Current trend

Shares of eBay Inc., an American online retailing company, are correcting around 50.00.

After the publication of the financial report for Q4 2023, leading analytical agencies began to revise their estimates of eBay Inc. shares. For example, the Jefferies Group experts raised the target price from 44.0 dollars to 48.0 dollars, keeping the recommendation at the "hold" level. Analysts believe that the two-year cycle of decline in the gross volume of goods has come to an end, and the emitter's quotes will soon move to an uptrend.

The financial report itself turned out to be stable: eBay Inc. revenue increased by 3.0% to 2.6 billion dollars, and the GAAP operating margin increased to 26.7%. The Motors Parts & Accessories and eBay Authenticity Guarantee divisions have achieved significant growth. The company's advertising business expanded by 25.0% and brought more than 1.4 billion dollars to the total result. For Q1 2024, the company expects revenue of 2.50–2.54 billion dollars, and the GMV figure may range from 18.2 billion dollars to 18.5 billion dollars.

On March 8, the shareholders' register was closed for the payment of dividends, scheduled for March 25. They were previously raised to 0.27 dollars per share, which could bring shareholders up to 2.13% of revenue for the quarter.

Support and resistance

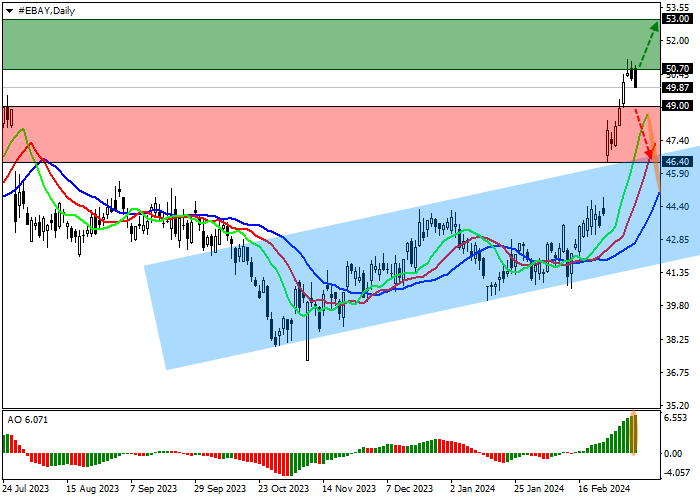

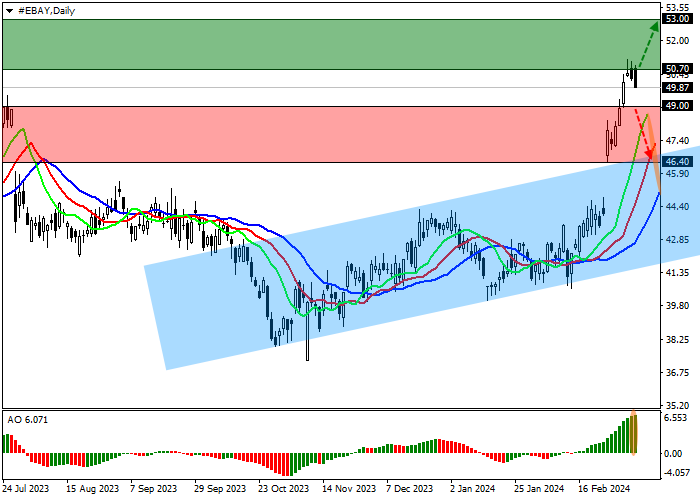

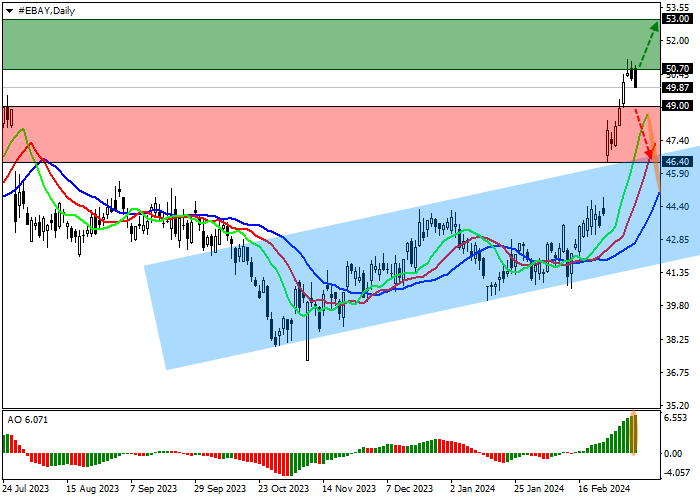

On the D1 chart, the asset is trading within the global uptrend, moving further away from the recent high of last year at 49.00.

Technical indicators maintain a stable buy signal: the range of EMAs fluctuations on the Alligator indicator expands in the direction of growth, and the AO histogram forms new correction bars, being significantly above the transition level.

Support levels: 49.00, 46.40.

Resistance levels: 50.70, 53.00.

Trading tips

If the asset continues to grow and the price consolidates above the local maximum of 50.70, one may open long positions with the target of 53.00 and stop-loss of 49.50. Implementation time: 7 days and more.

In case of a reversal and continued decline of the asset, as well as price consolidation below the support level of 49.00, one can open short positions with the target of 46.40 and stop-loss of 50.00.

Hot

No comment on record. Start new comment.