Current trend

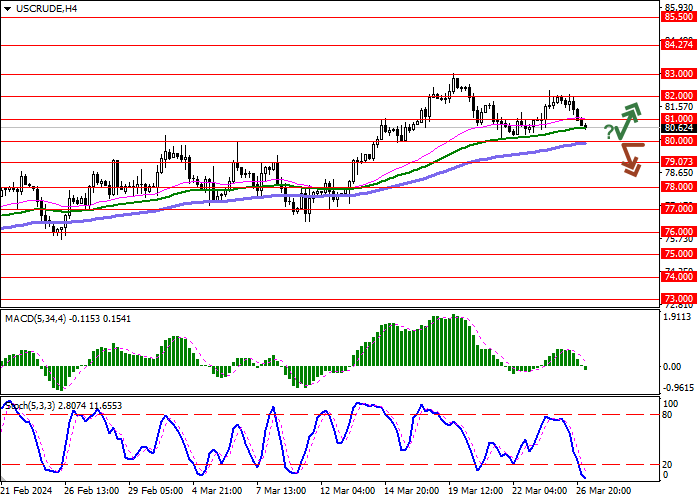

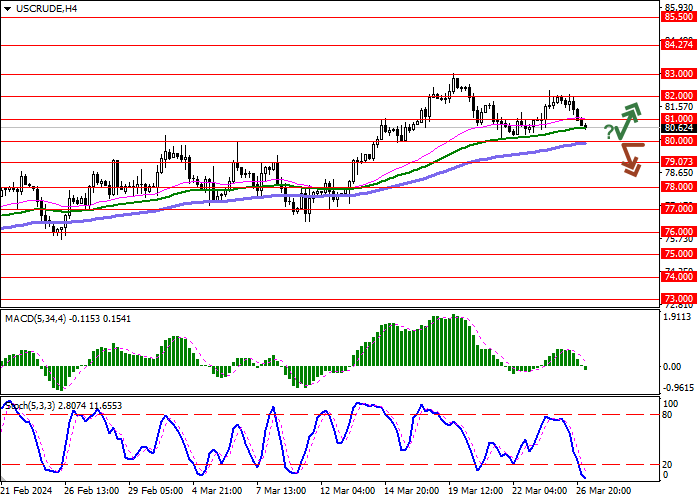

During the Asian session, prices for WTI Crude Oil are developing a downward momentum formed yesterday, when the quotes retreated from the highs of March 20, and are testing the level of 80.60 for a breakdown.

At the end of the week, investors wait for the key American macroeconomic statistics on consumer inflation. According to preliminary estimates, February price indices of personal consumption expenditures may increase from 0.3% to 0.4% MoM and from 2.4% to 2.5% YoY. In addition, personal income and spending of American households in February will be published, and the US FedChairman Jerome Powell will give a speech, clarifying the prospects for lowering interest rates this year. The main scenario assumes the first borrowing cost adjustment by 25 basis points during the June meeting, and in total, at the end of 2024, at least three changes to the indicator of 25 basis points are expected.

Yesterday’s report from the American Petroleum Institute (API) on the dynamics of commercial reserves put pressure on oil quotes. For the week of March 22, the value increased by 9.337M barrels after falling by 1.519M barrels earlier. On Wednesday, investors will be focusing on data from the US Department of Energy’s Energy Information Administration (EIA), which could show a weekly drop in inventories of 1.275M barrels from 1.952M barrels.

Meanwhile, Haitham al-Ghais, Secretary-General of the Organization of the Petroleum Exporting Countries (OPEC), called calls for a shift away from hydrocarbons to maintain climate balance “wrong and unrealistic.” According to him, this will negatively affect the development of transport, the production of food, pharmaceuticals, medical supplies, and even the production of renewable energy equipment such as wind turbines and solar panels. The official added that reports that oil demand will peak by 2030 are based on calls for a shift away from fossil fuels altogether. According to cartel forecasts, by 2045, this figure under the base scenario will reach 116.0M barrels per day or even 120.0M barrels per day. Haitham al-Ghais believes that to ensure the required supply levels by 2045, it is necessary to invest about 14.0T dollars in various energy industry sectors.

