Current trend

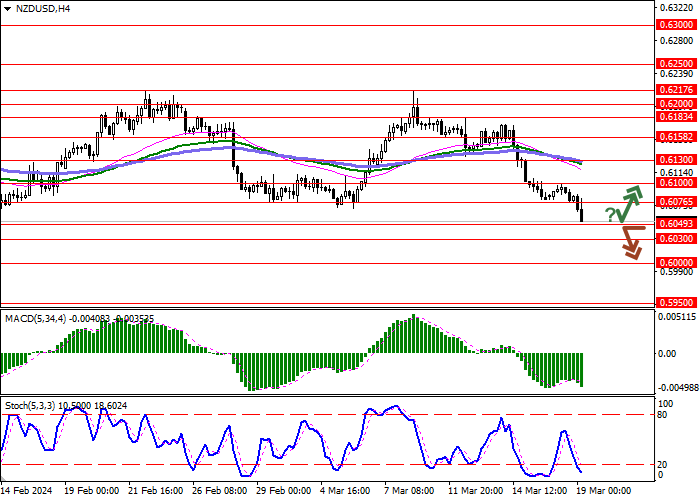

The NZD/USD pair is showing an active decline, returning to "bearish" dynamics, and is testing 0.6060 for a breakdown, updating the local lows of February 14.

Pressure on the position of the instrument today comes from the results of the meeting of the Reserve Bank of Australia (RBA), as most analysts draw parallels between the monetary policies of the Australian and New Zealand regulators. Officials kept the interest rate at 4.35%, but decided to abandon the thesis about a possible increase in borrowing costs if necessary. This means a gradual transition to the vector of the expected reduction in value, which is also expected from the Reserve Bank of New Zealand (RBNZ). Easing of monetary conditions in the region is expected after the US Federal Reserve, the European Central Bank (ECB) and possibly the Bank of England, closer to September 2024.

The focus of investors' attention today is the February statistics on the dynamics of Housing Starts in the United States: experts suggest that the figure will increase from 1.331 million to 1.425 million units. Tomorrow at 20:00 (GMT 2) the results of the US Federal Reserve meeting will be published, at which, most likely, the interest rate will remain unchanged, but analysts will focus on updated forecasts for borrowing costs for the near and long term. In turn, on Thursday New Zealand will present data on Gross Domestic Product (GDP) for the fourth quarter of 2023: the indicator is expected to grow by 0.1% after a decline of 0.3% in the previous quarter, and in annual terms the economy may add 0.1% after -0.6%.

