Current trend

Shares of RTX Corp., an American aerospace and defense conglomerate, are in a corrective trend and are trading near the 94.25 mark.

Yesterday, it became known that management signed a contract with the German Federal Ministry of Defense for the supply of Patriot Configuration 3 air defense systems with a total value of 1.2 billion dollars. Recently, the demand for the company's products has been at a consistently high level, which allows the shares to stay in an uptrend.

Against the background of the conclusion of this agreement, TD Cowen analysts revised their forecasts for RTX Corp.'s shares: the rating was maintained at the "Outperform" level, and the target price was increased from 106.0 dollars to 115.0 dollars per share. Experts believe that due to the growing demand for defense products, the company's EBITDA will grow by about 15.0% by 2026.

The emitter's financial report will be published on April 23, and analysts expect revenue to drop to 18.39 billion dollars after 19.9 billion dollars in the previous period, and earnings per share (EPS) may reach 1.22 dollars, also below 1.29 dollars previously. In addition, another dividend payment took place yesterday, which amounted to 0.59 dollars per share, and the quarterly yield exceeded 2.62%.

Support and resistance

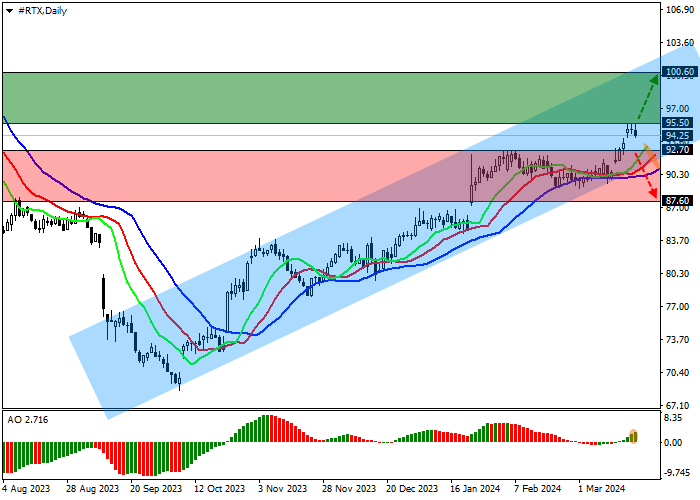

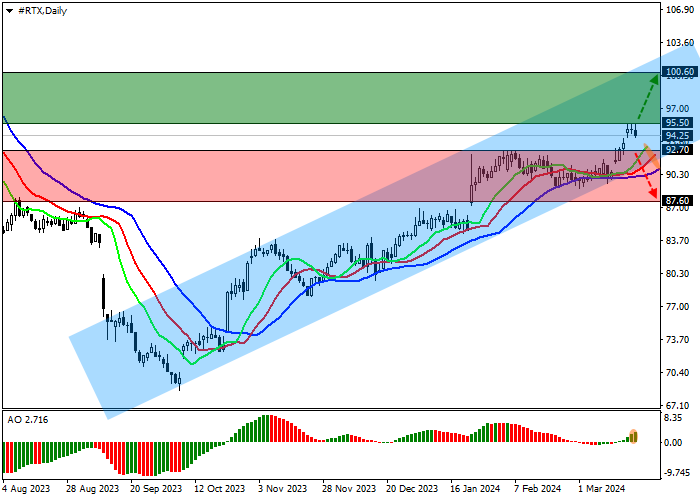

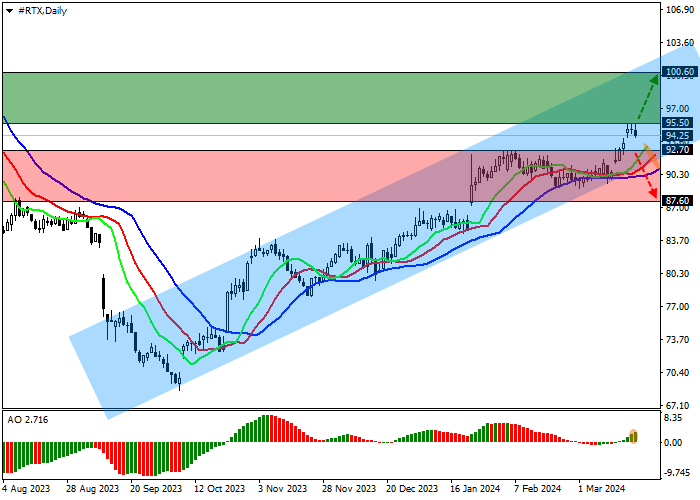

On the D1 chart, the instrument is rising within the channel with dynamic borders of 100.00–92.00.

Technical indicators hold the buy signal, which strengthened again last week: the Alligator indicator holds a stable range of fluctuations, and fast EMAs are significantly above the signal line, while AO oscillator, moving into the buy zone, forms ascending bars.

Support levels: 92.70, 87.60.

Resistance levels: 95.50, 100.60.

Trading tips

If the global growth of the asset continues and the price consolidates above the maximum and resistance level of 95.50, one may open long positions with the target of 100.60 and stop-loss of 93.00. Implementation time: 7 days and more.

If the asset continues to decline and the price consolidates below the minimum of 92.70, one can open short positions with the target of 87.60 and stop-loss of 95.00.

Hot

No comment on record. Start new comment.