Current trend

The USD/JPY pair added 1.6%, despite the change in the monetary rate by the Bank of Japan, and reached last year’s high of 151.80: the yen renews its lows of August 2008, against which investors are discussing the likelihood of direct foreign exchange interventions by the regulator.

On Tuesday, officials brought the interest rate out of the negative zone, bringing it to 0.00% but after that, the asset added 1.13%, as a 0.10% increase was not enough to attract buyers. Macroeconomic statistics reflect the problems in the national economy: industrial production in January adjusted from 1.2% to –6.7% MoM and from –1.0% to –1.5% YoY. The consumer price index published today in February amounted to 0.0% MoM, below the forecast of 0.2%, and 2.8% YoY compared to preliminary estimates of 3.0%, as a result of which financial authorities will not be able to increase the cost of borrowing further, which puts pressure on the yen.

The American dollar is supported by the preservation of the US Federal Reserve interest rate at 5.50% and subsequent comments from the head of the regulator, Jerome Powell, who said that three interest rate adjustments are expected this year, and not four, as previously thought. He also noted continued inflationary pressure but did not specify the exact timing of the start of monetary policy easing.

Support and resistance

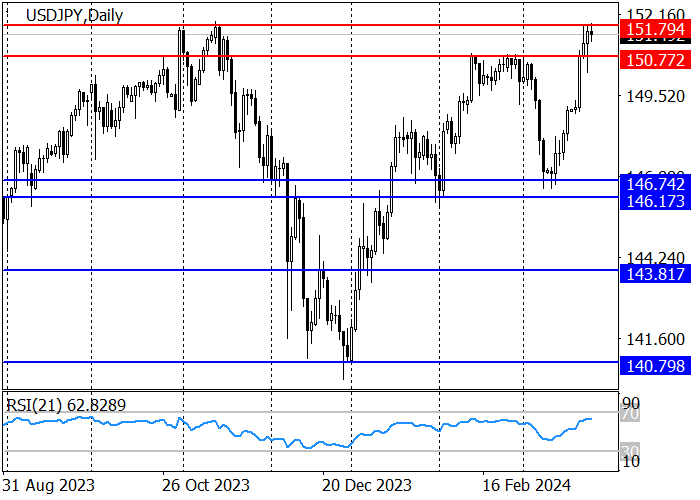

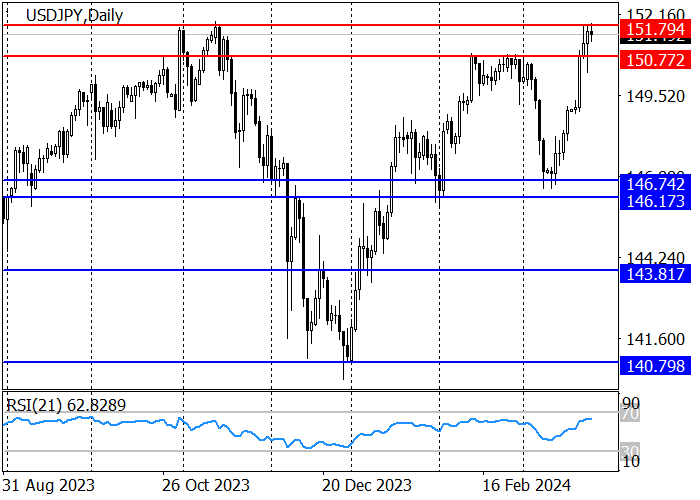

The long-term trend is upward: the price reached the resistance level of 151.80 but could not break it. Previously, the Bank of Japan carried out currency interventions from these levels, so if the level is maintained, a downward correction with the target in the support area of 146.74–146.17 is possible. However, if it is overcome, 155.50 is expected to be reached.

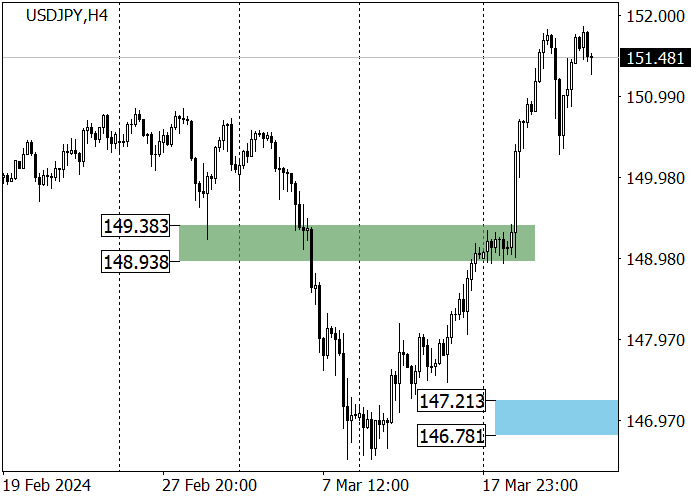

The medium-term trend is upward: the quotes have renewed their February highs and are headed towards zone 3 (154.17–153.69). After a correction to the key support area 147.21–146.78, long positions with the target at the current week’s high of 151.81 are relevant.

Resistance levels: 151.80, 155.50.

Support levels: 146.74, 146.17, 143.81.

Trading tips

Short positions may be opened from 151.80, with the target at 146.74 and stop loss 152.81. Implementation time: 9–12 days.

Long positions may be opened above 152.81, with the target at 155.50 and stop loss 151.81.

Hot

No comment on record. Start new comment.