Current trend

The USD/JPY pair shows multidirectional dynamics: the instrument remains near 149.15, and trading participants expect new drivers to emerge. This week, a block of macroeconomic data is expected to be published, and investors will focus on the results of the meetings of the US Federal Reserve and the Bank of Japan.

The Japanese regulator will announce a decision on interest rates tomorrow. Some analysts believe that officials will abandon the eight-year policy of negative interest rates, adjusting the value from -0.10%, attributing this primarily to a sharp increase in wages, which will help maintain the current momentum of inflation risks. More cautious forecasts for borrowing costs suggest the rate will rise in April. On Friday, Rengo, Japan's largest trade union group, representing the interests of 7.0 million workers, announced that it had reached an agreement with companies, according to which this year the wages of full-time employees will increase by 5.28%, and part-time employees by 6.0%, which is the most significant increase in the last 33 years. Experts believed that the correction of the indicator would be about 4.0%. Rengo president Tomoko Yoshino said the decision was driven by growing income inequality across businesses, accelerating inflation and the overall labor market crisis.

In addition, tomorrow Japan will present January Industrial Production statistics, which reflect the amount of manufactured goods and utilities produced in the country, taking into account the manufacturing and mining industries, as well as the electric power industry. Forecasts call for a further decline in output of 7.5% on a monthly basis, after falling by a similar amount a month earlier, and on an annualized basis, production fell 1.5% in December.

In turn, the US Federal Reserve meeting will take place on Wednesday and analysts do not expect officials to make changes to monetary policy, but they expect to receive forecasts regarding the cost of borrowing for the current year. The market continues to price in at least three 25 basis point interest rate cuts before the end of 2024, the first of which could come in June.

