Current trend

Last week, the AUD/USD pair grew, reaching three-month highs around 0.6667 against February statistics from the American labor market. Despite the increase in employment by 275.0K, the sector remains under pressure, as unemployment has adjusted from 3.7% to 3.9%, and the rate of wage increases slowed to 0.1% MoM and 2.3% YoY. The statistics put pressure on the American dollar, strengthening the support of monetary policy easing within the US Federal Reserve.

In anticipation of the publication of February inflation data in the US, which may affect further actions of the regulator, the asset stabilized at 0.6620. Experts expect that the consumer price index will remain at 3.1% YoY but increase from 0.3% to 0.4% MoM due to higher fuel prices. The implementation of forecasts may convince officials to take a wait-and-see approach, which will support the national currency.

The market reacted with restraint to the publication of February business activity data from the National Australia Bank (NAB): the business confidence index decreased from 1.0 points to 0.0 points but the index of current business conditions increased from 7.0 points to 10.0 points, and the index of trade conditions from 9.0 points to 14.0 points.

Support and resistance

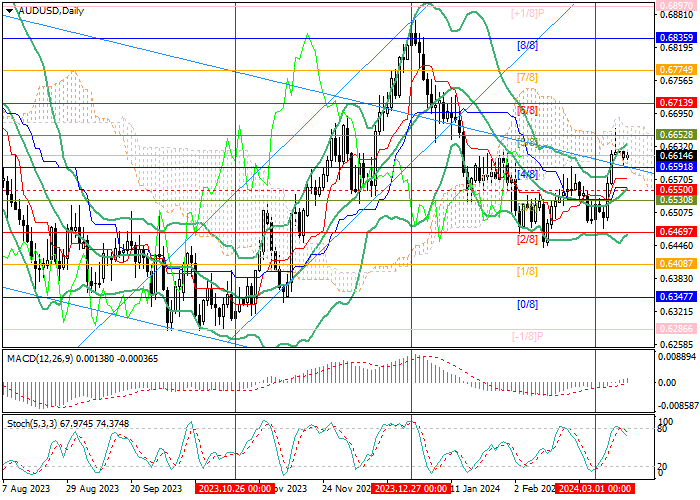

The trading instrument has been moving at 0.6620 for the second session, waiting for new drivers. If 0.6652 (Murrey level [5/8]) is broken upward, positive dynamics may reach 0.6774 (Murrey level [7/8]) and 0.6835 (Murrey level [8/8]). If the price consolidates below the key “bearish” middle line of Bollinger bands (0.6550), the decline to the zone of 0.6469 (Murrey level [2/8]) and 0.6408 (Murrey level 1/8]) will begin.

Technical indicators do not give a single signal, reflecting the uncertainty of the market before the publication of key economic statistics: Bollinger Bands are directed upward, the MACD histogram is increasing in the positive zone but Stochastic is reversing downwards.

Resistance levels: 0.6652, 0.6774, 0.6835.

Support levels: 0.6550, 0.6469, 0.6408.

Trading tips

Long positions may be opened above 0.6652 with the targets at 0.6774, 0.6835 and stop loss 0.6610. Implementation time: 5–7 days.

Short positions may be opened below 0.6550 with the targets at 0.6469, 0.6408 and stop loss 0.6590.

Hot

No comment on record. Start new comment.