Current trend

The NZD/USD pair is trading with near-zero dynamics, holding near 0.6170: investors are awaiting the publication of macroeconomic statistics, which will determine the direction of movement in the instrument. Today at 14:30 (GMT 2) the US will present February inflation statistics: a slight slowdown in the Core Consumer Price Index is expected from 3.9% to 3.7% in annual terms and from 0.4% to 0.3% on a monthly basis, while the main indicator is expected to remain unchanged at 3.1%.

Meanwhile, data published today from New Zealand currently has virtually no impact on the dynamics. Electronic Card Retail Sales fell 1.8% in February after growing 2.0% in the previous month (revised from 1.7%). At the same time, in annual terms the indicator accelerated from 1.6% to 2.5%. In turn, Karen Silk, Assistant Governor of the Reserve Bank of New Zealand, said the regulator had been fairly consistent in its messages to the market during its meetings on raising borrowing costs. The one-year swap rate adjusted by nearly 50 basis points during that time as traders reacted to weak economic activity and then stronger inflation and labor market data.

Some support for quotes continues to be provided by data from China that entered the market last week: the Consumer Price Index in February added 0.7% in annual terms after -0.8% a month earlier, while analysts expected 0.3%, and in monthly terms the indicator accelerated from 0.3% to 1.0%, with expectations of 0.7%.