Support and resistance

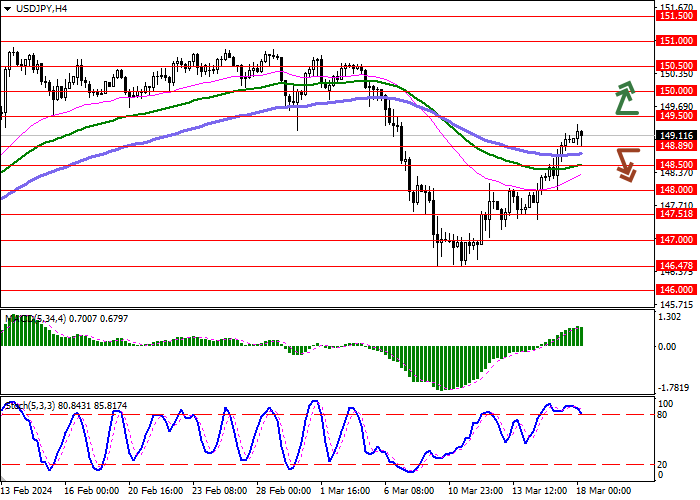

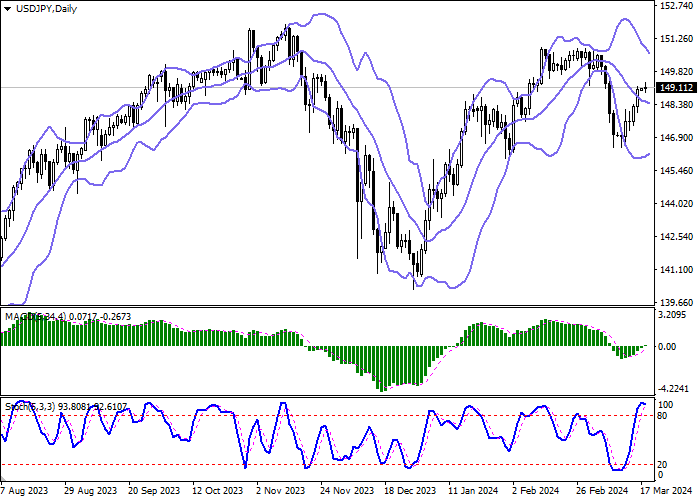

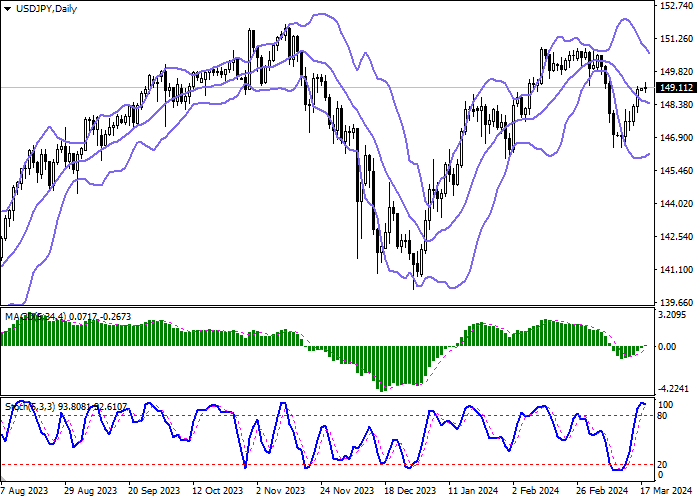

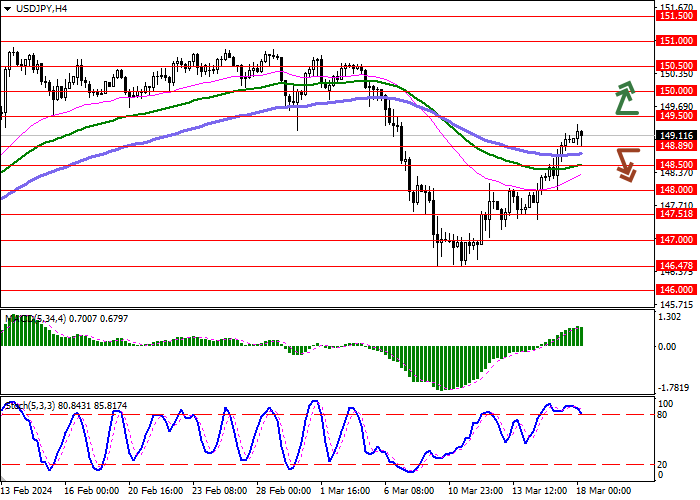

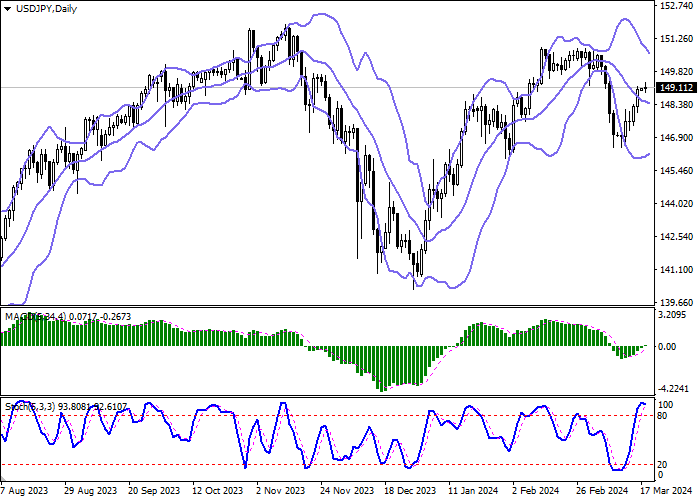

Bollinger Bands in D1 chart demonstrate a moderate decrease. The price range is narrowing, reflecting a sharp change of trend in the short term. MACD has reversed towards growth and currently maintains a strong buy signal (the histogram is located above the signal line). In addition, the indicator is testing the zero level for a breakout. Stochastic, having reached its highs, reversed into a horizontal plane, indicating significant risks of overbought American currency in the ultra-short term.

Resistance levels: 149.50, 150.00, 150.50, 151.00.

Support levels: 148.89, 148.50, 148.00, 147.51.

Trading tips

Long positions can be opened after a breakout of 149.50 with the target of 150.50. Stop-loss — 148.89. Implementation time: 2-3 days.

The return of a "bearish" trend with the breakdown of 148.89 may become a signal for new short positions with the target at 148.00. Stop-loss — 149.50.

Hot

No comment on record. Start new comment.