Current trend

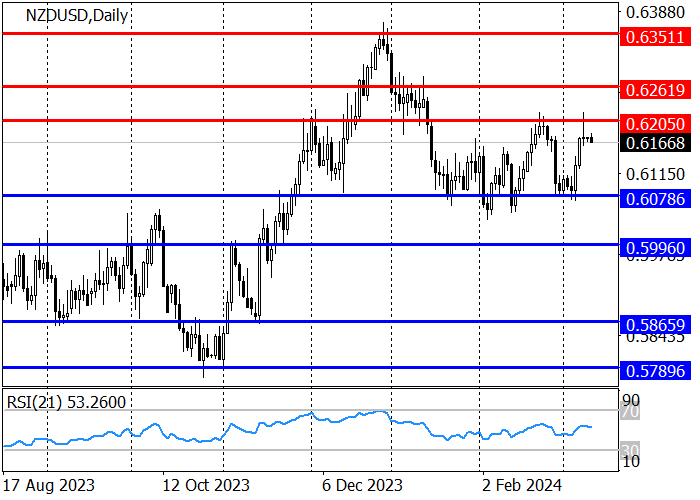

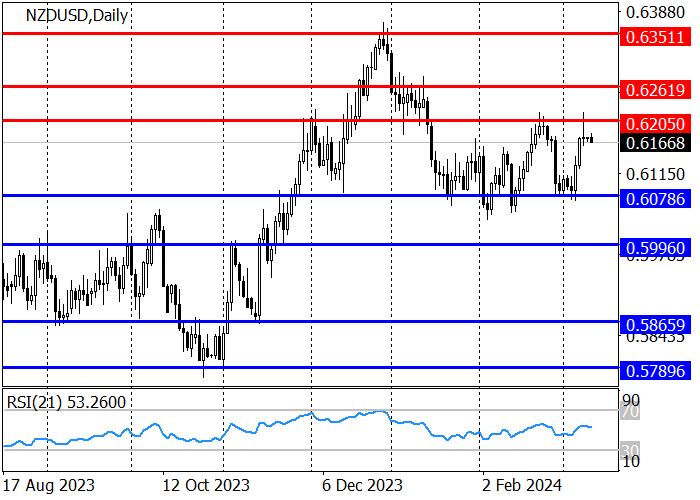

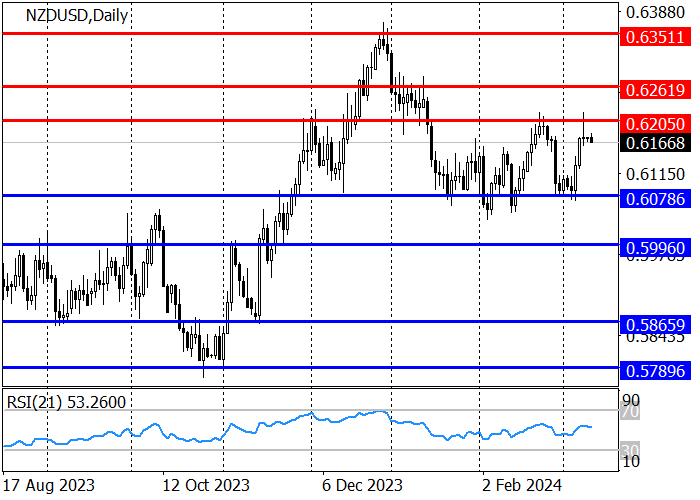

The NZD/USD pair formed a wide range of 0.6205–0.6078 amid continued uncertainty in the market due to the timing of the change in the monetary rate in the United States.

Against unstable American macroeconomic statistics, investors are not ready for large purchases or sales, and secondary assets, such as the New Zealand dollar, are awaiting the emergence of new macroeconomic data for upward or downward dynamics. Now, investors are analyzing the decision of the Reserve Bank of New Zealand, which kept the interest rate at 5.50% and lowered its forecast for the peak value of the indicator from 5.70% to 5.60%, softening its “hawkish” position and hinting at the absence of plans for further tightening of monetary stimulus, as most indicators of inflation risks have decreased.

The latest upward impulse, observed from October to December, indicates a long-term upward trend in the NZD/USD pair. Now, the quotes are moving within a downward correction, within which a narrower range of 0.6205–0.6978 has formed: if the price overcomes the resistance level of 0.6205, then an upward trend may continue to the area of 0.6262 and 0.6351, and after a breakdown of the support level of 0.6078, a correction to the area of 0.5996 and 0.5865 is expected.

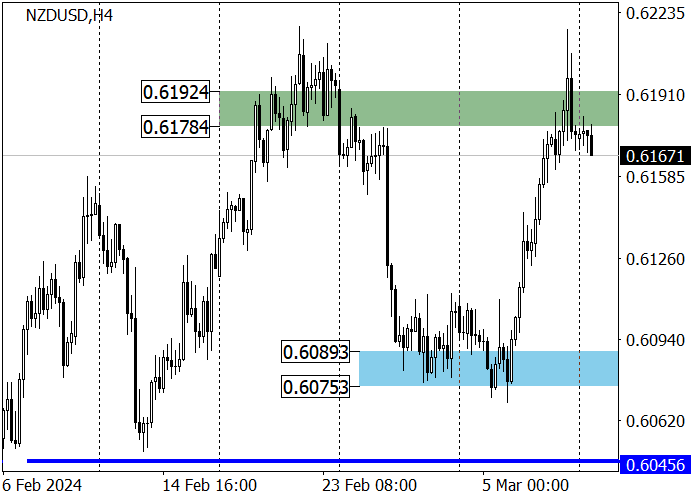

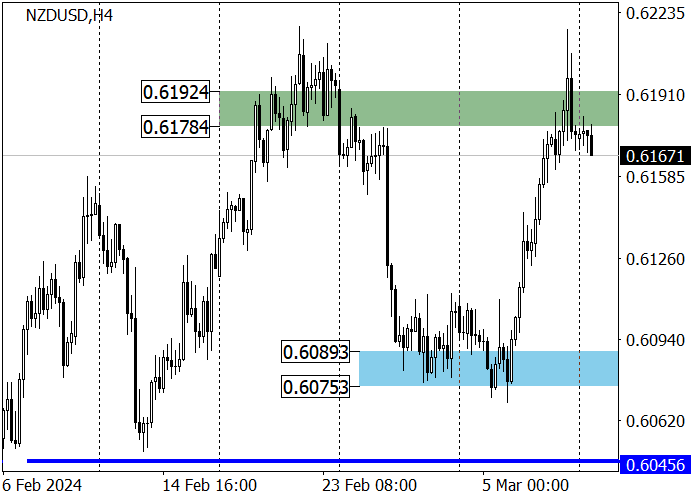

The medium-term trend is downward: last week, the asset tried to change the trend by testing the key resistance zone of 0.6192–0.6178. When a sell signal appears, short positions with the target in zone 2 (0.6089–0.6075) are relevant, after breaking through which the instrument will head to zone 3 (0.5949–0.5935). If the resistance area of 0.6192–0.6178 is broken, the trend will reverse upwards, and long positions with the targets of 0.6332–0.6318 will become relevant.

Support and resistance

Resistance levels: 0.6205, 0.6262, 0.6351.

Support levels: 0.6078, 0.5996, 0.5865.

Trading tips

Short positions may be opened from 0.6205 with the target at 0.6078 and stop loss around 0.6230. Implementation time: 9–12 days.

Long positions may be opened above 0.6230 with the target at 0.6351 and stop loss around 0.6185.

Hot

No comment on record. Start new comment.