Current trend

The USD/JPY pair again shows weak growth, testing 151.35 for a breakout: the yen is holding near its record lows since 1990. At the same time, trading participants again began to actively discuss the possibility of currency interventions by the Bank of Japan, as was the case last year, when the instrument consolidated above the level of 145.00.

The national currency received virtually no support after the Japanese regulator abandoned the policy of negative interest rates. This decision was expected, so analysts focused on the prospects for further tightening of monetary policy, which are not clear yet. Bank of Japan officials said they will continue to maintain loose monetary policy and the same volume of purchases in the bond market. Bank of Japan member of the Policy Board Naoki Tamura noted that the regulator must continue to consistently tighten monetary parameters, and also warned of the risks of an aggressive increase in borrowing costs if the rate of growth in consumer prices is too rapid.

On Friday, Japan will present March inflation data in the Tokyo region: the CPI excluding Fresh Food is forecast to adjust from 2.5% to 2.4%. Also, during the day, the publication of February statistics on Retail Sales and Industrial Production are expected. The monthly Industrial Production rate is expected to increase 1.4% from -6.7% in the previous month, while Retail Sales could rise from 2.3% to 3.0%.

In addition, tomorrow at 14:30 (GMT 2) investors will pay attention to data on the Personal Consumption Expenditures - Price Index from the United States: in February the index is expected to adjust from 0.3% to 0.4% in monthly terms and from 2.4% to 2.5% in annual terms.

Support and resistance

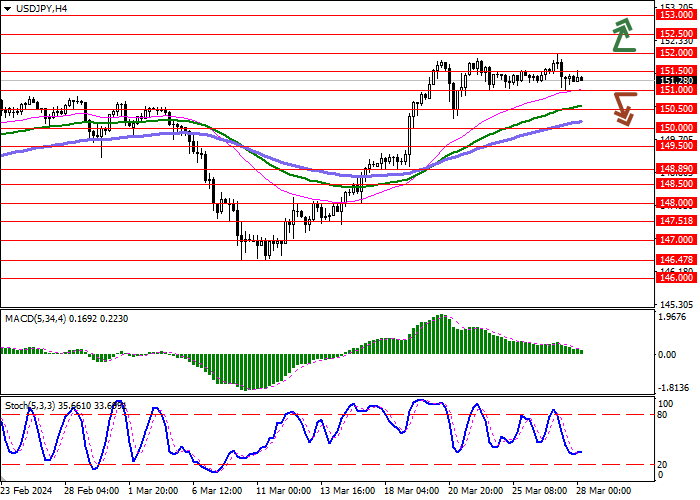

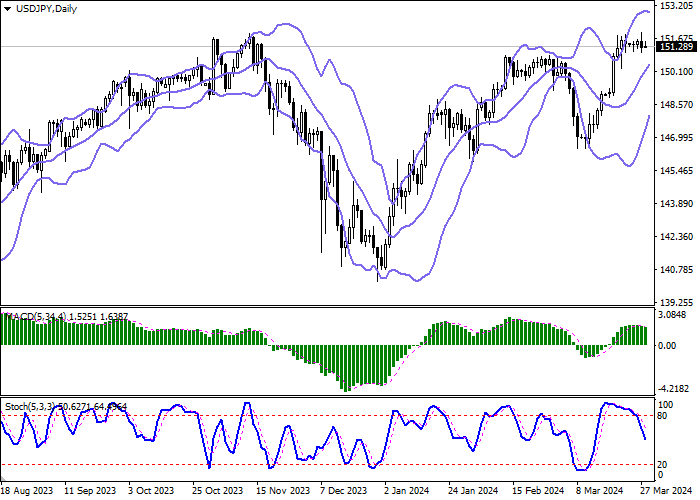

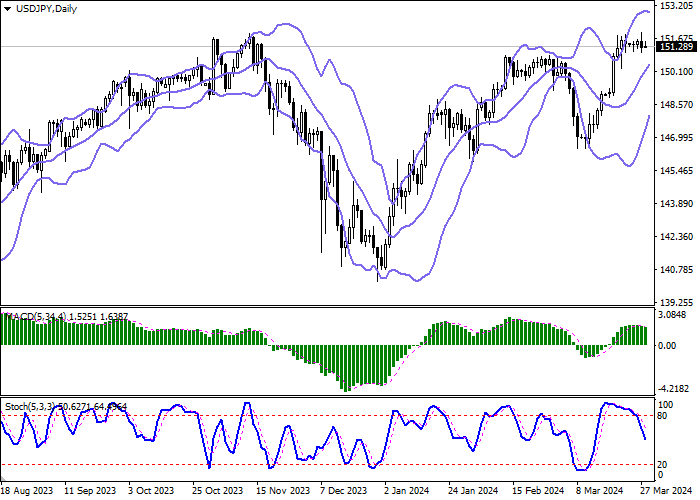

Bollinger Bands on the daily chart show a steady increase. The price range is actively narrowing, reflecting ambiguous nature of trading in the short term. MACD reversed towards declining, having formed a new sell signal (located below the signal line). Stochastic is showing more stable decline and is located in the middle of its area.

Resistance levels: 151.50, 152.00, 152.50, 153.00.

Support levels: 151.00, 150.50, 150.00, 149.50.

Trading tips

Short positions may be opened after a breakdown of 151.00 with the target at 150.00. Stop-loss — 151.50. Implementation time: 2-3 days.

The return of the "bullish" trend with the breakout of 152.00 may become a signal for new purchases with the target of 153.00. Stop-loss — 151.50.

Hot

No comment on record. Start new comment.