Current trend

The GBP/USD pair is trading slightly higher, approaching resistance at 1.2800. The instrument is developing a fairly strong "bullish" impetus, formed the day before in response to the publication of the results of a two-day meeting of the US Federal Reserve. The regulator decided to keep the parameters of the current monetary policy unchanged, confirming previous theses about the need to receive additional signals regarding the confident movement of inflation towards the target of 2.0%. At the same time, officials lowered their interest rate forecasts for 2025 and now expect only three cuts of 25 basis points instead of the previous four. In general, the published minutes turned out to be slightly more "dovish" than expected, strengthening the negative dynamics of the American currency quotes.

The focus of investors' attention the day before was on key macroeconomic statistics from the UK on inflation: in February, the Consumer Price Index added 0.6% after declining by the same amount in the previous month, while analysts expected 0.7%, and in annual terms the growth rate of the indicator slowed down from 4.0% to 3.4%, which was below expectations of 3.6%. Core CPI excluding Food and Energy, fell from 5.1% to 4.5%, with a forecast of 4.6%. Most experts assume that monetary easing will begin in June, but current economic conditions increase the likelihood of adjusting parameters as early as May, earlier than members of the US Federal Reserve and the European Central Bank (ECB). Today at 14:00 (GMT 2) the minutes of the Bank of England meeting will be published, at which, most likely, the current interest rate will be kept unchanged at 5.25%.

