Current trend

The USD/JPY pair is correcting after quite active growth, which led to new record highs at 152.00. Against this background, former Vice Finance Minister Eisuke Sakakibara said that the authorities may resort to intervention if the yen/dollar exchange rate reaches the range of 155.00–160.00. Previously, investors believed that the threshold for active government action would be 150.00, but these expectations did not materialize. In turn, pressure on the positions of the American currency is exerted by the results of the two-day meeting of the US Federal Reserve that ended the day before.

As expected, the regulator kept the interest rate at 5.50%, noting that in order to move to easing monetary policy at the moment it is necessary to wait for confirmation of stable negative inflation dynamics towards the target 2.0%. Officials also corrected their forecasts for borrowing costs for 2025: the current schedule assumes only three reductions in value instead of the previous four, which were announced back in December last year. Following the release of the minutes, expectations for a possible interest rate adjustment in June were adjusted, with markets now forecasting a "dovish" scenario with a probability of 53.0%, while previously, according to the Chicago Mercantile Exchange (CME Group) FedWatch Tool, it was just over 60.0%.

Macroeconomic statistics provide additional support to the yen today: the Manufacturing PMI from Jibun Bank in March rose from 47.2 points to 48.2 points, and the Services PMI — from 52.9 points to 54.9 points. Markets also paid attention to the active growth of Exports, which added 7.8% in February after an increase of 11.9%, but analysts expected 5.3%, and Imports grew by 0.5%, which led to a noticeable reduction in the trade deficit balance from –1760.3 billion yen to –379.4 billion yen.

