Current trend

Yesterday, the price of WTI Crude Oil reached the resistance level of 83.50, around which large volumes of purchases were recorded before the decision on the US Fed interest rate, after which the quotes dropped to 82.50.

Today at 20:00 (GMT 2), the monetary policy meeting results will become known. Experts expect that the cost of borrowing will remain at 5.50%. The accompanying statement may focus on maintaining high inflation and a strong labor market, preventing the rhetoric from softening. Against this background, the dollar may strengthen, putting pressure on oil quotes.

The correction continues in the market: according to the latest report from the US Commodity Futures Trading Commission (CFTC), last week, net speculative positions decreased from 238.5K to 233.8K, and the balance of “bulls” with swap dealers amounted to 20.663K against 31.148K for the “bears.” Last week, buyers reduced the number of contracts by 0.664K and sellers – by 0.107K, confirming a decrease in demand.

Oil reserves data supports the trading instrument. According to the American Petroleum Institute (API), the figure was –1.519M, below the forecast of 0.077M barrels. In addition, the risks of oil supplies associated with an attack on oil refineries in Russia, as well as the most likely postponement of additional voluntary cuts in oil production by OPEC countries to the second quarter, may have a positive impact on the quotes, so the current price decline is corrective. Therefore, we can expect a further weakening of the WTI Crude Oil rate in the medium term and a new upward wave.

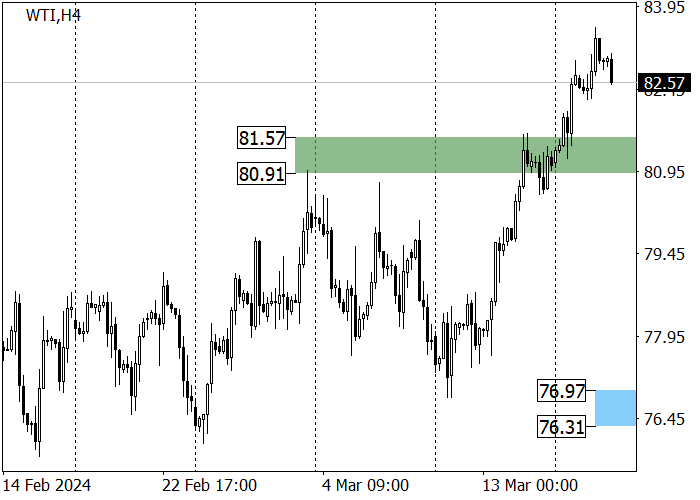

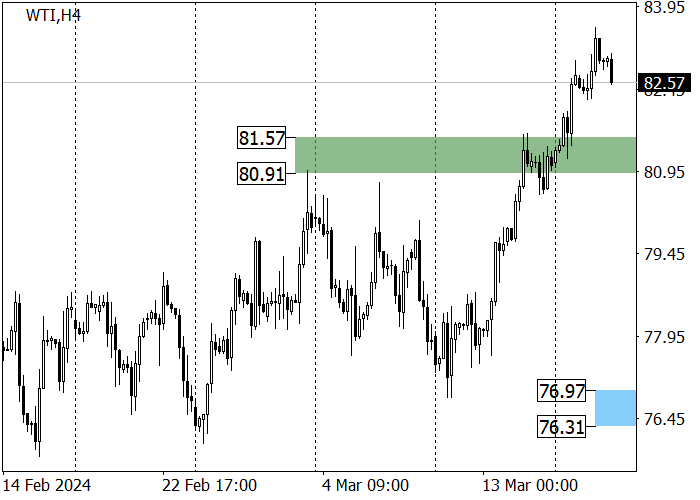

Support and resistance

The long-term trend is upward: the price reached the resistance level of 83.50 and began a correction, within which it can decline to the nearest strong support level of 79.00, where long positions with the target at 83.50 are relevant.

The medium-term trend is upward: the quotes have overcome zone 2 (81.57–80.91) and went to zone 3 (88.17–87.51). Now, the asset is correcting downwards and may reach the key trend support area of 76.97–76.31. After testing, long positions with the first target at the current week’s high of 83.43 are relevant.

Resistance levels: 83.50, 90.45.

Support levels: 79.00, 75.60.

Trading tips

Long positions may be opened from 79.00, with the target at 83.50 and stop loss around 77.50. Implementation time: 9–12 days.

Short positions may be opened below 77.50, with the target at 75.14 and stop loss around 78.61.

Hot

No comment on record. Start new comment.