Current trend

During the Asian session, the AUD/USD pair is trading at 0.6622, developing a strong upward momentum formed yesterday after the Fed’s meeting minutes release.

The Australian currency has noticeably strengthened in recent days, supported by macroeconomic statistics: the unemployment rate in February decreased from 4.1% to 3.7%, renewing the October low, helped by an increase in employment by 116.5K compared to 15.3K last month, while analysts expected 40.0K. Full employment increased by 78.2K, and part-time employment grew by 38.3K. Among the positive data, there is the strengthening of March service PMI from 53.1 points to 53.5 points.

The American dollar is weakening, trading at 102.80 in the USDX after the US Fed decided to keep interest rates at 5.25–5.50%. In its forecasts, the regulator assumes that the first reduction in borrowing costs may occur in June, after which, in early autumn, officials may decide on an additional reduction, which ultimately should bring the rate to 4.50–4.75% by the end of the year. If previously trading participants expected the first rate cut this year with a probability of about 60.0%, today it, according to the Chicago Mercantile Exchange (CME) FedWatch Instrument, is 53.0%.

Under these conditions, continued local growth of the AUD/USD pair looks like the most likely scenario.

Support and resistance

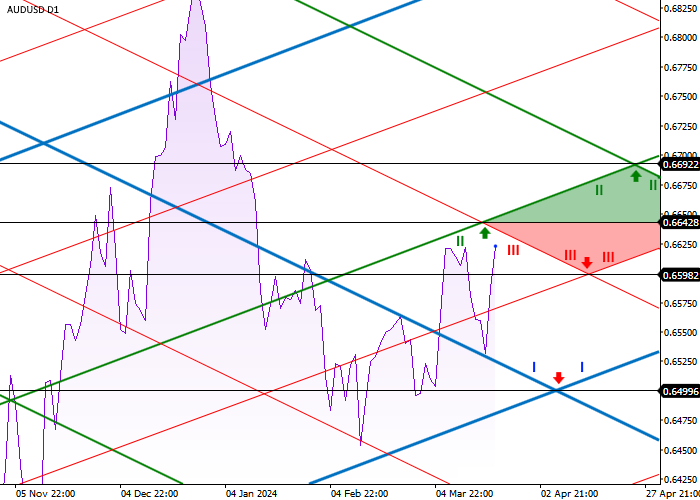

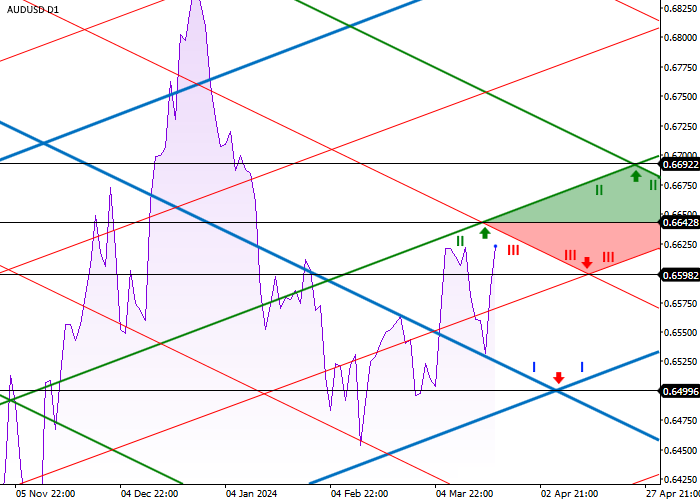

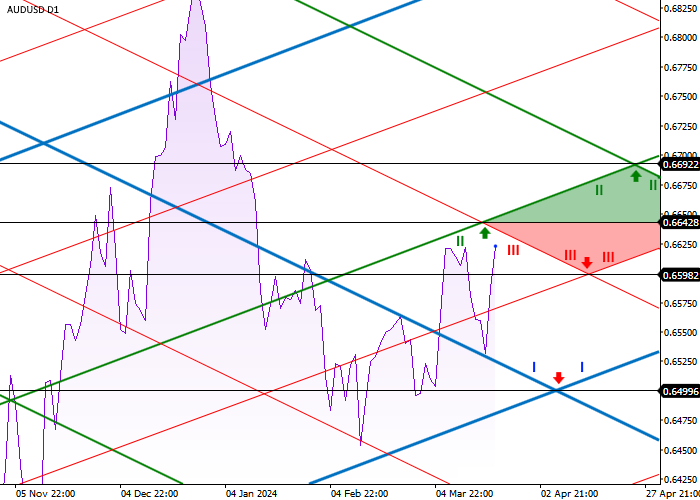

On the daily chart, the trading instrument is moving within a new range between the first-order levels (I), and after a reversal at the first-order left support level (I) at 0.6529, it continues to grow.

The most likely scenario is to reach the crosshairs of the left second order resistance (II) and the right third order resistance (III) at 0.6642, after which the price may rise to the crosshairs of the left second order resistance (II) and the right second order resistance (II) at 0.6692. In the event of a reversal, further dynamics will develop in a poor downward trend, where the local crosshair of the third-order right support (III) and the third-order left support (III) at 0.6598 will be the nearest target, and the crosshair between the first-order left support (I) and right support of the first order (I) at 0.6499 – the long-term one.

Resistance levels: 0.6642, 0.6692.

Support levels: 0.6598, 0.6499.

Trading tips

Long positions may be opened after the price rises and consolidates above 0.6642 with the target at 0.6692. Stop loss – 0.6610. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 0.6598 with the target at 0.6499. Stop loss is 0.6640.

Hot

No comment on record. Start new comment.