Current trend

The quotes of WTI Crude Oil are trading at 77.88, preparing to continue their downward trend after a change in the US Department of Energy’s oil production forecasts: this year, the figure will increase by 80.0K barrels per day to 13.19M barrels per day, putting pressure on oil prices. In addition, US statistics confirmed an increase in inflation in February from 0.3% to 0.4%, while the core indicator consolidated at 0.4%, exceeding preliminary estimates of 0.3%, against which the Fed officials may delay interest rate adjustments, which will negatively impact oil prices.

The quotes are supported by the publication of the monthly OPEC report: according to forecasts, this year, oil demand will increase by 2.25M barrels per day, and in 2025 – by 1.85M barrels per day. Consumption is also strengthening as US energy inventories adjust by –5.521M barrels, according to the American Petroleum Institute (API), below the 0.400M barrel forecast.

Thus, at the moment, there are no factors to affect the dynamics of the asset, and it will stabilize around 79.62–77.64, awaiting new drivers for movement.

Support and resistance

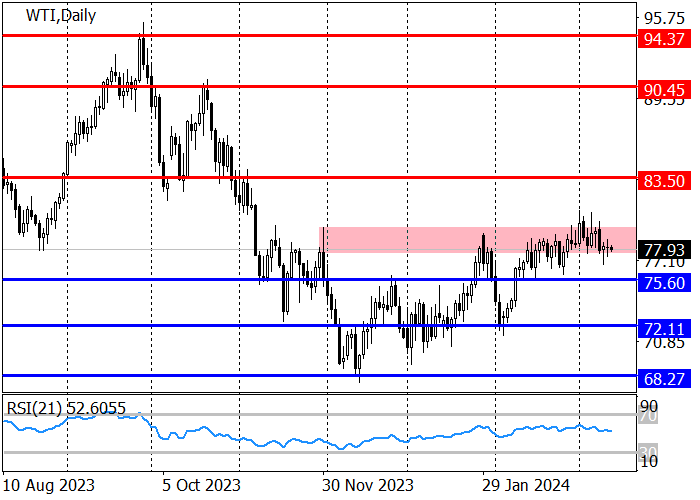

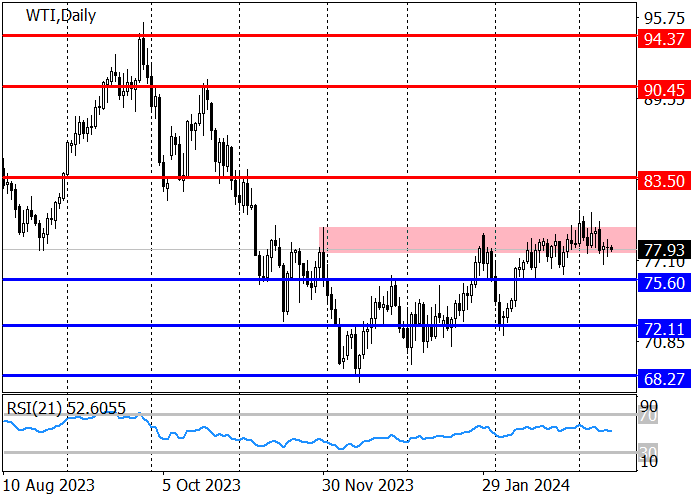

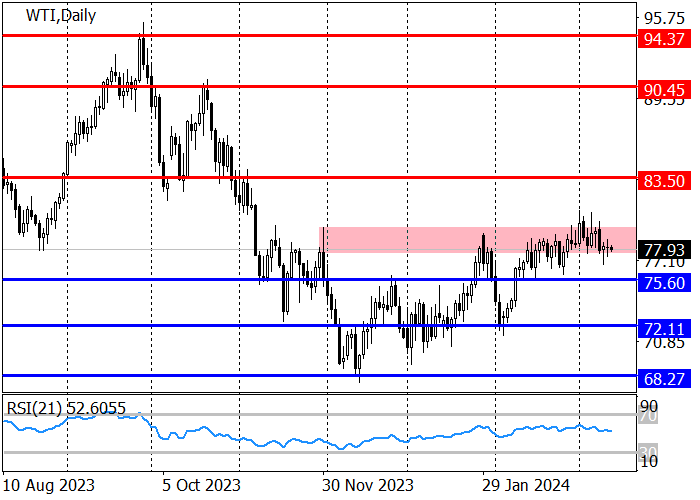

The long-term trend is downward: the price unsuccessfully tried to overcome the resistance area of 79.62–77.64. Today, it is declining slightly and may receive a sell signal with the nearest target at 75.60.

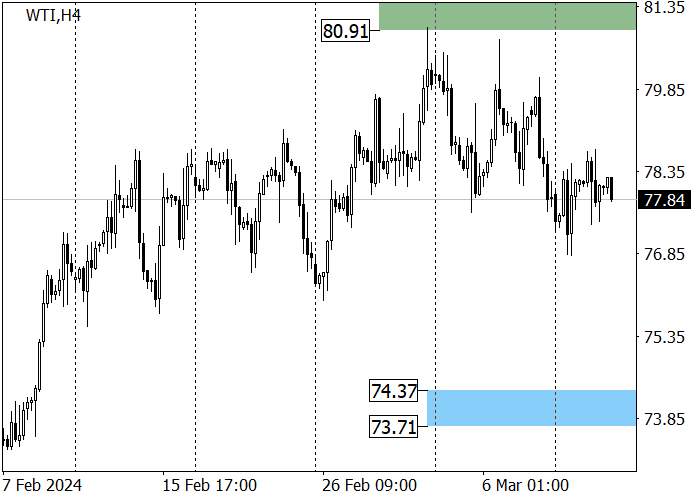

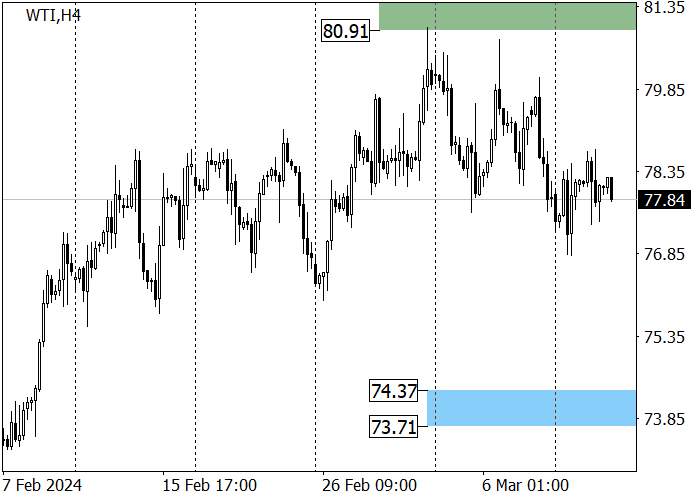

The medium-term trend is upward: at the end of February, the asset reached zone 2 (81.57–80.91), after which a downward correction began. Within its framework, a movement to the area of key trend support 74.37–73.71 is expected, after the test of which long positions with the target at 80.91 are relevant.

Resistance levels: 77.64, 79.62, 83.50.

Support levels: 75.60, 72.11, 68.27.

Trading tips

Short positions may be opened from the current level, with the target at 72.11 and stop loss 79.62. Implementation time: 9–12 days.

Long positions may be opened above 79.62, with the target at 83.50 and stop loss 78.10.

Hot

No comment on record. Start new comment.