Support and resistance

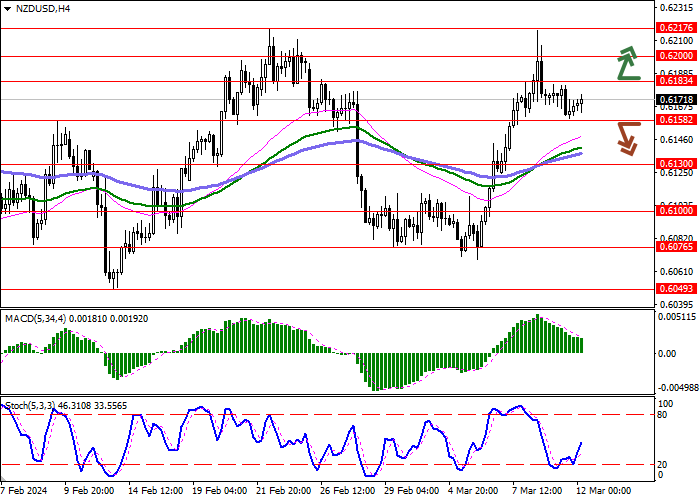

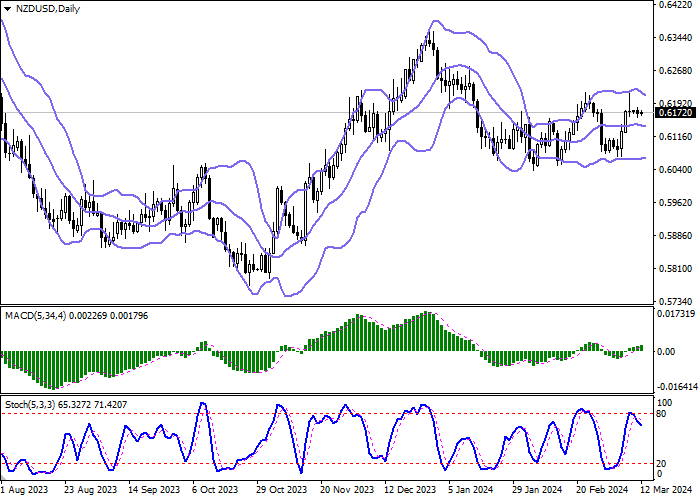

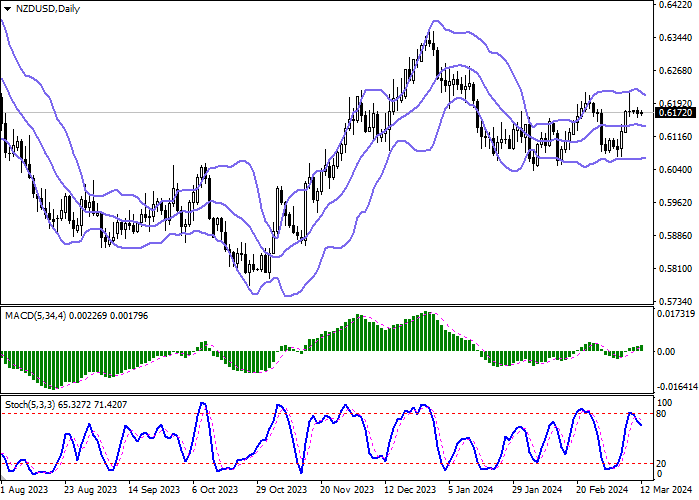

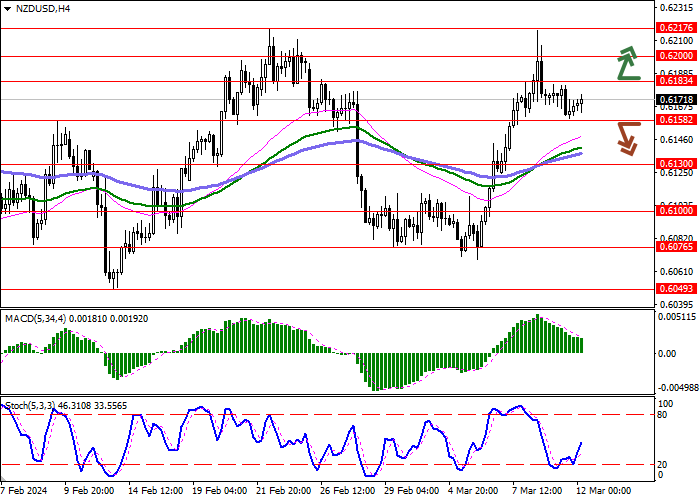

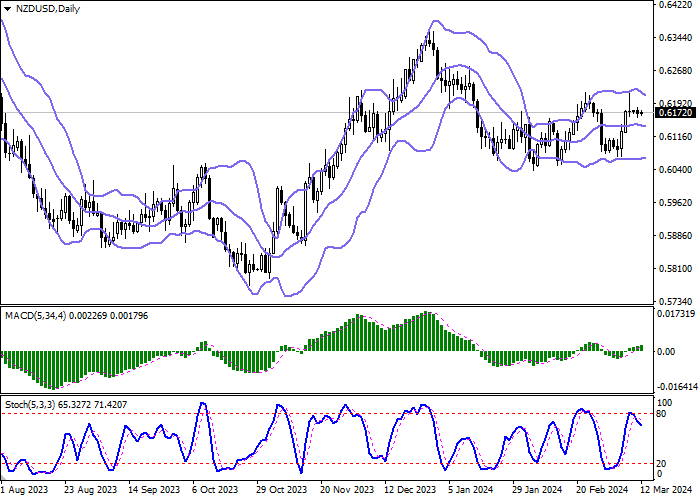

Bollinger Bands on the daily chart show flat dynamics. The price range is narrowing, reflecting mixed trading in the short term. MACD indicator is growing, while preserving a rather stable buy signal (located above the signal line). Stochastic, having retreated from its peak values, is reversing into a descending plane, signaling in favor of the development of a correctional decline in the short term.

Resistance levels: 0.6183, 0.6200, 0.6217, 0.6250.

Support levels: 0.6158, 0.6130, 0.6100, 0.6076.

Trading tips

Short positions may be opened after a breakdown of 0.6158 with the target at 0.6130. Stop-loss — 0.6175. Implementation time: 2-3 days.

The return of the "bullish" trend with the breakout of 0.6183 may become a signal for new purchases with the target of 0.6217. Stop-loss — 0.6165.

Hot

No comment on record. Start new comment.