Current trend

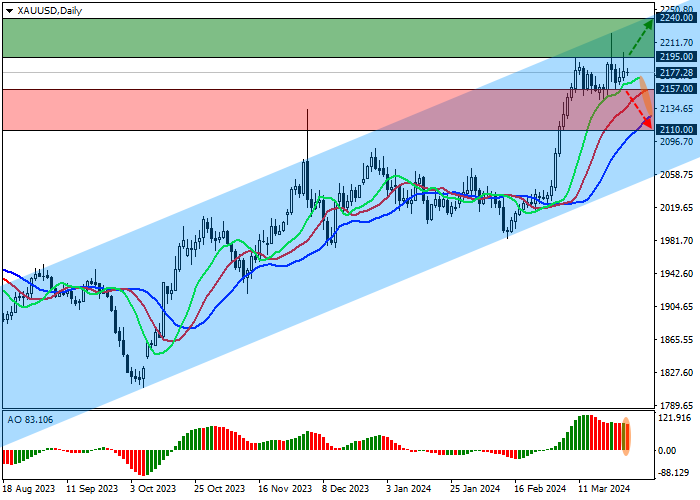

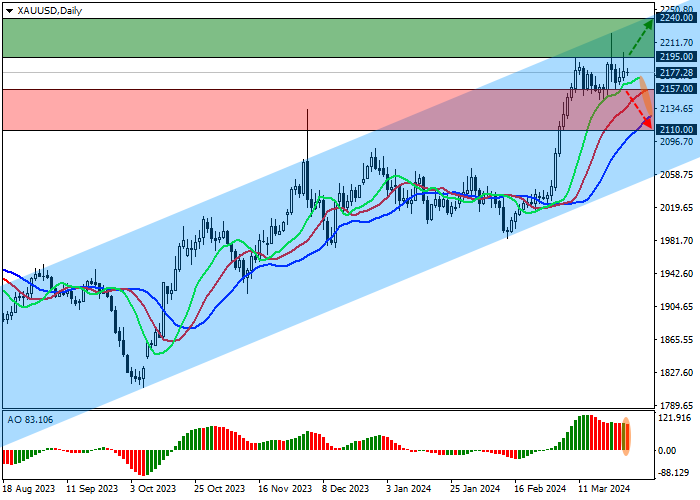

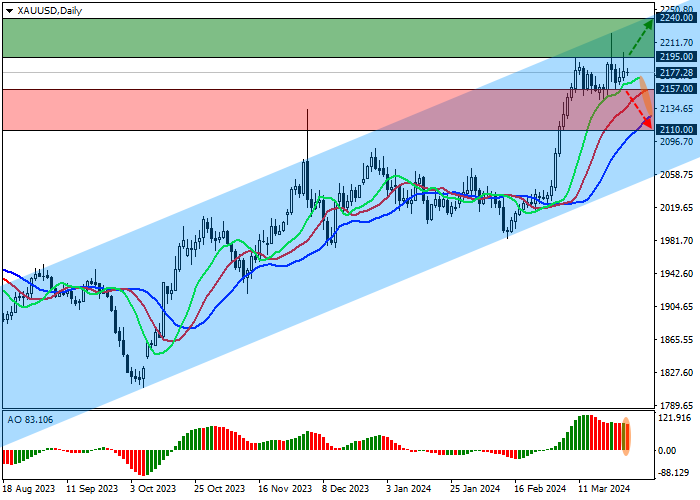

The XAU/USD pair is moving within an upward trend, and now there is a correction caused by the fixation of a part of long positions after breaking through the resistance level of 2150.0.

Global growth factors remain but to break through the current level, a stronger driver is required, which could be the results of the US Fed’s latest meeting. Despite softer comments from the head of the regulator, Jerome Powell, easing of monetary policy has not yet begun but plans to reduce the interest rate as at least three times before the end of the year have emerged, which supports gold prices. According to the Chicago Mercantile Exchange (CME) FedWatch Instrument, the likelihood of an adjustment to borrowing costs at the May 1 meeting is estimated at 11.7%, much higher than before the March meeting (2.0%). Since Powell’s call for a “dovish” policy, forecasts have been rising steadily, and as they approach 30.0%, we can expect increased volatility in the market.

In addition, the asset also supports investment demand on commodity exchanges: since the beginning of March, the average trading volume over the last five trading sessions, according to CME data, is 378.5K contracts, exceeding 525.0K transactions at peak values, much higher than the average value February in 178.0K positions. An increase in the indicator by more than two times could not but be accompanied by an increase in quotations.

Support and resistance

On the daily chart, the price is correcting below the resistance line of the ascending channel 2240.0–2020.0.

Technical indicators are strengthening the buy signal: fast EMA on the Alligator indicator are above the signal line, maintaining a wide range of fluctuations, and the AO histogram is forming corrective bars above the transition level.

Resistance levels: 2195.0, 2240.0.

Support levels: 2157.0, 2110.0.

Trading tips

Long positions may be opened after the price rises and consolidates above 2195.0, with the target at 2240.0. Stop loss – 2170.0. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 2157.0, with the target at 2110.0. Stop loss – 2170.0.

Hot

No comment on record. Start new comment.