Current trend

The USD/CHF pair rises to 0.8997 as the Swiss National Bank (SNB) reduces the interest rate from 1.75% to 1.50%.

According to subsequent comments, the adjustment of the indicator became possible because inflation has been kept below the target level of 2.0% for several months, and forecasts do not imply its strengthening: according to preliminary estimates, the consumer price index will be 1.4% this year, in 2025 year – 1.2%, and in 2026 – 1.1%. Easing monetary policy makes the national currency less attractive to investors, causing it to weaken.

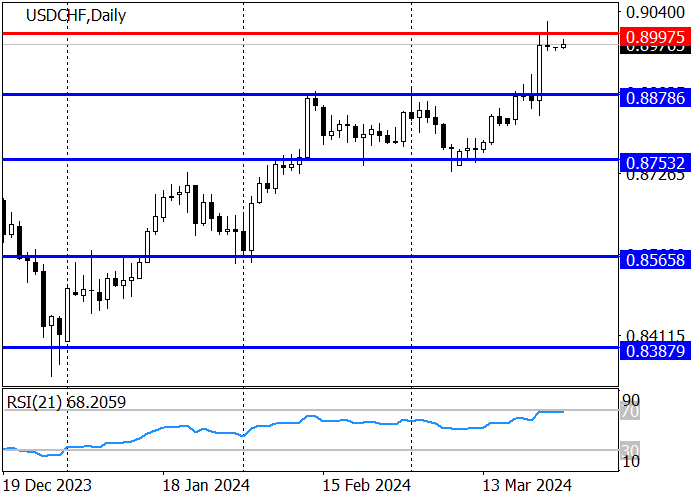

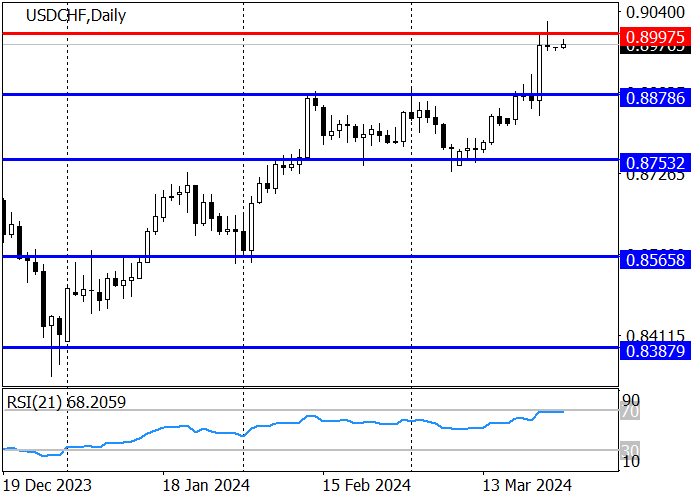

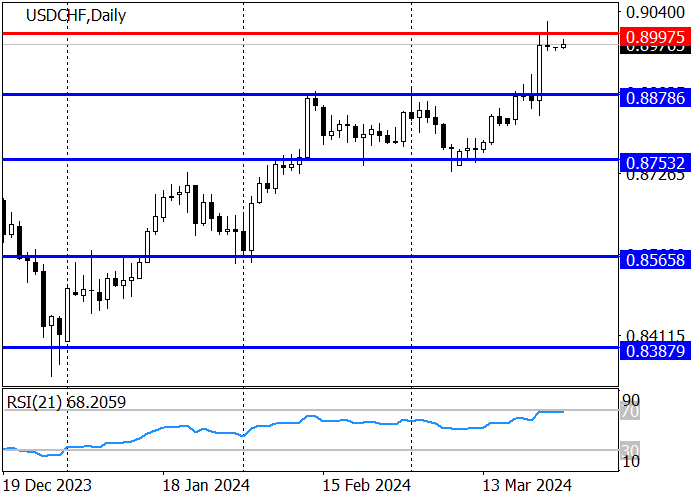

The long-term trend is upward: last week, the price reached the resistance level of 0.8997. If it holds, a correction to the support level of 0.8878 is expected, and then to 0.8753. The probability of growth remains: if 0.8997 is broken, the quotes may reach 0.9103.

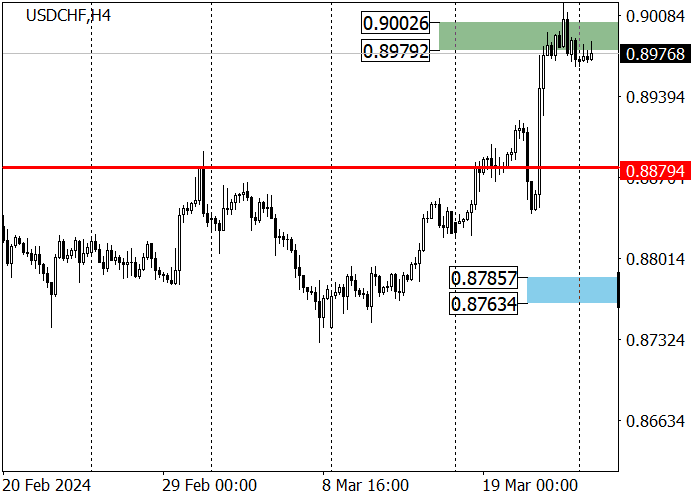

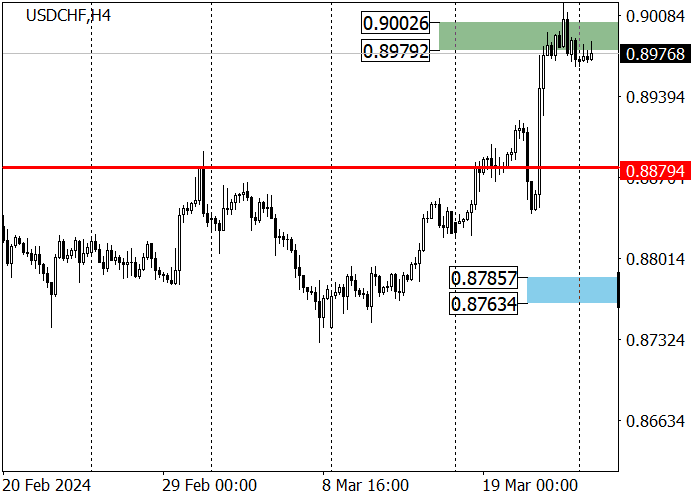

The medium-term trend is upward: last week, the asset rose to the target zone of 0.9002–0.8979, from where a downward correction to the support area of 0.8785–0.8763 may begin, after which long positions with the target at 0.9002 are relevant.

Support and resistance

Resistance levels: 0.8997, 0.9103.

Support levels: 0.8878, 0.8753.

Trading tips

Short positions may be opened from 0.8997, with the target at 0.8878 and stop loss 0.9030. Implementation time: 9–12 days.

Long positions may be opened above 0.9030, with the target at 0.9103 and stop loss 0.8997.

Hot

No comment on record. Start new comment.