Current trend

The leading index of US technology companies NQ 100 is trading at 18332.0 against the backdrop of a local correction in the bond market, as well as the strengthening of the position of the US dollar against a basket of world currencies.

Last week, the US Federal Reserve kept the interest rate at 5.25–5.50%, which generally did not affect the dynamics, since investors factored in the likelihood of such a decision in advance. However, the Chair of the regulator, Jerome Powell, noted that the Fed plans to reduce borrowing costs at least three times by the end of this year, and the first adjustment should be expected closer to mid-summer. US stock markets have been growing for a long time, and a decrease in interest rates could be the driver that will lead to an increase in quotes to new highs, since a lower debt load will allow companies to take out more loans. Currently, the Chicago Mercantile Exchange (CME Group) FedWatch Tool indicates an 8.0% chance of an interest rate cut in May.

In the bond market today, the 10-year bonds are trading at a yield of 4.243%, slightly higher than the 4.195% recorded at the end of last week, while the 20-year bonds yield is holding at 4.497% after 4.445% on Friday.

The growth leaders in the index are Micron Technology Inc. ( 6.28%), DexCom Inc. ( 5.20%), Constellation Energy Corp. ( 5.06%), Moderna Inc. ( 4.70%).

Among the leaders of the decline are Take-Two Interactive Software Inc. (-4.15%), Lululemon Athletica Inc. (-3.54%), O’Reilly Automotive Inc. (-2.61%).

Support and resistance

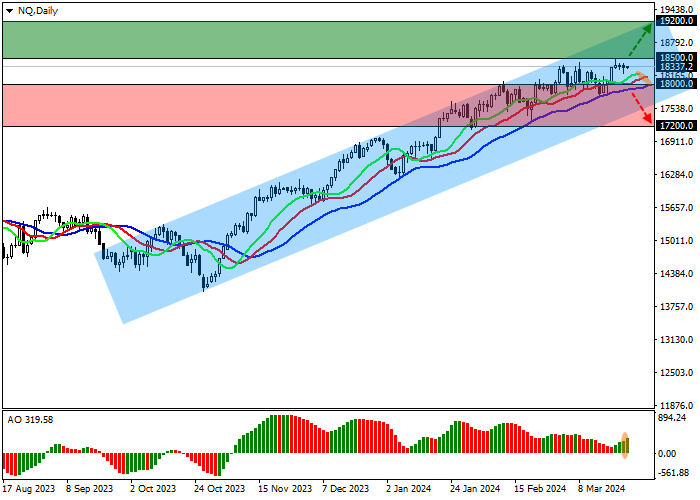

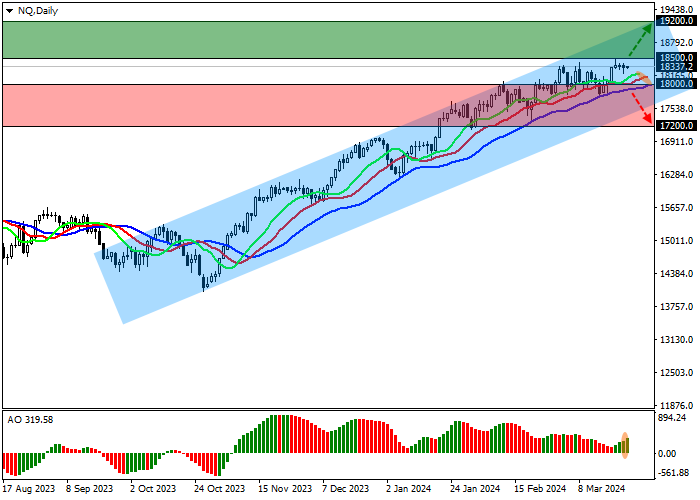

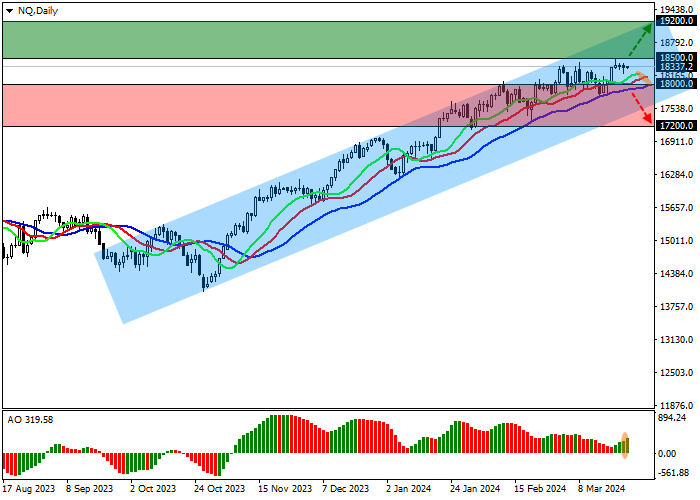

On the daily chart, quotes continue to correct, which is developing within an ascending corridor with boundaries of 19000.0–17500.0.

Technical indicators hold a buy signal, which remains quite stable: fast EMAs on the Alligator indicator are above the signal line, and the AO histogram is forming new corrective bars, holding in the buy zone.

Support levels: 18000.0, 17200.0.

Resistance levels: 18500.0, 19200.0.

Trading tips

If the asset continues growing and consolidates above 18500.0, long positions with the target at 19200.0 will be relevant. Stop-loss — 18200.0. Implementation time: 7 days and more.

If the asset continues declining and the price consolidates below 18000.0, short positions can be opened with the target at 17200.0. Stop-loss — 18500.0.

Hot

No comment on record. Start new comment.