Support and resistance

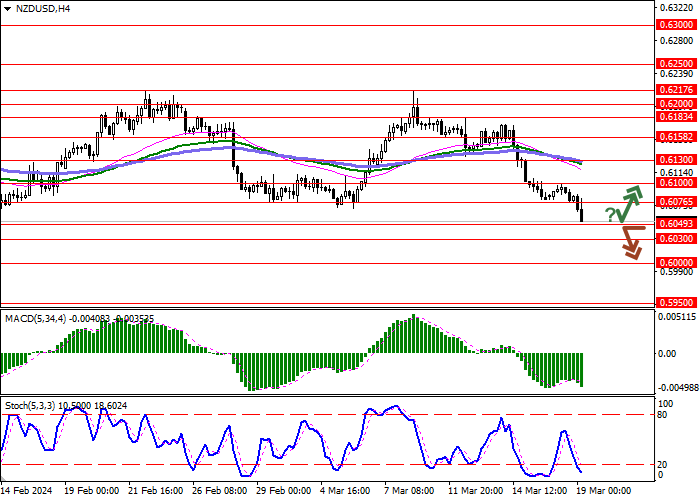

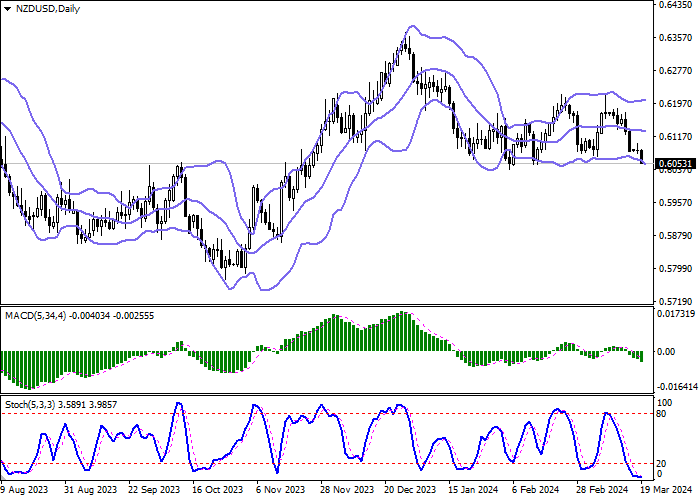

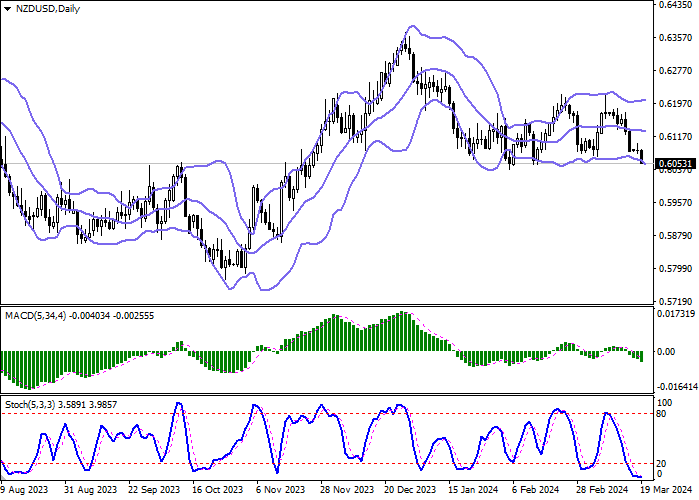

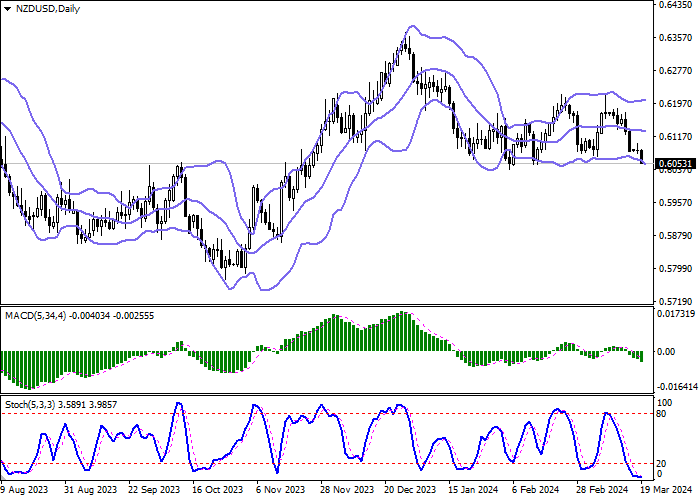

Bollinger Bands in D1 chart demonstrate mostly flat dynamics. The price range is expanding, but at the moment it is difficult to keep up with the surge in "bearish" sentiment. MACD is going down preserving a stable sell signal (located below the signal line). Stochastic, having reached its lows, reversed into the horizontal plane, indicating risks of oversold New Zealand dollar in the ultra-short term.

Resistance levels: 0.6076, 0.6100, 0.6130, 0.6158.

Support levels: 0.6049, 0.6030, 0.6000, 0.5950.

Trading tips

Short positions may be opened after a breakdown of 0.6049 with the target at 0.6000. Stop-loss — 0.6076. Implementation time: 1-2 days.

A rebound from 0.6049 as from support followed by a breakout of 0.6076 may become a signal for opening new long positions with the target at 0.6130. Stop-loss — 0.6049.

Hot

No comment on record. Start new comment.