Current trend

Shares of Hewlett-Packard Co., an American giant in the field of information technology, are moving in a corrective trend and are at around 30.50.

The company continues to actively develop its products using artificial intelligence (AI) technologies, presenting at the recent Amplify conference the HP WEX digital platform, which is designed to increase staff efficiency, as well as a number of new Elite and Pro series personal computers and Z by HP workstations.

In the financial report for Q1 2024, Hewlett-Packard Co. reported a decrease in net revenue of -4.0%, but non-GAAP and EPS operating profit increased by 5.0% and 11.0% YoY, respectively. The emitter's revenue amounted to 13.20 billion dollars, which was below analysts' expectations of 13.57 billion dollars, and earnings per share (EPS) were 0.81 dollars, coinciding with forecasts. By the end of 2025, management expects to reduce costs to 1.6 billion dollars.

A new share repurchase program for Hewlett-Packard Co. is planned for the second half of 2024. The next dividend payment will take place on April 3 and will amount to 0.2756 dollar per share, which is equivalent to a yield of 3.65%.

Support and resistance

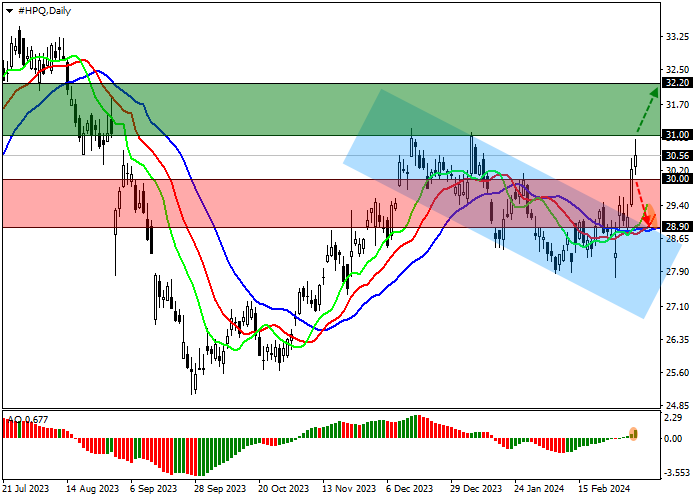

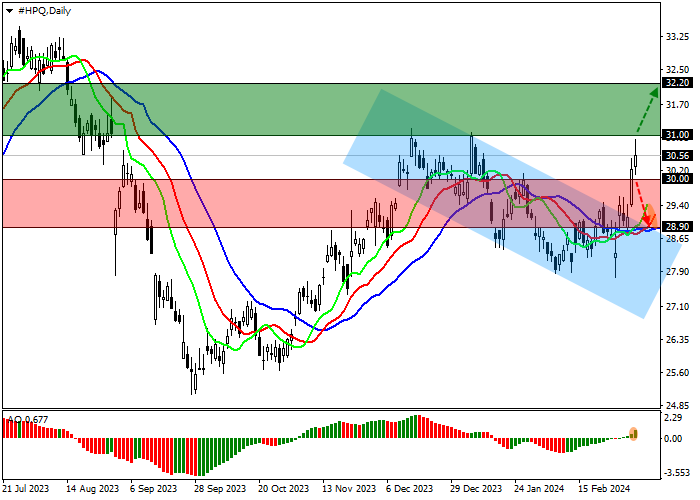

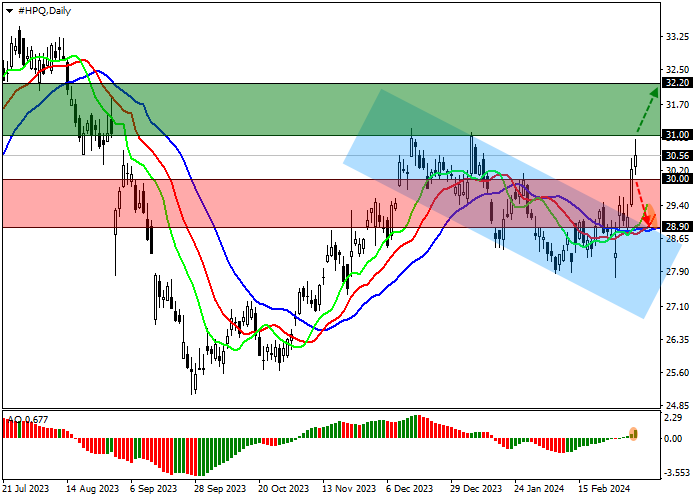

On the D1 chart, the shares are trading in a corrective uptrend after exiting the local descending channel with the borders of 27.60–29.40.

Technical indicators are in the state of a buy signal, which has begun to actively strengthen: the fast EMAs of the Alligator indicator are above the signal line, and the AO histogram is in the buy zone, forming new ascending bars.

Support levels: 30.00, 28.90.

Resistance levels: 31.00, 32.20.

Trading tips

If the local growth of the asset continues and the price consolidates above the local resistance level at 31.00, one may open long positions with the target of 32.20 and stop-loss of 30.50. Implementation time: 7 days and more.

In the event of a reversal and continued decline of the asset, as well as price consolidation below the local support level at 30.00, one can open short positions with the target of 28.90 and stop-loss of 30.50.

Hot

No comment on record. Start new comment.