Current trend

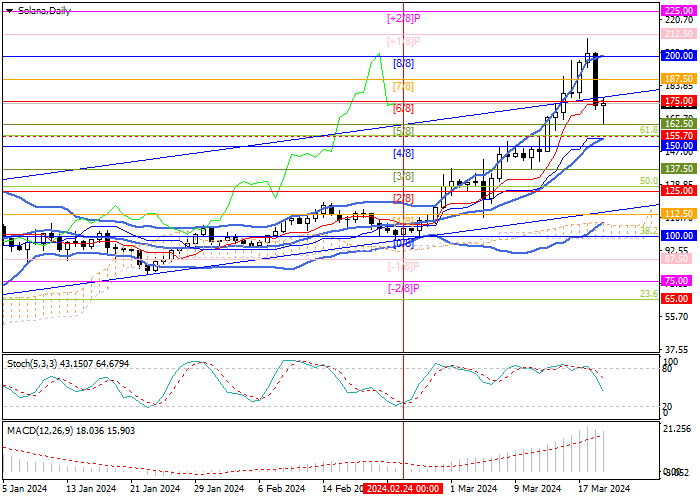

The SOL/USD pair is trading as part of a long-term upward trend around 172.65: last week, quotes managed to continue growing, despite the fact that the cryptocurrency market as a whole went into correction. However, on Monday, after reaching the November 2021 highs around 209.90, the instrument also began to lose ground.

The upward trend in the market still persists; to change it, the price needs to break below the support zone of 155.70–150.00 (Fibonacci retracement 61.8%, center line of Bollinger Bands, Murrey level [4/8]), and then it will be able to return to the levels of 125.00 (Fibonacci retracement 50.0%, Murrey level [2/8]) and 110.00 (Fibonacci retracement 38.2%, Murrey level [0/8]). The key level for the "bulls" remains 200.00 (Murrey level [8/8]), consolidation above which will lead to continued growth to the levels of 225.00 (Murrey level [ 2/8] and 250.00 (Murrey level [ 2/8], W1).

Technical indicators confirm the likelihood of renewed growth: Bollinger Bands are directed upwards, MACD is stable in the positive zone, and Stochastic's reversal down from the overbought zone does not exclude the continuation of a downward price rollback, but its potential seems limited.

Support and resistance

Resistance levels: 200.00, 225.00, 250.00.

Support levels: 150.00, 125.00, 100.00.

Trading tips

Long positions may be opened above the level of 200.00 with targets at 225.00, 250.00 and stop-loss at 184.00. Implementation period: 5-7 days.

Short positions may be opened from 150.00 with targets at 125.00, 100.00 and stop-loss at 165.00.

Hot

No comment on record. Start new comment.