Support and resistance

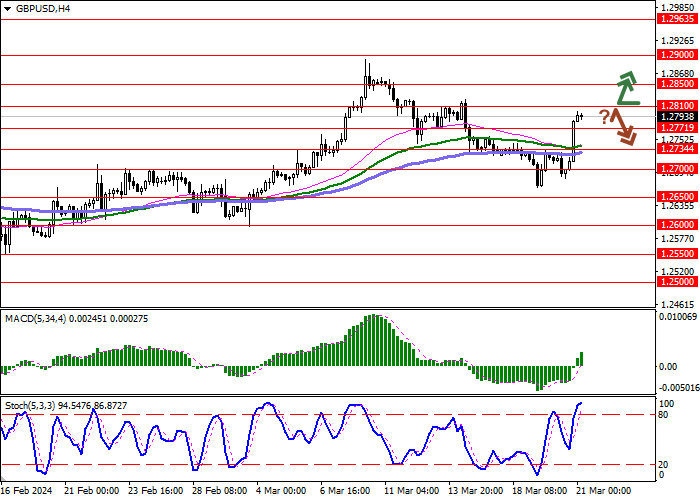

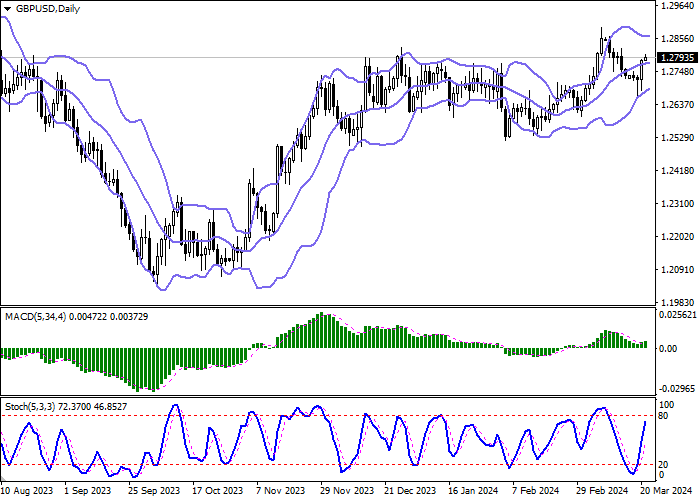

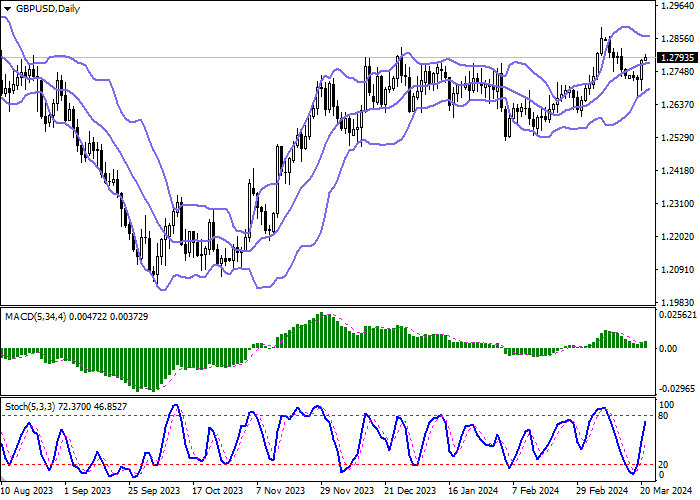

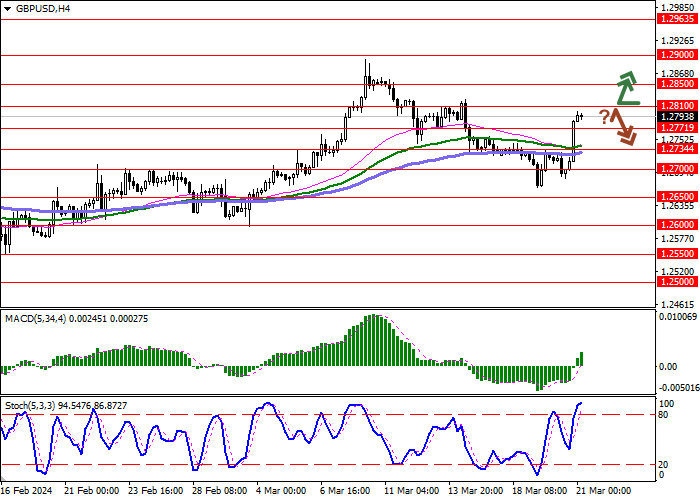

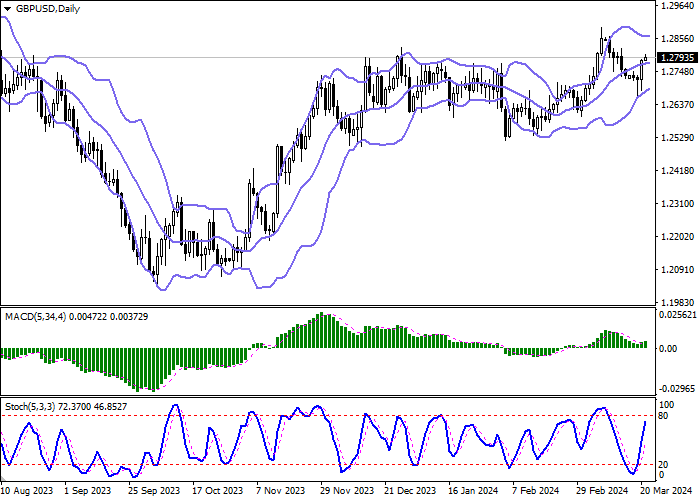

Bollinger Bands in D1 chart show moderate growth. The price range is narrowing from below, reflecting the emergence of ambiguous dynamics of trading in the short term. MACD has reversed to growth having formed a new buy signal (located above the signal line). Stochastic shows more active growth; however, it is quickly approaching its highs, indicating the risks of the instrument being overbought in the ultra-short term.

Resistance levels: 1.2810, 1.2850, 1.2900, 1.2963.

Support levels: 1.2771, 1.2734, 1.2700, 1.2650.

Trading tips

Long positions can be opened after a confident breakdown of the level of 1.2810 upwards with a target of 1.2900. Stop-loss — 1.2771. Implementation time: 1-2 days.

A rebound from 1.2810 as from resistance, followed by a breakdown of 1.2771 may become a signal for opening of new short positions with the target at 1.2700. Stop-loss — 1.2810.

Hot

-THE END-