Current trend

During the Asian session, the USD/CHF pair is correcting after last week’s decline and is testing the level of 0.8775 for a breakout, waiting for new drivers for movement.

Thus, renewed American inflation data for February will be published on Tuesday, and on Thursday, they will be supplemented by the dynamics of producer prices. Analysts’ forecasts do not imply significant changes, and therefore the market reaction may be restrained: the consumer price index will accelerate from 0.3% to 0.4% MoM and will remain at 3.1% YoY, and without taking into account the cost of food and energy, indicator may drop from 3.9% to 3.7%.

Meanwhile, investors are assessing Friday’s labor market statistics: nonfarm payrolls in January increased from 229.0K to 275.0K, although analysts expected an increase of only 200.0K, while the figure for last month was revised from the previous estimate of 353.0K. Average hourly wages in February slowed from 4.4% to 4.3% YoY and from 0.5% to 0.1% MoM.

In Switzerland on Thursday, there will be February data on the dynamics of the producer price index and imports: previously there was a drop in values by 0.5% and 2.3%, respectively.

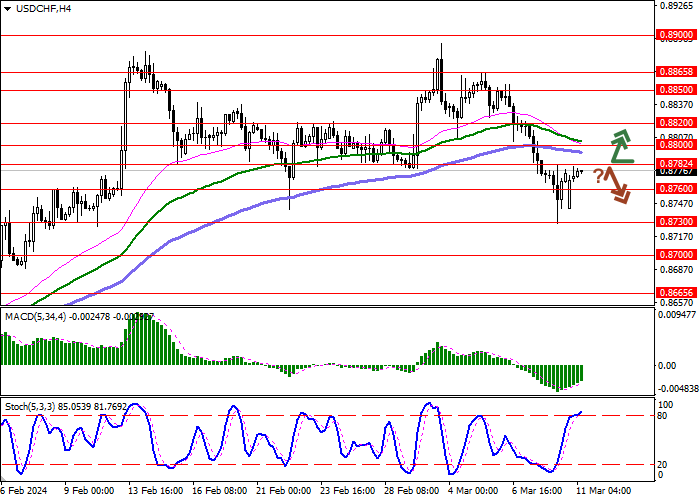

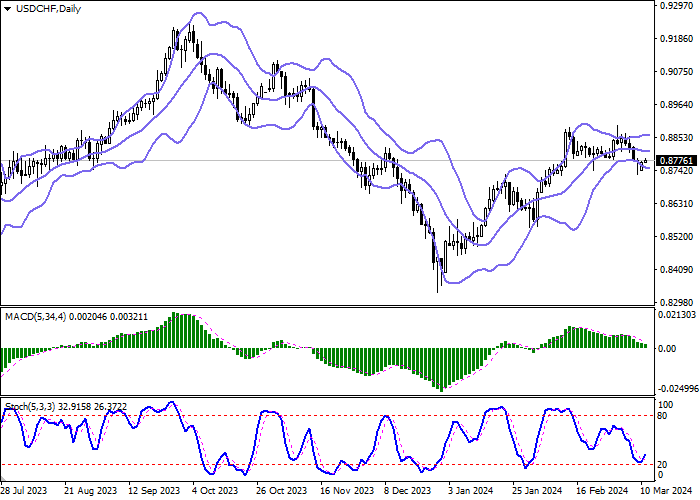

Support and resistance

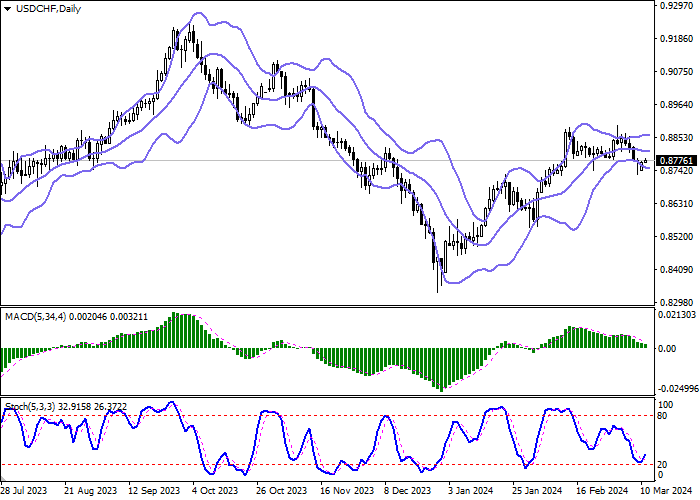

On the daily chart, Bollinger Bands are moving flat: the price range changes slightly, remaining wide enough for the current market activity. The MACD indicator is declining, maintaining a poor sell signal: the histogram is below the signal line. Stochastic reversed at “20” into an ascending plane and signals in favor of the development of the “bullish” dynamics soon.

Resistance levels: 0.8782, 0.8800, 0.8820, 0.8850.

Support levels: 0.8760, 0.8730, 0.8700, 0.8665.

Trading tips

Long positions may be opened after a breakout of 0.8782 with the target at 0.8820. Stop loss – 0.8760. Implementation time: 1–2 days.

Short positions may be opened after a rebound from 0.8782 and a breakdown of 0.8760 with the target at 0.8700. Stop loss – 0.8790.

Hot

No comment on record. Start new comment.