Current trend

Today, the EUR/USD pair reached three-month highs around 1.0955 with the support of monetary factors.

Yesterday, a meeting of the European Central Bank (ECB) took place, which left interest rates at the same levels: key – at 4.50%, deposit – at 4.00%, margin – at 4.75%. At the same time, officials lowered their inflation forecasts: now they believe that this year it will be only 2.3% instead of 2.7%, previously expected, and by the summer of 2025 it will drop to 1.9%. During a traditional press conference, the head of the regulator, Christine Lagarde, acknowledged significant progress in the fight against rising consumer prices and said that the institution would receive enough macroeconomic data to make decisions on adjusting monetary policy in early summer. Investors took this remark as a hint at the beginning of a decrease in the cost of borrowing in June, which put pressure on the position of the European currency, but it soon resumed its uptrend, as the attention of market participants was drawn to the comments of the chairman of the US Federal Reserve.

Speaking before the Senate Banking Committee, Jerome Powell said that officials expect new evidence of inflation moving towards the 2.0% target, after which it will be possible to begin normalizing monetary policy, noting that the moment of gaining confidence in stabilizing consumer prices is already close, which strengthened investors' hopes for an early start of interest rate cuts and led to sales of the American currency.

Currently, growth is being restrained by the expectation of the publication of February employment data in the United States and the publication of weak data on the gross domestic product (GDP) of the Eurozone for Q4 2023, which increased by 0.1% YoY. If the increase in the employment indicator turns out to be weak, US Federal Reserve officials will receive another argument in favor of monetary policy correction, and the dollar will be under additional pressure, otherwise a corrective decline in the EUR/USD pair will become possible.

Support and resistance

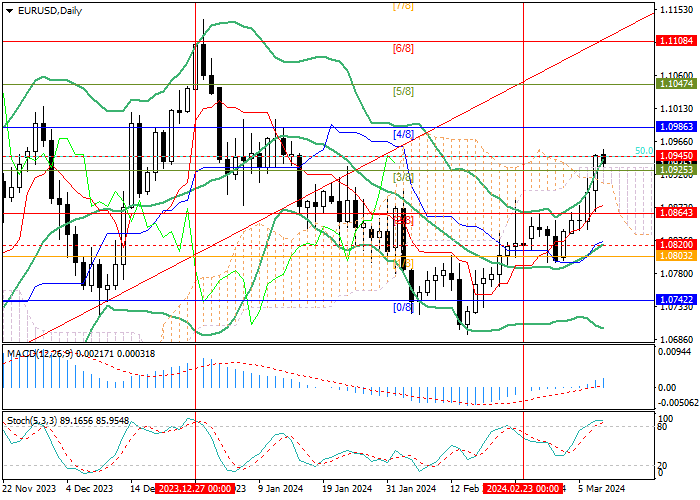

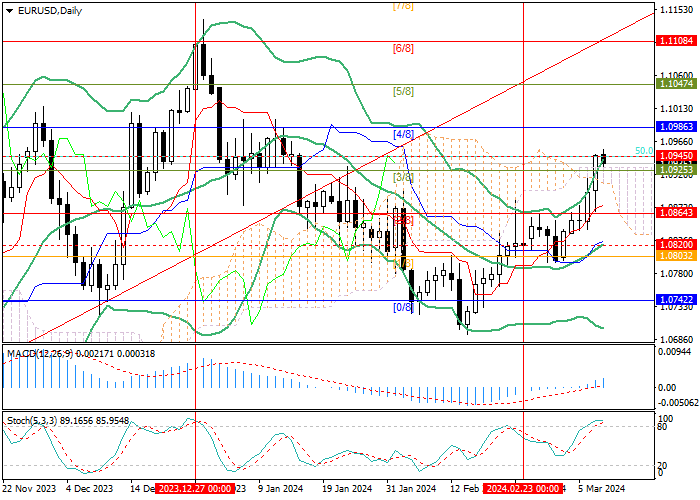

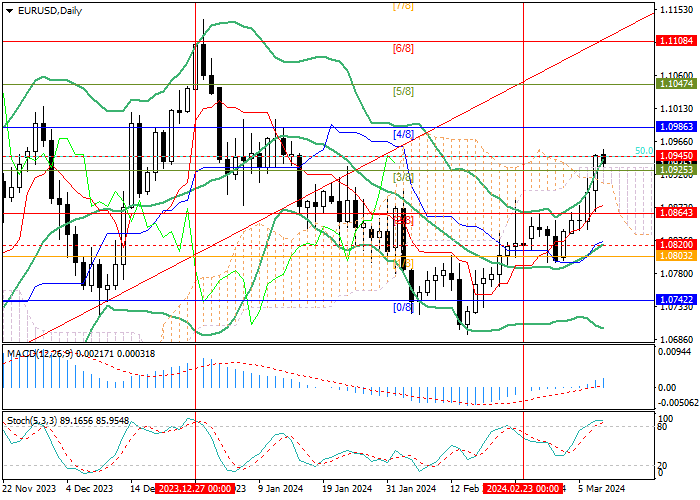

Technically, the price is testing the 1.0945 mark (50.0% Fibonacci retracement), the breakdown of which will cause further growth towards the targets of 1.0986 (Murrey level [4/8]) and 1.1047 (Murrey level [5/8]). The key for the "bears" is the central line of Bollinger Bands (1.0820), when consolidated below which the quotes will be able to return to 1.0742 (Murrey level [0/8]).

Technical indicators allow for increased growth: Bollinger Bands and Stochastic are directed upwards, although the latter has entered the overbought zone, and MACD is increasing in the positive zone.

Resistance levels: 1.0945, 1.0986, 1.1047.

Support levels: 1.0820, 1.0742.

Trading tips

Long positions can be opened above the 1.0945 mark or after the price reverses around 1.0820 with targets of 1.0986, 1.1047 and stop-losses around 1.0915 and 1.0780, respectively. Implementation period: 5–7 days.

Hot

No comment on record. Start new comment.