We present a medium-term investment review of the Brent Crude Oil trading instrument.

Recently, geopolitical tensions have increased significantly, and the attention of most investors is focused on the dynamics of quotations of commodity assets, among which oil remains in high demand.

The situation in the Middle East continues to have a key impact on oil prices against stable interruptions in oil supplies: yesterday, representatives of the Ansar Allah movement attacked the American liquefied petroleum gas tanker Mado in the Red Sea. Thus, the situation in the water area remains tense, which has significantly reduced traffic through this region, as a result of which the energy market is experiencing significant supply disruptions, causing positive asset dynamics.

In addition, the trading instrument is supported by forecasts from the International Energy Agency (IEA): the Q1 production may decrease by 870.0K barrels per day. This year, the value for OPEC member countries will be 102.9M barrels per day, and for countries outside the organization, it will increase by 1.6M barrels per day due to increased production in the United States. Thus, the country is trying to actively counteract the effect of the OPEC decision to reduce production, and last year the growth of American production amounted to 9.0%, reaching 12.9M barrels per day, which is not enough to compensate for the cartel’s measures, where Saudi Arabia alone reduced production by more than 1.0M barrels per day.

Investment demand for the asset remains high: according to the Chicago Mercantile Exchange (CME Group), the average daily trading volume is 897.0K contracts, which approximately corresponds to the February indicators of 856.0K positions. As for the global position spread between Brent Crude Oil and WTI Crude Oil, it is holding at 4.16 dollars, close to the recent average, reflecting the reluctance of investors to change the current trend.

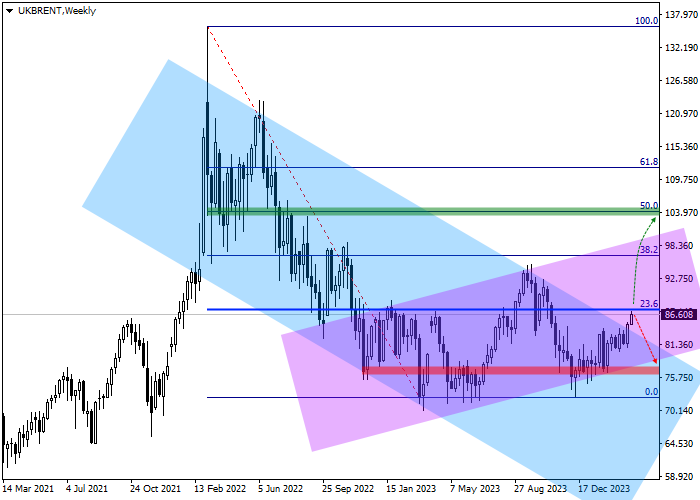

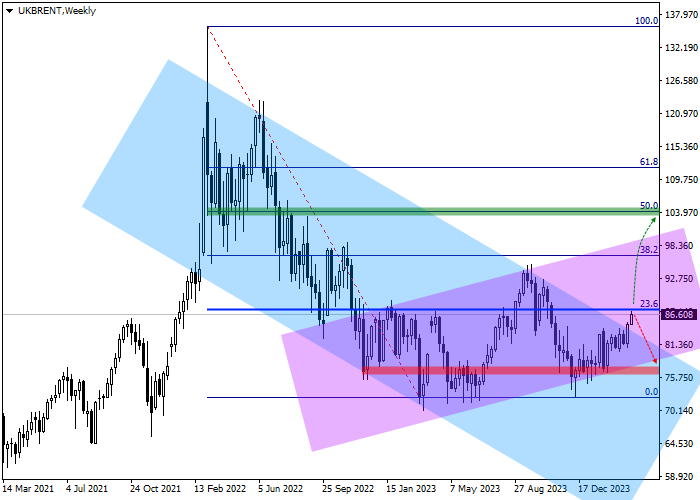

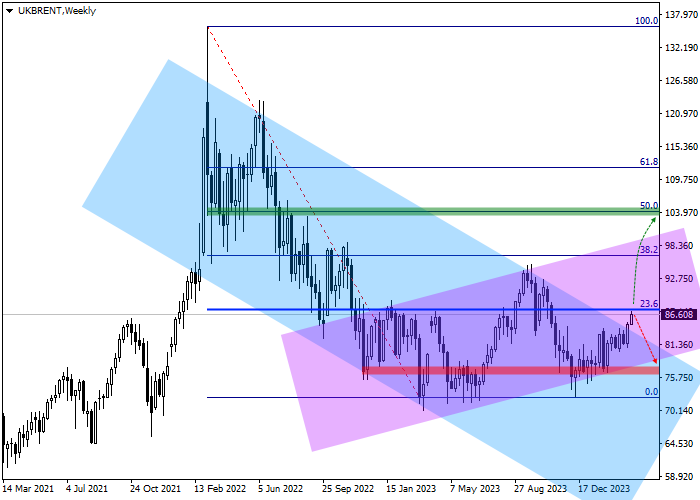

In addition to underlying fundamental factors, continued growth is confirmed by the readings of technical indicators. On the weekly chart, the price is trying to leave the global downward channel of 84.00–58.00, approaching the initial 23.6% Fibonacci correction level of 87.40.

At the moment, the quotes have almost reached the initial correction level of 23.6% at 87.40, consolidation above which will be a key marker for continued growth.

