Current trend

During the Asian session, the GBP/USD pair is trading at 1.2620, developing the downward momentum formed yesterday after a retreat from the highs of March 21.

The results of the Bank of England meeting on monetary policy supported last week’s negative dynamics. The interest rate was kept at 5.25%, approved by eight board members, and the reduction was approved by one person. In subsequent comments, the head of the regulator, Andrew Bailey, emphasized that a sustainable slowdown in inflation rates can only be confirmed by macroeconomic data monitored daily. Analysts believe the meeting minutes could add pressure on the pound, reflecting a more “dovish” rhetoric than previously thought. On Thursday, final statistics on the Q4 gross domestic product (GDP) will be published: experts do not assume any changes in previous estimates, expecting a weakening of the British economy by 0.3% QoQ and by 0.2% YoY, while the US GDP may strengthen by 3.2%.

The American dollar lost ground after the decision on monetary policy by US Fed officials, who kept the interest rate at 5.50% but then strengthened against statistical data. February existing home sales adjusted by 9.5% against expectations of –1.3%, and initial jobless claims amounted to 210.0K, higher than preliminary estimates of 212.0K. Today, the US currency is under pressure from macroeconomic statistics. The Conference Board consumer confidence index, based on a survey of 5.0K American households and considering their vision of the current and future economic situation, amounted to 104.7 points in March, below the forecast of 106.9 points, and the previous value was corrected from 106.7 points to 104.8 points.

Support and resistance

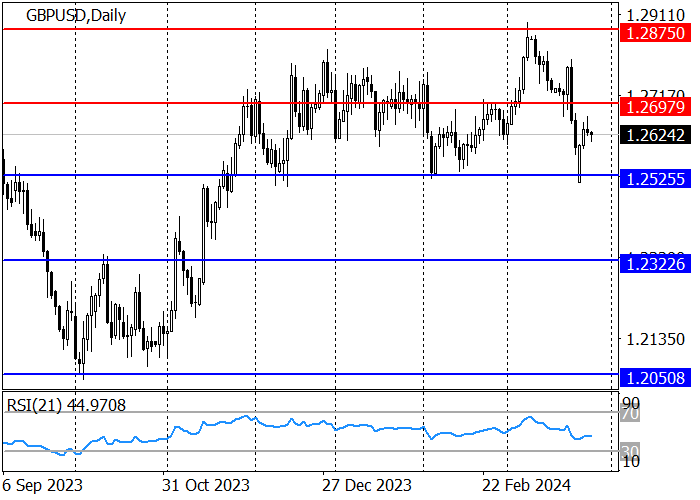

The long-term trend is upward: in March, the price renewed the December high of 1.2828 and reached the resistance level of 1.2875, after which it went into a correction and broke the support level of 1.2698, which has now become the resistance level. At the moment, the quotes are rising to 1.2698, after holding which a reversal and decline to the trend line of 1.2525 is expected. Otherwise, the trend will continue to 1.2875.

The medium-term trend is upward: last week, the price tested the key trend support zone 1.2589–1.2559 and is developing positive dynamics towards the March high of 1.2887, with the strong resistance levels on the way of 1.2668 and 1.2798.

Resistance levels: 1.2697, 1.2875.

Support levels: 1.2525, 1.2322.

Trading tips

Short positions may be opened from 1.2698 with the target at 1.2525 and stop loss 1.2745. Implementation time: 9–12 days.

Long positions may be opened above 1.2745 with the target at 1.2875 and stop loss 1.2698.

Hot

No comment on record. Start new comment.