Current trend

The XRP/USD pair continues its corrective decline within the general market trend: yesterday, the quotes reached three-week lows around 0.5680, but then made an attempt to restore positions after the announcement of the results of the US Federal Reserve monetary policy meeting.

Officials maintained the forecast of a three-times reduction in interest rates, confirming their determination to begin easing current parameters, while the head of the regulator, Jerome Powell, said that the increase in inflationary pressure in January-February did not change the general trend towards a slowdown in consumer price growth. Thus, investors still expect the beginning of a reduction in the cost of borrowing in June. The results of the US Fed meeting were met positively by the cryptocurrency community and caused an increase in prices for major digital assets: in particular, XRP quotes returned to the area of 0.6185. However, further growth may be limited by the continuation of the trend towards withdrawing funds from bicoin ETFs: at the beginning of the week alone, exchange-traded funds lost about 480.0 million dollars.

Support and resistance

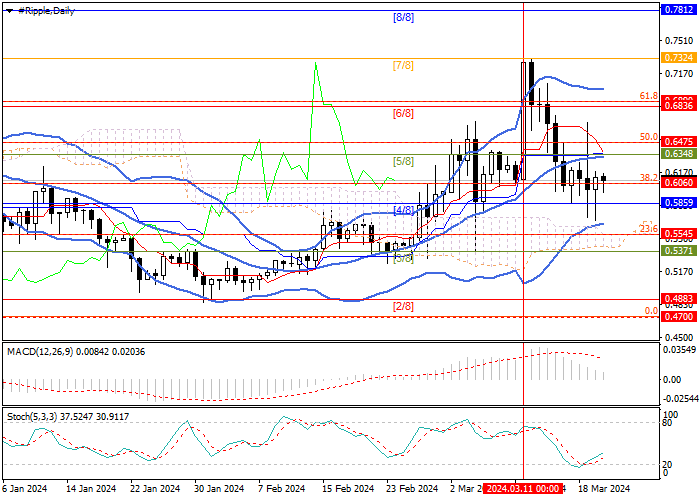

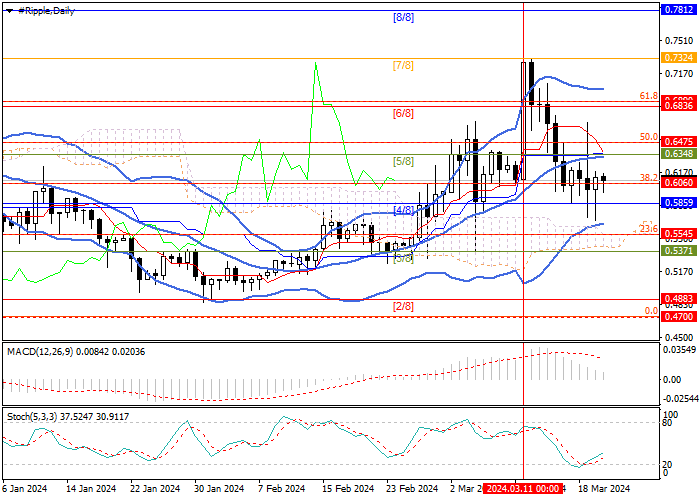

The instrument is trading within the long–term lateral range of 0.6890–0.4700 (61.8% Fibonacci retracement, Murrey level [6/8]–0.0% Fibonacci retracement). Currently, the quotes have reached the support zone of 0.6060–0.5859 (38.2% Fibonacci retracement–Murrey level [4/8]), if consolidated below which the decline can continue to the levels of 0.5371 (Murrey level [3/8]) and 0.4700 (0.0% Fibonacci retracement). The key for the "bulls" is the level of 0.6348 (Murrey level [5/8]), supported by the central line of Bollinger Bands, the breakdown of which will allow quotes to resume growth towards the targets of 0.6890 (61.8% Fibonacci retracement, Murrey level [6/8]), 0.7324 (Murrey level [7/8]) and 0.7812 (Murrey level [8/8]).

Technical indicators do not give a clear signal: Bollinger Bands and Stochastic are reversing up, but MACD is decreasing in the positive zone.

Resistance levels: 0.6348, 0.6890, 0.7324, 0.7812.

Support levels: 0.5859, 0.5371, 0.4700.

Trading tips

Long positions can be opened above the 0.6348 mark with targets of 0.6890, 0.7324, 0.7812 and stop-loss around 0.6060. Implementation period: 5–7 days.

Short positions should be opened below the level of 0.5859 with targets of 0.5371, 0.4700 and

Hot

No comment on record. Start new comment.