upwards, forming a buy signal: the histogram tends to be above the signal line. Stochastic is quickly approaching its highs, indicating that the American dollar may become overbought in the ultra-short term.

Resistance levels: 32.3000, 32.45000, 32.6000, 32.7500.

Support levels: 32.1500, 32.0000, 31.8306, 31.6877.

Trading tips

Long positions may be opened after a breakout of 32.3000, with the target at 32.6000. Stop loss – 32.1500. Implementation time: 2–3 days.

Short positions may be opened after a rebound from 32.3000 and a breakdown of 32.1500, with the target at 31.8306. Stop loss – 32.3000.

Hot

No comment on record. Start new comment.