Current trend

During the Asian session, the AUD/USD pair is trading at 0.6612, correcting after the rapid upward dynamics at the end of last week, which developed against macroeconomic statistics from Australia.

Thus, exports increased by 1.6%, and imports decreased from 4.0% to 1.3%, supporting the trade balance from 10.743B Australian dollars to 11.027B Australian dollars. Tomorrow at 02:30 (GMT 2), data on the real estate market will be published, which remains one of the lagging sectors of the national economy. Building permits may adjust by –1.0%, better than –10.1% earlier. However, the indicator for private houses is –9.9% compared to –0.5% in the previous period. Given these expectations, the US currency will continue to have a key influence on the asset.

The American dollar has stabilized after falling in the middle of last week and is now holding around 102.50 in USDX against ambiguous Friday statistics. Thus, investors were disappointed by the data on average hourly wages, which decreased from 0.5% to 0.1% MoM and from 4.4% to 4.3% YoY. However, nonfarm payrolls increased from 229.0K to 275.0K, and the private nonfarm payrolls – from 177.0K to 223.0K.

Inflation data will be published on Tuesday: according to preliminary estimates, the February consumer price index increased by 0.4% MoM and 3.1% YoY, slightly higher than previous estimates of 0.3% and 3.1%, respectively, and the index excluding food products and energy resources will decrease from 3.9% to 3.7%.

Support and resistance

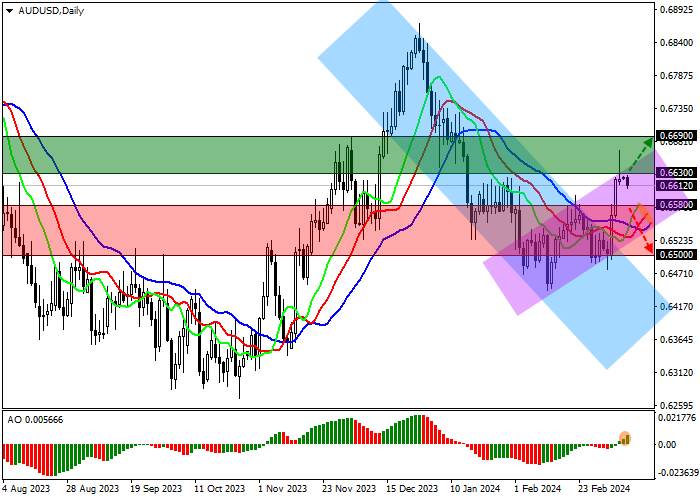

On the daily chart, the price is rising within a local ascending channel with dynamic boundaries of 0.6650–0.6550.

Technical indicators are strengthening the global buy signal: fast EMAs on the Alligator indicator are above the signal line, expanding the range of fluctuations, and the AO histogram forms ascending bars in the buy zone, moving away from the transition level.

Resistance levels: 0.6630, 0.6690.

Support levels: 0.6580, 0.6500.

Trading tips

Long positions may be opened after the price rises and consolidates above 0.6630, with the target at 0.6690. Stop loss – 0.6600. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 0.6580, with the target at 0.6500. Stop loss – 0.6620.

Hot

No comment on record. Start new comment.