Current trend

The BTC/USD pair continues to grow within the medium-term uptrend. Last Friday, the quotes rose above the 70000.00 mark, and are now in the area of historical highs at 71500.00. Thus, the instrument completely overcame the consequences of a deep correction last week, when the price fell to 59200.00.

Expectations of halving of the Bitcoin network and correction of the monetary policy of the US Federal Reserve contribute to strengthening the position of the world's first cryptocurrency. The upcoming next reduction in the remuneration for miners, along with the achievement of historical price highs, has led to a rush for BTC, which is currently mainly supported by small investors. So, according to the analytical portal Santiment, the number of transactions in the amount of 100.0 thousand dollars decreased significantly last week. At the same time, the number of addresses of small traders continues to grow and, according to calculations by Glassnode AG, now reaches a record high of 35.0 million.

In addition, the short-term support for the BTC/USD pair is provided by the February data on the American labor market published on Friday. Despite a significant increase in employment by 223.0 thousand, unemployment increased by 3.9%, and the rate of growth in average wages decreased to 0.1% MoM and 4.3% YoY. Thus, the risks of inflationary pressure in the American economy are decreasing, which pushes the US Fed to reduce the cost of borrowing and weakens the US currency.

Support and resistance

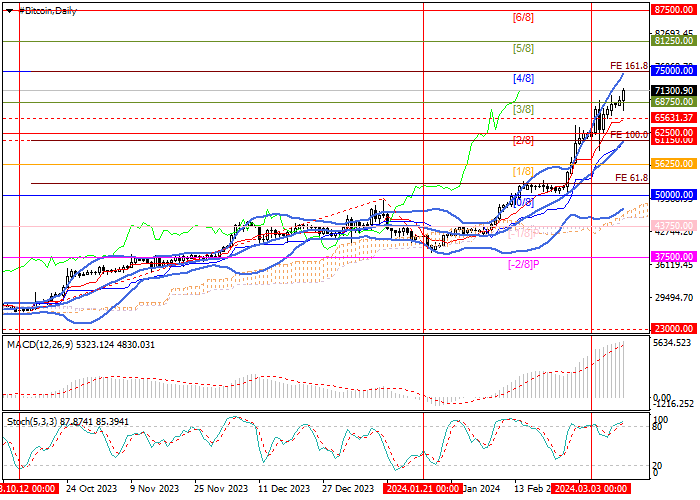

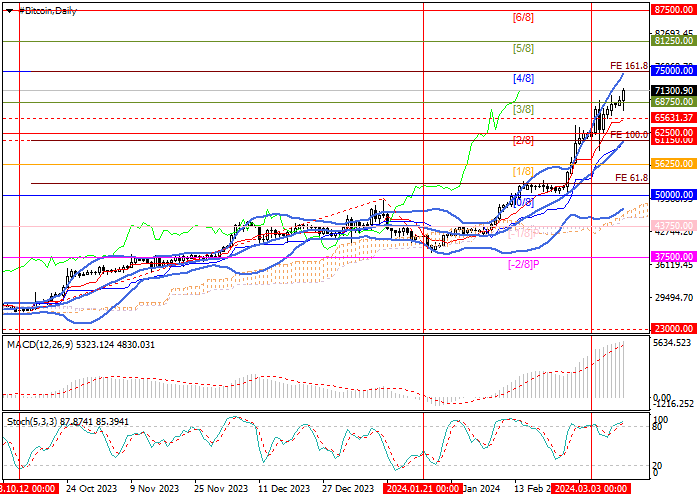

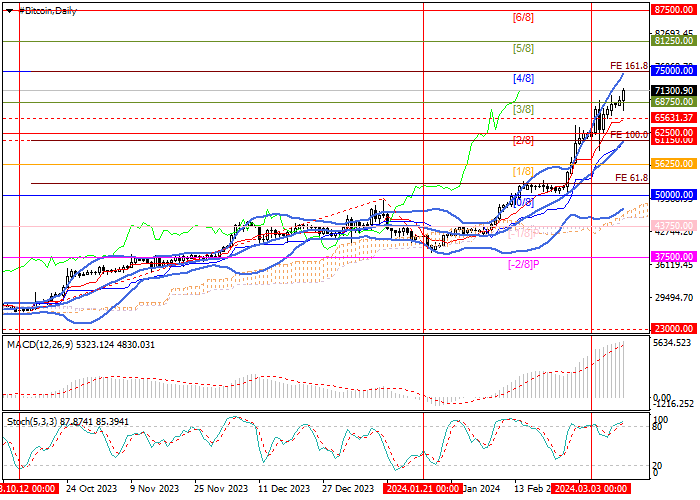

The price has consolidated above 68750.00 (Murrey level [3/8]), which opens the way for further growth towards the targets of 75000.00 (Murrey level [4/8]), 81250.00 (Murrey level [5/8]), and 87500.00 (Murrey level [6/8]). The key for the "bears" is the support zone of 62500.00–61150.00 (Murrey level [2/8], the central line of Bollinger Bands, 100.0% Fibonacci extension ), after consolidation below which the price may drop to 50000.00 (Murrey level [0/8]).

Technical indicators confirm the continuation of the uptrend: Bollinger Bands and Stochastic are directed upwards, and MACD is increasing in the positive zone.

Resistance levels: 75000.00, 81250.00, 87500.00.

Support levels: 61150.00, 56250.00, 50000.00.

Trading tips

Long positions can be opened from the current level with targets of 75000.00, 81250.00, 87500.00 and stop-loss of 68800.00.

Short positions can be opened below the 61150.00 mark with targets of 56250.00, 50000.00 and stop-loss of 65600.00. Implementation period: 5–7 days.

Hot

No comment on record. Start new comment.