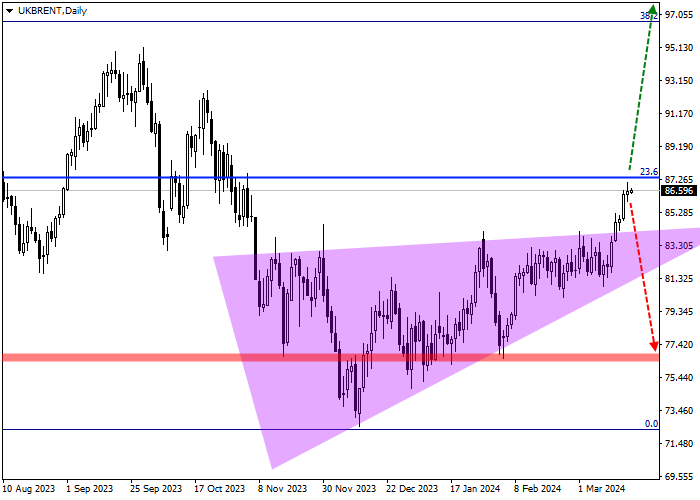

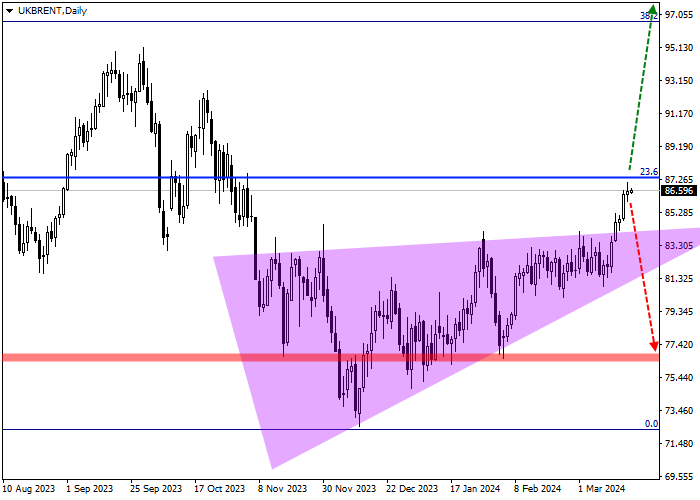

Let’s consider key levels on the daily chart.

The price has left the local Triangle pattern, breaking the resistance line of 84.00, and the target for its completion is the mid-September high of 95.00 above the initial correction level of 23.6%, the achievement of which means the transition to the stage of a full-fledged upward correction. In the event of a reversal and reaching one of the lows of early February 76.70, the upward scenario will either be canceled or noticeably delayed in time, and it is better to liquidate open buy positions. The target zone is around the intermediate correction level of 50.0% Fibonacci 104.00; if this zone is reached, it is better to take profit on open buy positions.

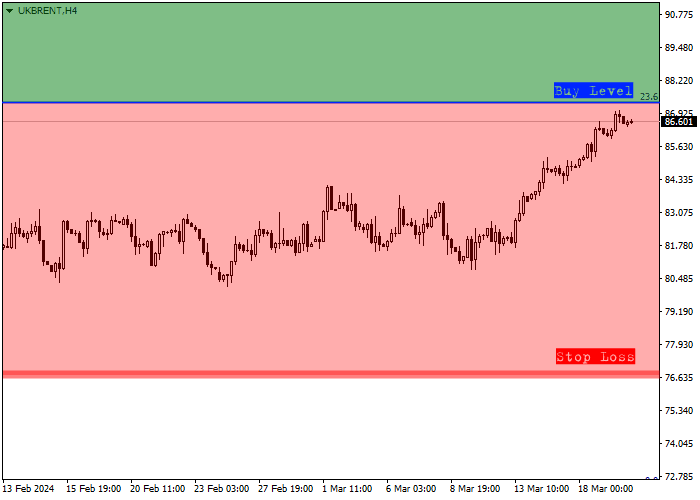

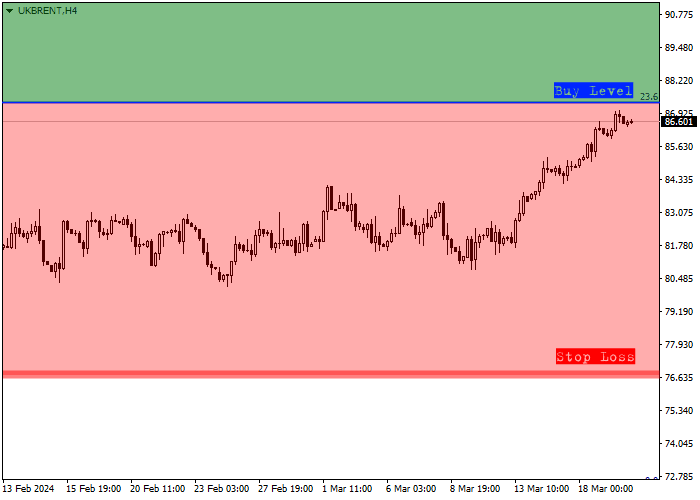

Let’s consider trade entry levels on the four-hour chart.

The entry levels for buy transactions are located at 87.40, which coincides with the initial correction level of 23.6% Fibonacci, and a local signal can be received in the coming days, when a breakdown of this level is realized, after which, there is no resistance on the way to the target level of 104.00, and positions can be implemented.

Considering the average daily volatility of a trading instrument over the last month, which is 1230.0 points, the price movement to the target zone of 104.00 may take approximately 49 trading sessions but if the indicator increases, this time may be reduced to 39 days.

Hot

No comment on record. Start new comment.