Current trend

The AUD/USD pair is showing an active decline, retreating from the local highs of March 13, updated the day before: during the Asian session, quotes are testing 0.6525 for a breakdown, while the US dollar is rapidly recovering weekly losses. The growth of the exchange rate is supported by investor interest in risky assets against the backdrop of maintaining a high level of interest rates along with fairly strong macroeconomic indicators. Earlier, analysts slightly adjusted their expectations regarding the possibility of reducing the cost of borrowing by the US Federal Reserve in June. Now the probability of such a scenario is estimated at approximately 50.0%, and may decrease if the rate of slowdown in price growth is insufficient.

Statistics on business activity in the US, published the day before, also provided minor support to the national currency. The Manufacturing PMI from S&P Global in March rose from 52.2 points to 52.5 points, while analysts expected 51.7 points, and the Services PMI decreased from 52.3 points to 51.7 points, with a forecast of 52.0 points.

In turn, the Australian dollar received support the day before, reacting to the publication of a report on the labor market. The Employment Change in February showed a record increase of 116.5 thousand jobs, while experts expected 40.0 thousand, despite the fact that in January the figure was revised from 0.5 thousand to 15.3 thousand. The Unemployment Rate fell sharply from 4.1% to 3.7%, with preliminary estimates at 4.0%. Thus, the labor market remains strong enough to allow Reserve Bank of Australia (RBA) officials to keep interest rates high further. Also, yesterday, preliminary March data on business activity was published: the Manufacturing PMI decreased from 47.8 points to 46.8 points, while the Services PMI increased from 53.1 points to 53.5 points, and the Composite PMI rose from 52.1 points to 52.4 points.

Support and resistance

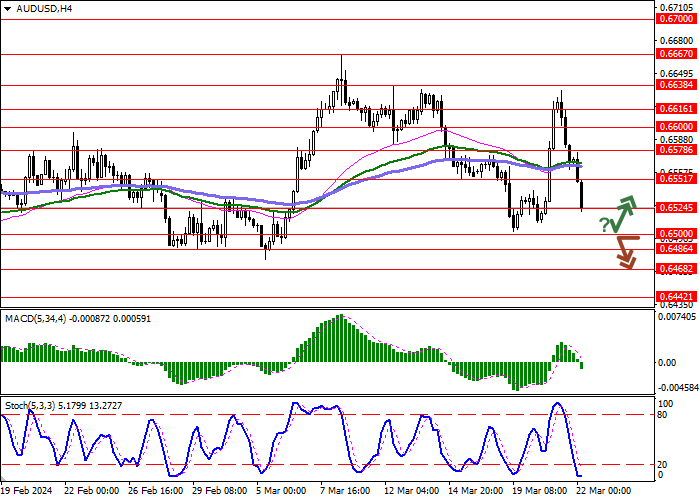

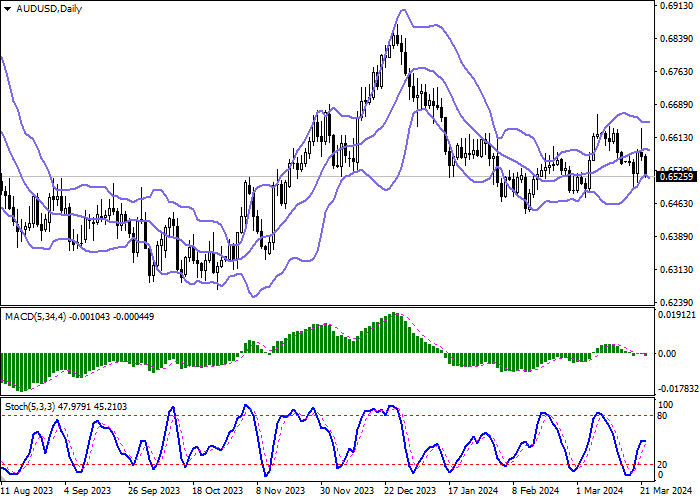

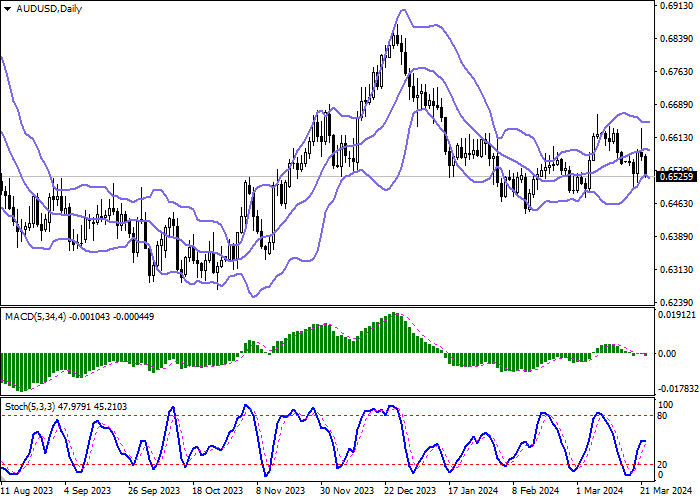

On the D1 chart, Bollinger Bands demonstrate a tendency to reverse into a descending plane. The price range expands from below, making way for new local lows for the "bears". MACD shows a moderate decline, having formed a new sell signal (the histogram is located below the signal line). The indicator is trying to consolidate below the zero level. Stochastic, reacting to a sharp change in the direction of trading in the ultra-short term, reversed horizontally, indicating a fragile balance of forces at the end of the week.

Resistance levels: 0.6551, 0.6578, 0.6600, 0.6616.

Support levels: 0.6524, 0.6500, 0.6486, 0.6468.

Trading tips

Short positions may be opened after a breakdown of 0.6500 with the target at 0.6450. Stop-loss — 0.6524. Implementation time: 1-2 days.

A rebound from the level of 0.6500 as a support, followed by a breakout of 0.6524, may become a signal to open new long positions with the target at 0.6578. Stop-loss — 0.6500.

Hot

No comment on record. Start new comment.