Current trend

The XAU/USD pair is consolidating near the level of 2170.00 after uncertain growth the day before. Trading participants are in no hurry to open new positions, preferring to wait for the emergence of new macroeconomic indicators, as well as comments from representatives of the US Federal Reserve, which can clarify the prospects for the timing of the start of softening the Fed’s rhetoric. Markets are still considering the possibility of a 25 basis point interest rate cut in June as their main scenario, but as of today the probability of this is barely above 60.0%. In total, no more than 3-4 rate adjustments are predicted this year, but there are still too many risk factors on the market.

Today in the US, statistics on Durable Goods Orders will be published: the indicator is expected to grow by 1.3% in February after -6.2% in the previous month, and Nondefense Capital Goods Orders excluding Aircraft may add 0.1% after zero dynamics of January. Another indicator, which is actively used by the US Federal Reserve in assessing average inflation in the country, will be presented on Friday, when most of the European markets will be closed for the Easter weekend. The Personal Consumption Expenditures - Price Index may increase by 0.4% in February after rising by 0.3% a month earlier, and in annual terms the dynamics may accelerate from 2.4% to 2.5%, while the Core index is expected to remain unchanged at 2.8%.

There is a correction in the gold contract market. According to the report of the US Commodity Futures Trading Commission (CFTC), last week the number of net speculative positions in precious metal remained unchanged at 201.6 thousand. Buyers took a short break to fix their current portfolios: their balance in positions secured by real money amounted to 186.681 thousand versus 29.214 thousand for sellers. Last week, "bulls" liquidated 3.693 thousand contracts, and "bears" liquidated 1.600 thousand.