Support and resistance

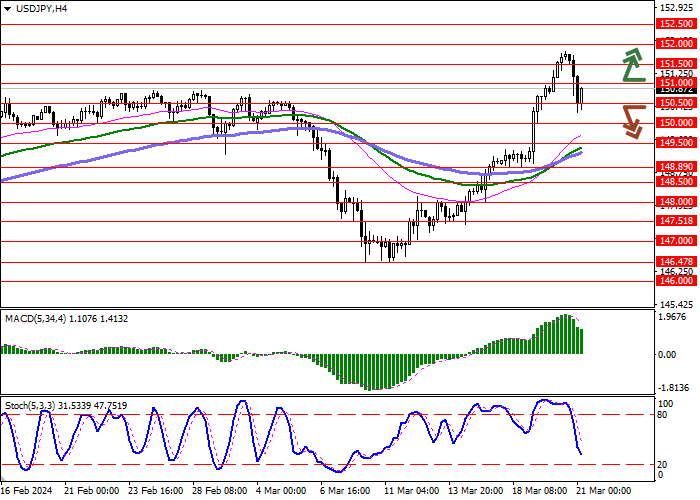

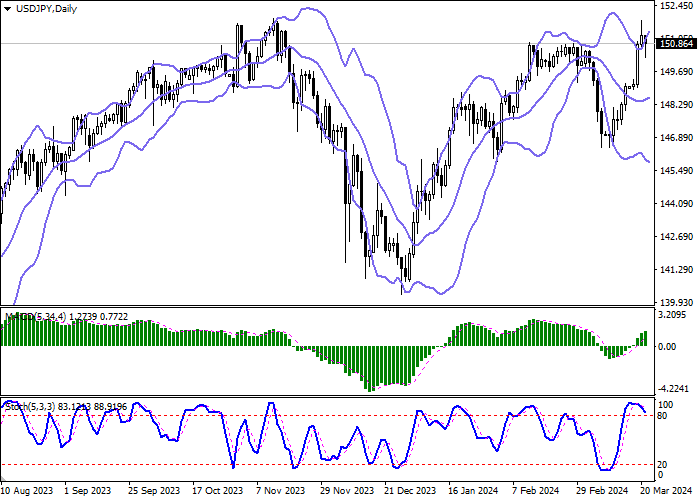

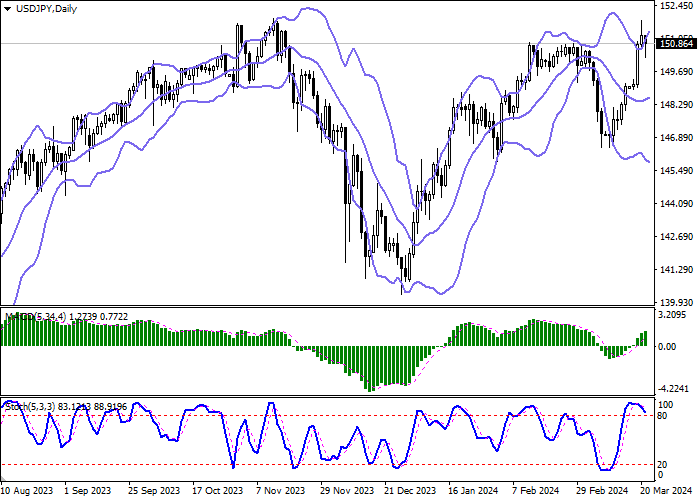

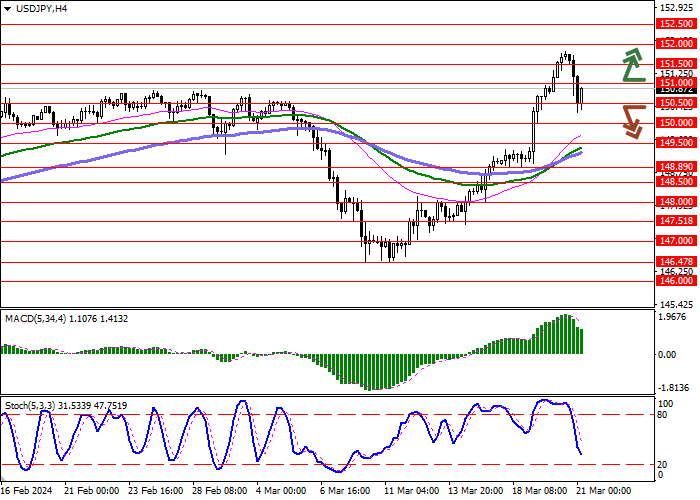

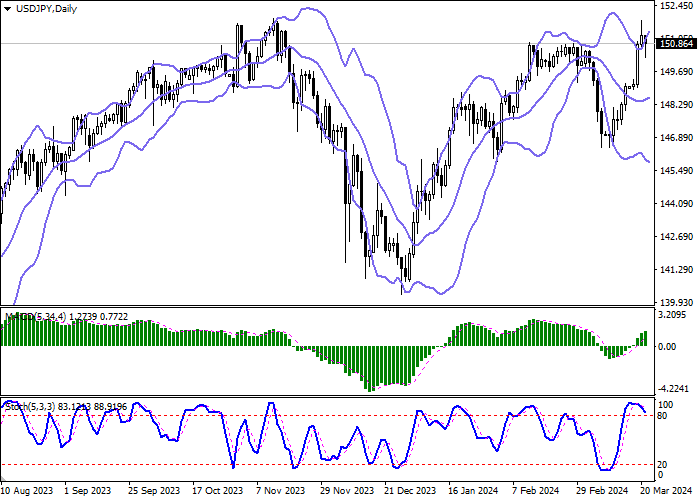

On the D1 chart Bollinger Bands are trying to reverse into the ascending plane. The price range is expanding, being spacious enough for the current activity level in the market. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic, having retreated from its highs, is trying to reverse into a downward plane, signaling in favor of the development of a full-fledged downward trend in the ultra-short term.

Resistance levels: 151.00, 151.50, 152.00, 152.50.

Support levels: 150.50, 150.00, 149.50, 148.89.

Trading tips

Short positions may be opened after a breakdown of 150.50 with the target at 149.50. Stop-loss — 151.00. Implementation time: 2-3 days.

The return of the "bullish" trend with the breakout of 151.00 may become a signal for new purchases with the target of 152.00. Stop-loss — 150.50.

Hot

No comment on record. Start new comment.