Current trend

The leading index of the Frankfurt Stock Exchange DAX 40 is trading at 17740.0 amid a correction in the bond market, as well as macroeconomic reports. One can note an increase in German industrial production by 1.0% after a decrease of 2.0% a month earlier, with expectations of 0.5%. In addition, the producer price index (PPI) in January added 0.2% after -0.8%, and YoY the indicator rose to -4.4% from -5.1%, while analysts expected -6.6%.

Since the beginning of last week, there has been a downtrend in the domestic bond market, which provides additional support to the index: 10-year securities are trading at a rate of 2.270%, significantly lower than last week's indicator at 2.406%, and the yield of 20-year bonds is 2.457%, down from 2.578%.

The growth leaders in the index are Covestro AG ( 1.87%), Symrise AG ( 1.63%), Beiersdorf AG ( 1.62%), Vonovia SE ( 1.36%).

Rheinmetall AG (-3.37%), Continental AG (-2.50%), Deutsche Post AG (-2.31%) stand out among the leaders of the decline.

Support and resistance

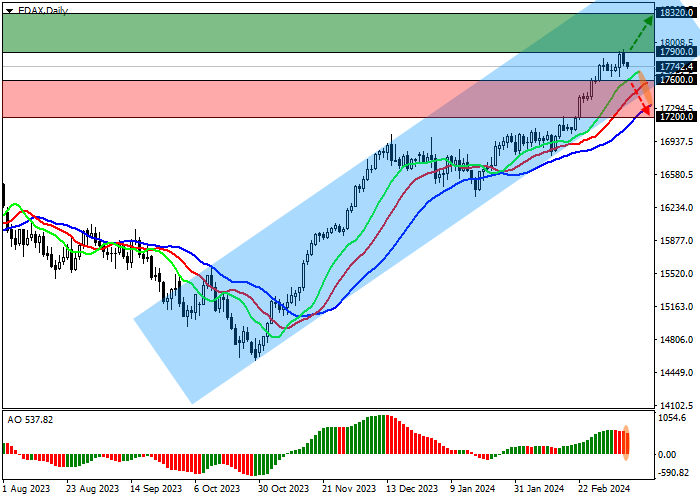

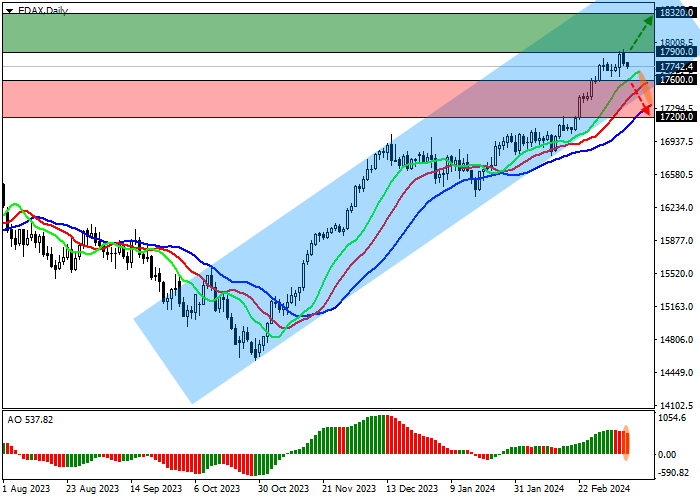

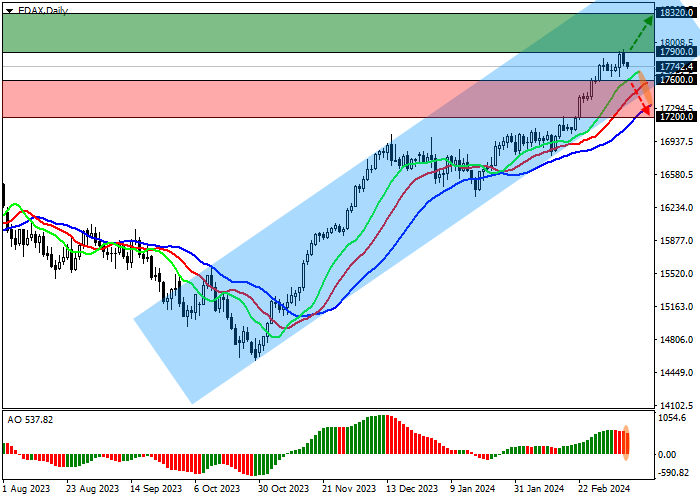

On the D1 chart, the price is trading in an uptrend, approaching the resistance line of the global ascending channel with dynamic borders of 18300.0–17400.0.

Technical indicators have completely reversed towards growth, strengthening the current buy signal: the fast EMAs on the Alligator indicator are moving away from the signal line, and the AO histogram, being in the buy zone, forms ascending bars.

Support levels: 17600.0, 17200.0.

Resistance levels: 17900.0, 18320.0.

Trading tips

In case of continued local growth of the asset, and price consolidation above the local resistance level of 17900.0, buy positions with the target of 18320.0 may be opened. Stop-loss – 17800.0. Implementation time: 7 days and more.

In the event of a reversal and decline of the asset, as well as price consolidation below the local support level of 17600.0, sell positions with the target of 17200.0 can be opened. Stop-loss – 17800.0.

Hot

No comment on record. Start new comment.