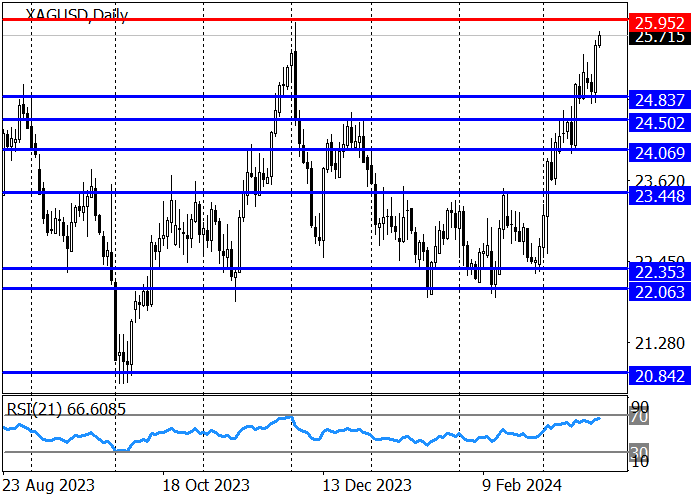

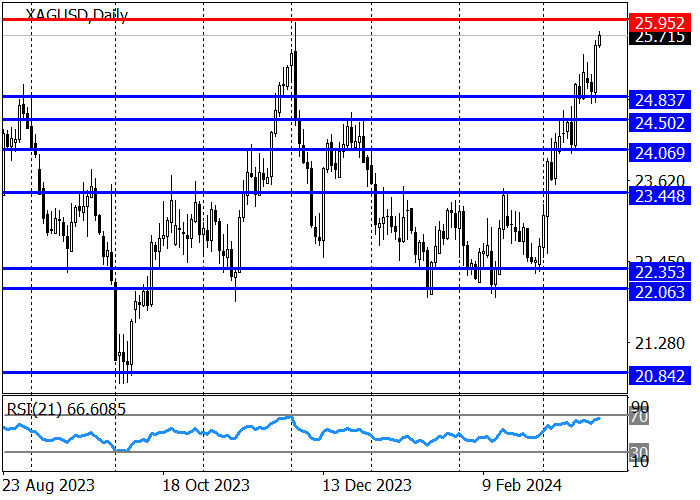

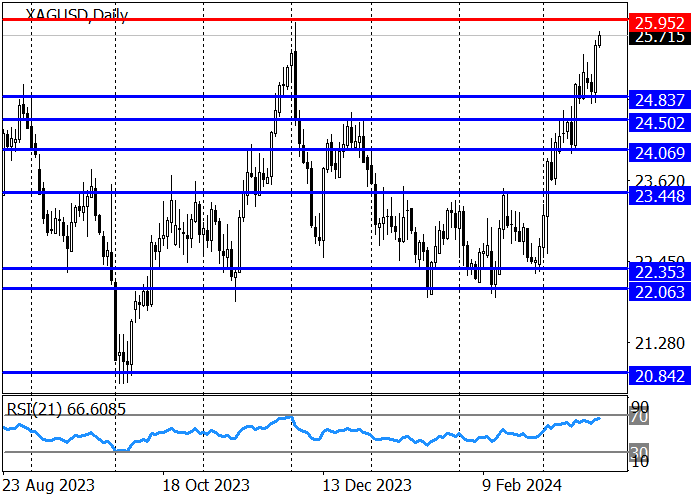

Current trend

The XAG/USD pair actively increased in value after the publication of the results of the US Federal Reserve meeting, and today quotes are approaching last year’s high of 25.95.

The day before, the American regulator decided to keep the interest rate unchanged at 5.50%. At the follow-up press conference, the Chair of the Fed, Jerome Powell, noted that restrictive policies are putting downward pressure on inflation and economic activity. The rate of growth in US consumer prices has slowed down significantly over the past year, but the rate remains above the target of 2.0%. The official said borrowing costs are likely already at their peak in this tightening cycle and a cut would be appropriate later this year, with three adjustments of 0.25% expected in 2024 and three more in 2025. Against this background, risk assets and other currencies strengthened against the US dollar.

Meanwhile, the silver contract market is experiencing a correction. According to the report of the US Commodity Futures Trading Commission (CFTC), last week the number of net speculative positions in precious metal increased to 41.0 thousand from 28.5 thousand a week earlier. According to the report on positions backed by real money, their balance is 45.652 thousand for "bulls" versus 18.991 thousand for "bears". Last week, buyers opened 4.603 thousand transactions, and sellers liquidated 6.529 thousand, indicating a continued build-up of long positions.

The XAG/USD pair continues to develop a long-term upward trend: yesterday, trading participants broke through the resistance level of 25.20, allowing quotes to continue moving towards last year’s high of 25.95. If this level is overcome, the next target will be 26.58. If the resistance level of 25.95 holds, the price will likely go into a downward correction with a target at the nearest support of 24.83. The RSI indicator (21) is approaching the market overbought zone, but has not yet entered it, which allows one to consider new purchases within the trend.

The medium-term trend is upward: this week target zone 2 (25.39–25.22) was broken, and the next growth target is target zone 3 (27.09–26.92). The key support for the trend is shifting to the levels of 24.07–23.90 and if, as part of the correction, the price reaches this zone, it will be possible to consider new purchases of the instrument with the first target at the current week’s high of 25.73.

Support and resistance

Resistance levels: 25.95, 26.58.

Support levels: 24.83, 24.50, 24.07.

![XAG/USD: QUOTES ARE PREPARING TO TEST LAST YEAR'S HIGH OF 25.95]()

Trading tips

Long positions may be opened from the level of 24.83 with target at 25.95 and stop-loss at 24.53. Implementation time: 9-12 days.

Short positions may be opened from the level of 24.53 with target at 24.07 and stop loss at 24.75.

Hot

No comment on record. Start new comment.