Current trend

The leading Japanese stock index NI 225 is correcting near the level of 38737.0. The period for publishing corporate reports has come to an end, and macroeconomic reports and the situation on the bond market are coming to the fore.

Japan's Gross Domestic Product (GDP) rose 0.1% in the fourth quarter of 2023 from -0.7% in the previous period, pushing the annual rate up 0.4% from -3.2%. In turn, Consumer Spending continued to decline, losing 0.3% in the fourth quarter after -0.2% in the previous period, and the BSI Large Manufacturing Conditions Index in the first quarter of 2024 dropped to -6.7 points from 5.7 points.

The main negative factor for the stock index remains the growth in the domestic bond market, which stands out against the backdrop of a decline in securities of the EU and US. Japan's 10-year bonds yield held at 0.766%, up from 0.709% a week earlier, the 20-year bonds yield stood at 1.518% from 1.477% earlier, and the 30-year bonds yield rose to 1.793% from 1.754%.

The growth leaders in the index are Dainippon Sumitomo Pharma Co. Ltd. ( 2.17%), Toho Co. Ltd. ( 2.53%), Daikin Industries Ltd. ( 2.60%), DeNA Co. Ltd. ( 2.33%).

Among the leaders of the decline are Mitsui & Co. Ltd. (-4.08%), Renesas Electronics Corp. (-4.29%), Keisei Electric Railway Co. (-3.81%).

Support and resistance

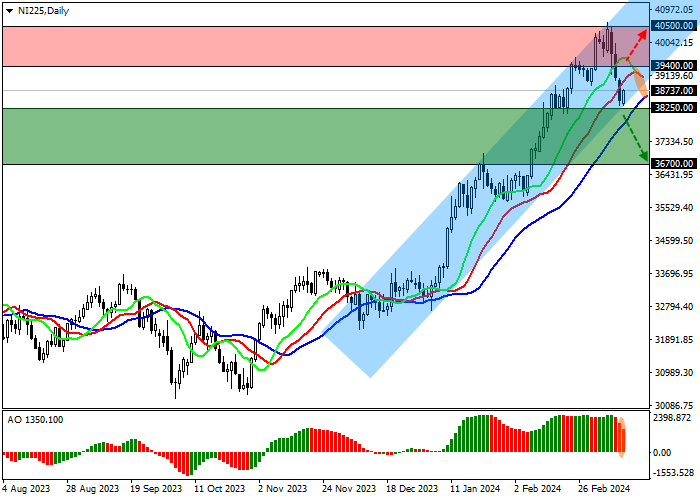

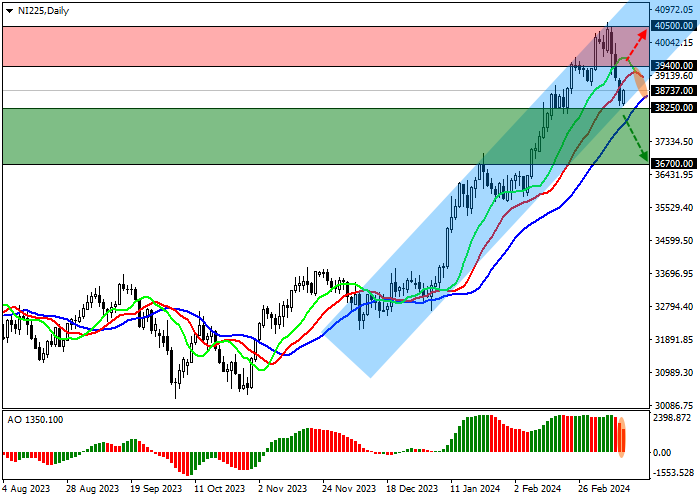

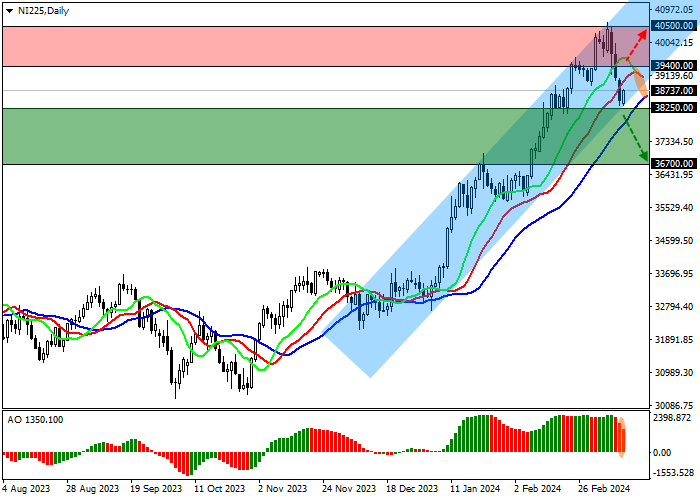

On the daily chart, the price is held near the support line of the local ascending channel with dynamic boundaries of 40000.0–38800.0.

Technical indicators have almost reversed and are ready to issue a new sell signal: the AO histogram is forming new descending bars, and fast EMAs on the Alligator indicator are approaching the signal line, narrowing the range of fluctuations.

Support levels: 38250.0, 36700.0.

Resistance levels: 39400.0, 40500.0.

Trading tips

In the event of a reversal and continued local decline in the asset, as well as price consolidation below the support level of 38250.0, sell positions with a target of 36700.0 will be relevant. Stop-loss — 38600.0. Implementation time: 7 days and more.

If the asset continues to grow and consolidates above the resistance level of 39400.0, buy positions with a target of 40500.0 will be relevant. Stop-loss — 39000.0.

Hot

No comment on record. Start new comment.