Current trend

The EUR/USD pair shows ambiguous trading dynamics, consolidating near 1.0830. the day before, the instrument attempted to demonstrate fairly active growth, continuing the development of Monday’s "bullish" momentum and managing to update the local highs of March 22. However, the US dollar managed to fully recover losses, reacting to positive macroeconomic statistics on Durable Goods Orders in the United States. Thus, in February, their volumes added 1.4% after a sharp decline of 6.9% in the previous month, with a forecast of 1.3%, and the Nondefense Capital Goods Orders excluding Aircraft increased by 0.7% after -0.4% a month earlier, while analysts expected 0.1%. The Redbook Retail Sales Index for the week ended March 22 also increased from 3.4% to 3.9%. Data on the dynamics of Durable Goods Orders are used by the US Federal Reserve in assessing average inflation in the country. In addition, the Personal Consumption Expenditures - Price Index will be published on Friday: in February the value is expected to adjust from 0.3% to 0.4% on a monthly basis and from 2.4% to 2.5% on an annual basis.

Today investors will evaluate the March statistics on Economic Sentiment in the eurozone. Also, during the day, the market will receive data on inflation in Spain (the dynamics are projected to accelerate in March from 0.4% to 0.6% in monthly terms and from 2.8% to 3.2% in annual terms) and there will be speeches by representatives of the European Central Bank (ECB), among them Piero Cipollone and Frank Elderson.

The day before, Germany presented April data on Gfk Consumer Confidence Survey, which turned out to be positive: the index rose from -28.8 points to -27.4 points, being higher than preliminary estimates of -27.9 points. Thus, consumer sentiment in the leading European economy is gradually improving, and more and more households are finding opportunities for additional spending. Gfk Group expert Rolf Bürkl noted that income growth and a stable labor market in themselves are positive prerequisites for a rapid recovery in consumption, but citizens still lack confidence in economic prospects.

Support and resistance

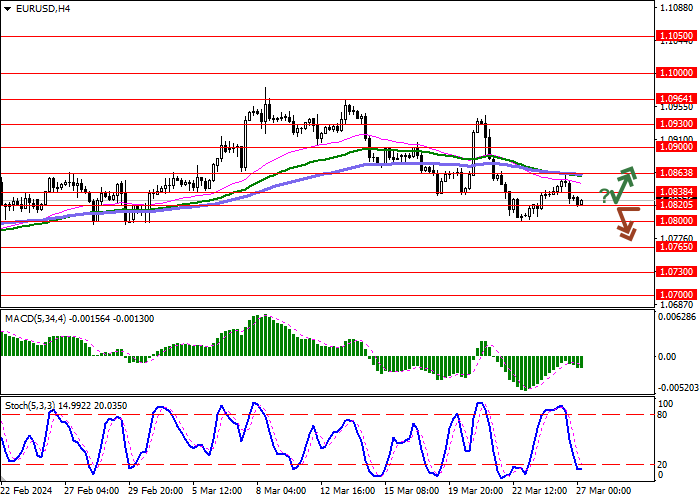

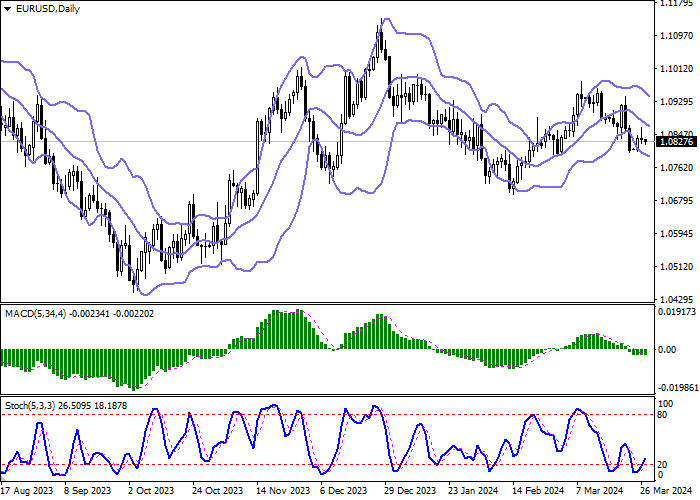

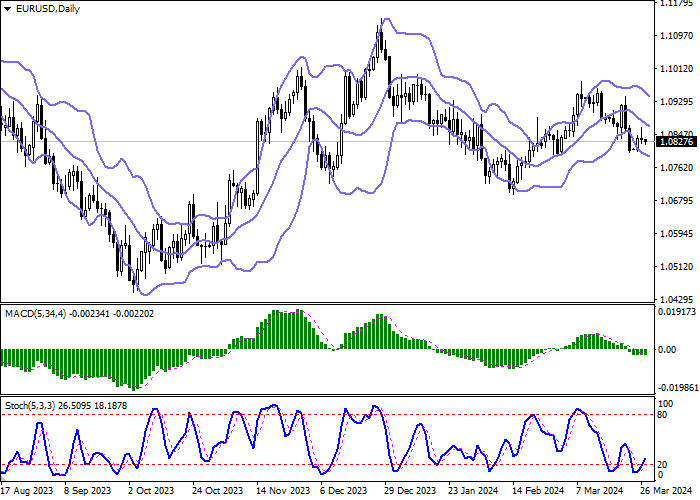

Bollinger Bands on the daily chart show a steady decline. The price range is narrowed from above, being spacious enough for the current activity level in the market. MACD is declining keeping a weak sell signal (located below the signal line) Stochastic, on the contrary, maintains a relatively strong upward direction, signaling in favor of the development of a full-fledged "bullish" correction in the ultra-short term.

Resistance levels: 1.0838, 1.0863, 1.0900, 1.0930.

Support levels: 1.0820, 1.0800, 1.0765, 1.0730.

Trading tips

Short positions may be opened after a breakdown of 1.0820 with the target at 1.0765. Stop-loss — 1.0850. Implementation time: 1-2 days.

A rebound from 1.0820 as from support followed by a breakout of 1.0838 may become a signal for opening new long positions with the target at 1.0900. Stop-loss — 1.0800.

Hot

No comment on record. Start new comment.