Support and resistance

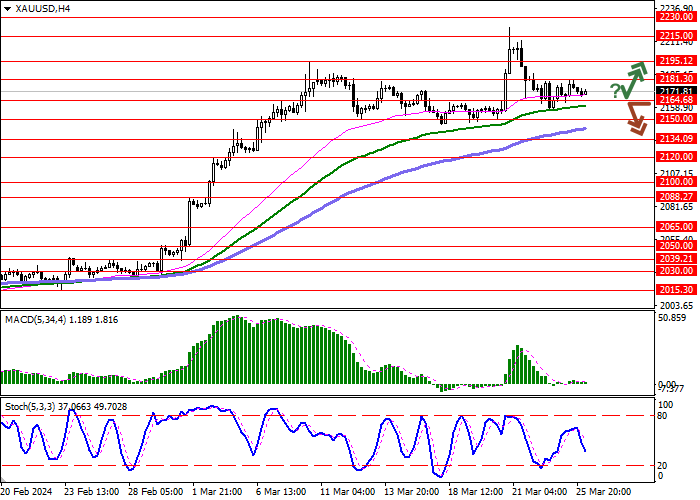

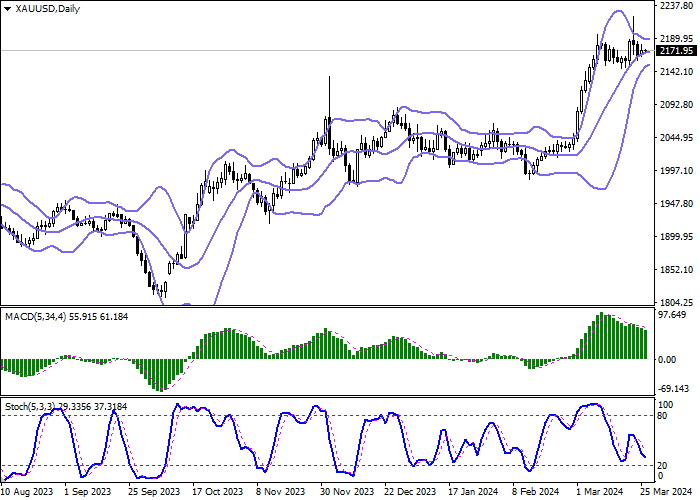

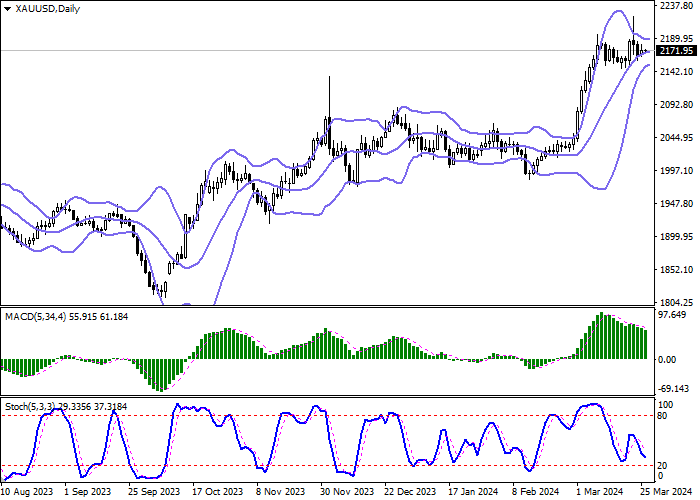

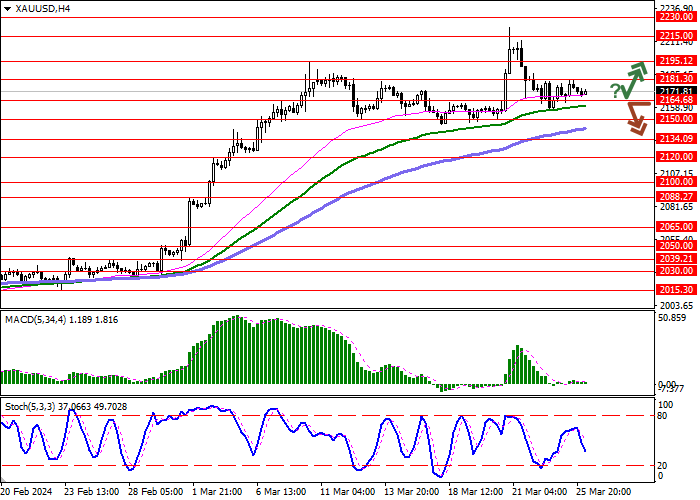

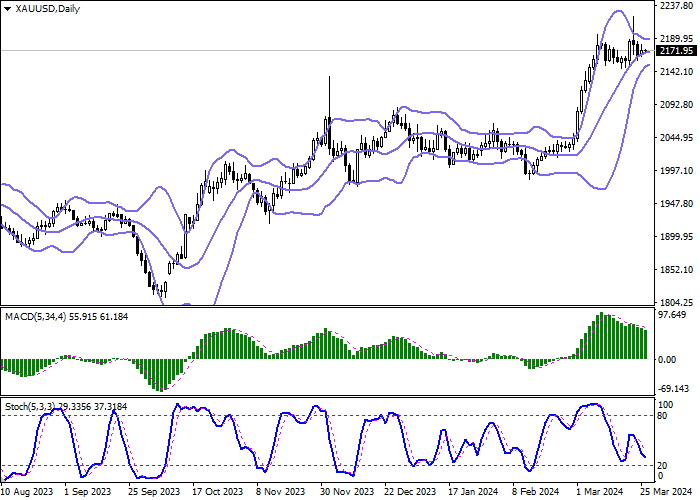

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is narrowing, reflecting ambiguous dynamics of trading in the short term. MACD is going down preserving a stable sell signal (located below the signal line). Stochastic is showing similar dynamics; however, the indicator line is already approaching its lows, indicating the risks of oversold instrument in the ultra-short term.

Resistance levels: 2181.30, 2195.12, 2215.00, 2230.00.

Support levels: 2164.68, 2150.00, 2134.09, 2120.00.

Trading tips

Short positions may be opened after a breakdown of 2164.68 with the target at 2134.09. Stop-loss — 2181.30. Implementation time: 2-3 days.

A rebound from 2164.68 as from support followed by a breakout of 2181.30 may become a signal for opening new long positions with the target at 2215.00. Stop-loss — 2164.68.

Hot

No comment on record. Start new comment.