Current trend

The USD/CHF pair is showing restrained growth, testing 0.8895 for a breakout and updating the local highs of mid-November 2023. Activity on the market remains moderate, as traders are in no hurry to open new positions ahead of the publication of the results of the two-day meeting of the US Federal Reserve. Markets do not yet expect drastic changes in the regulator’s rhetoric, but doubts are gradually growing about the likelihood of three reductions in borrowing costs this year. If officials indicate only two declines, the position of the American currency may noticeably strengthen.

Investors evaluate macroeconomic statistics from the US on the housing market, published the day before. Housing Starts in February increased from 1.374 million to 1.521 million units, which was significantly higher than expectations of 1.425 million. The dynamics of Building Permits accelerated from 1.489 million to 1.518 million, also ahead of forecasts at 1.495 million, and in percentage terms the growth rates were 10.7% and 1.9%, respectively.

The Swiss National Bank meeting on monetary policy will take place tomorrow at 10:30 (GMT 2). As in the case of the US Federal Reserve, analysts do not expect any changes in the parameters of monetary policy, so with a high degree of probability the interest rate will be kept at 1.75%. The Swiss regulator, in the event of a change in the parameters of monetary policy, will make a decision after the American and, possibly, the European one. The rate of increase in consumer prices in the country in February decreased to the lowest since October 2021, from 1.3% to 1.2% in annual terms. Food and non-alcoholic drinks rose in price by 0.8% year-on-year, housing and energy by 3.1%, and educational services by 1.8%, while health services fell in price by 0.4%, and transport - by 0.5%.

Support and resistance

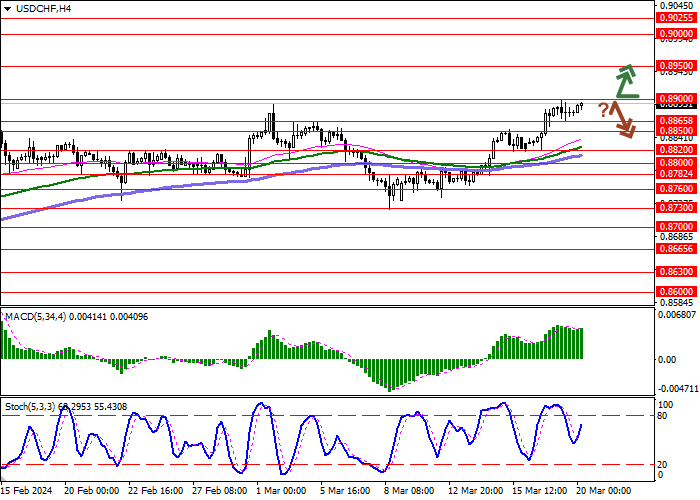

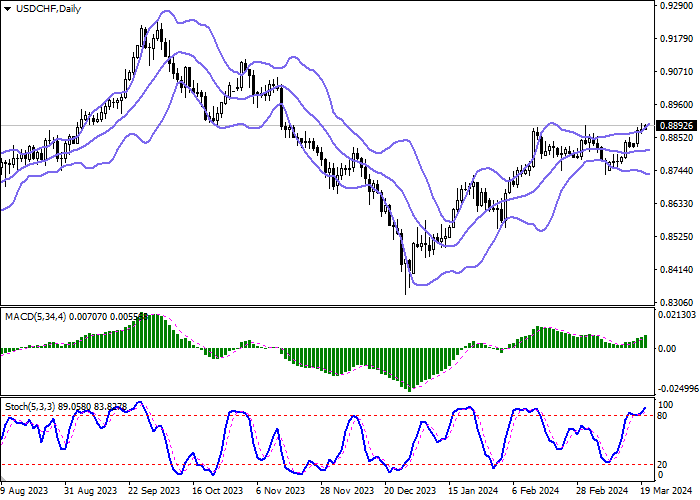

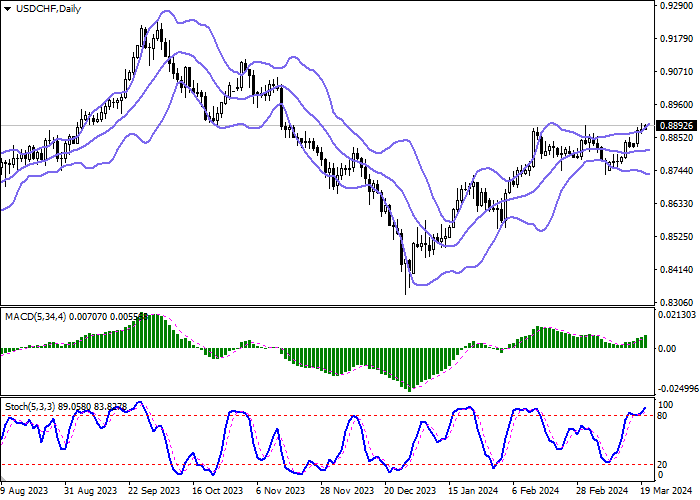

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is expanding from above, but currently does not keep pace with the development of "bullish" sentiment in the ultra-short term. MACD indicator is growing, while preserving a rather stable buy signal (located above the signal line). Stochastic is showing similar dynamics; however, the indicator line is already approaching its highs, indicating the risks of an overbought instrument in the ultra-short term.

Resistance levels: 0.8900, 0.8950, 0.9000, 0.9025.

Support levels: 0.8865, 0.8850, 0.8820, 0.8800.

Trading tips

Long positions can be opened after a breakout of 0.8900 with the target of 0.8950. Stop-loss — 0.8865. Implementation time: 1-2 days.

A rebound from 0.8900 as from resistance, followed by a breakdown of 0.8865 may become a signal for opening of new short positions with the target at 0.8800. Stop-loss — 0.8900.

Hot

No comment on record. Start new comment.