Support and resistance

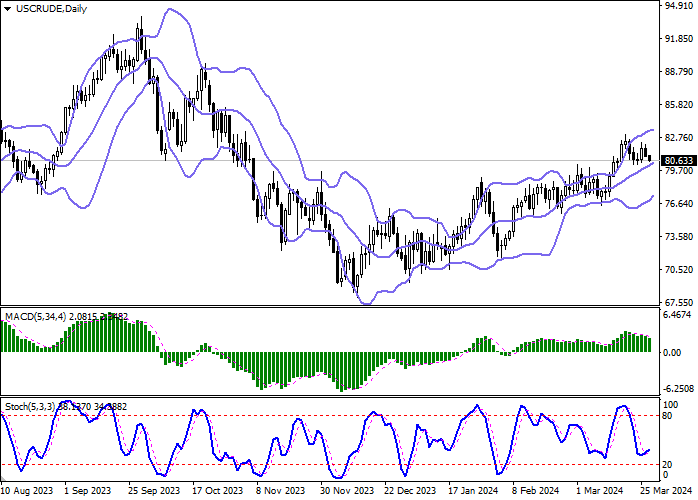

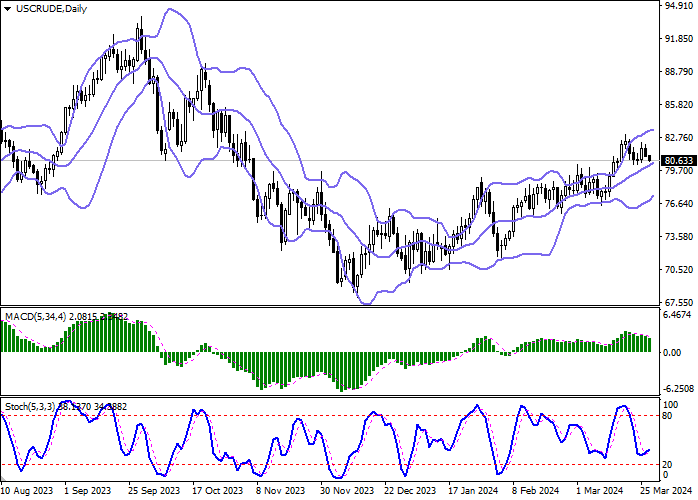

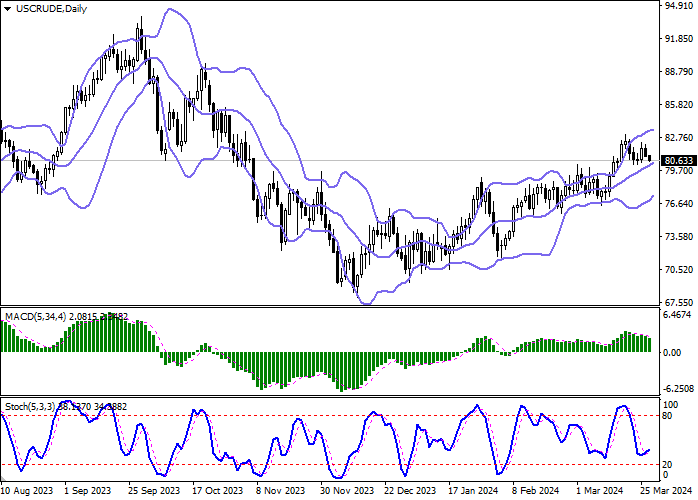

On the daily chart, Bollinger Bands are steadily growing: the price range is narrowing, reflecting the emergence of ambiguous trading dynamics in the short term. The MACD indicator is declining, maintaining a relatively strong sell signal: the histogram is below the signal line. Stochastic reversed upwards not far from the level of “20”, which slightly correlates with real market dynamics.

Resistance levels: 81.00, 82.00, 83.00, 84.27.

Support levels: 80.00, 79.07, 78.00, 77.00.

Trading tips

Short positions may be opened after a breakdown of the 80.00 level with the target at 78.00. Stop loss – 81.00. Implementation time: 2–3 days.

Long positions may be opened after a rebound from 80.00 and a breakout of 81.00 with the target at 83.00. Stop loss – 80.00.

Hot

No comment on record. Start new comment.