Current trend

The leading Japanese stock index NI 225 continues to correct near the level of 39762.0. The period for publishing reports from component companies has come to an end, and the focus of investors is once again shifting to macroeconomic data and the situation on the bond market.

Overall Household Spending fell by 2.1% in January from -0.9%, and in annual terms to -6.3% from -2.5%. In turn, Leading Economic Index decreased by 0.6% after increasing by 1.8%, amounting to 109.9 points after 110.5 points, and Bank Lending slowed down to 3.0% from 3.1%.

The domestic bond market is showing a neutral trend: 10-year bonds are trading at a rate of 0.733%, almost exactly the same as a week earlier at 0.729%, the yield on 20-year bonds fell to 1.476% after 1.515%, and 30-year bonds are trading at 1.756%, which is slightly higher than the 1.745% recorded in the previous period.

The growth leaders in the index are Osaka Gas Co. Ltd. ( 7.23%), Taisei Corp. ( 5.25%), Kajima Corp. ( 4.81%), Mizuho Financial Group Inc. ( 4.19%).

Among the leaders of the decline are Keisei Electric Railway Co. Ltd. (-9.51%), Isuzu Motors Ltd. (-3.93%), Tokyo Tatemono Co. Ltd. (-4.07%).

Support and resistance

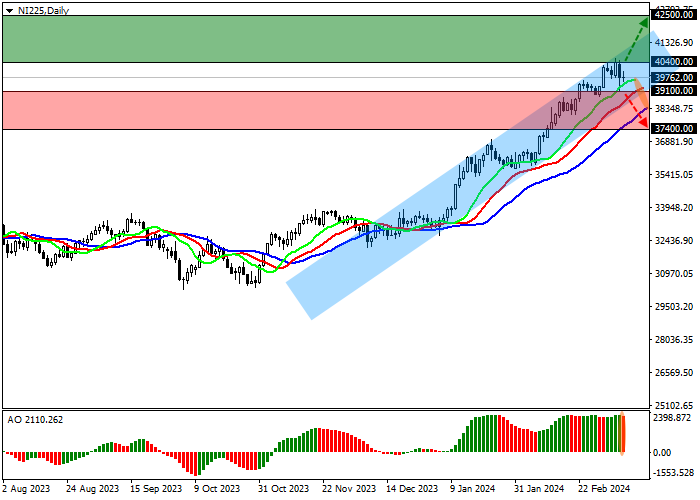

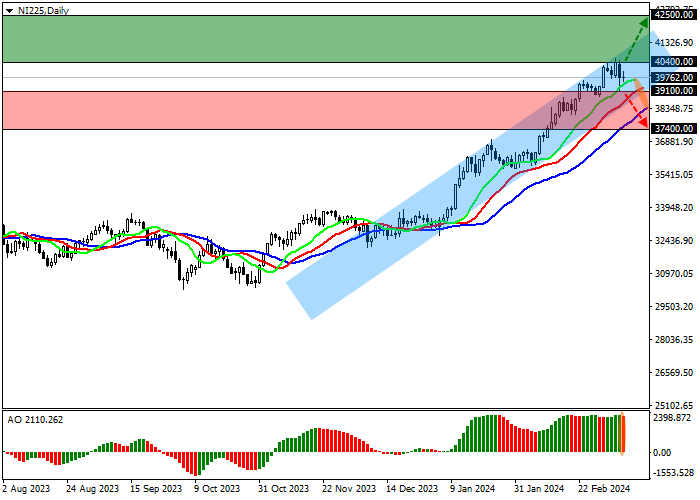

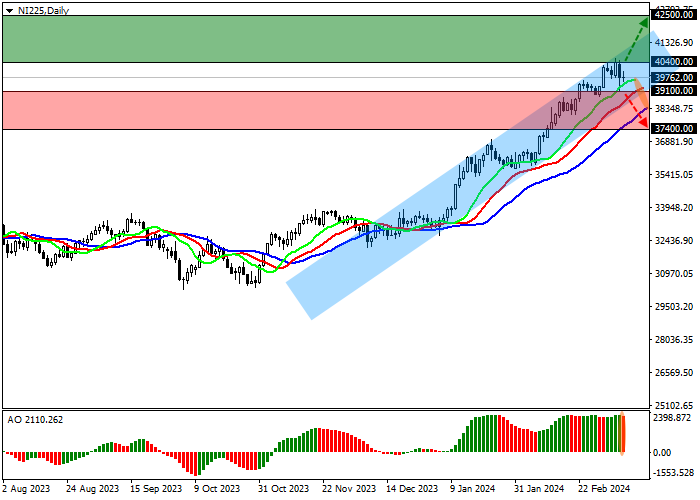

On the daily chart, the price is held just below the resistance line of the local ascending channel with dynamic boundaries of 40400.0–39000.0.

Technical indicators have reversed and keep a stable buy signal: the AO histogram forms new ascending bars, and fast EMAs on the Alligator indicator remain at a stable distance from the signal line.

Support levels: 39100.0, 37400.0.

Resistance levels: 40400.0, 42500.0.

Trading tips

If the asset continues to grow and consolidates above the resistance level of 40400.0, buy positions with a target of 42500.0 will be relevant. Stop-loss — 39200.0. Implementation time: 7 days and more.

If the asset reverses and continues local decline and the price consolidates below the support level of 39100.0, short positions can be opened with the target at 37400.0. Stop-loss — 40000.0.

Hot

No comment on record. Start new comment.