Current trend

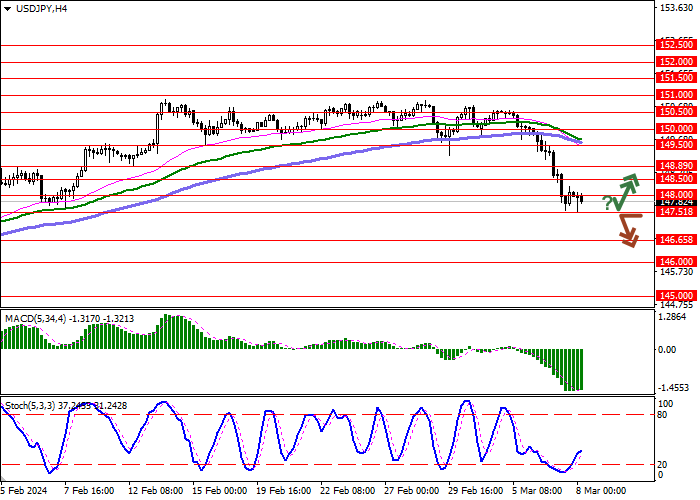

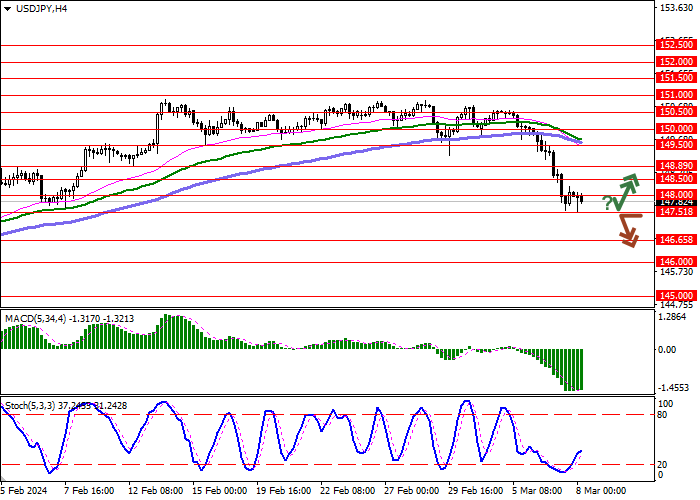

The USD/JPY pair is showing an uncertain decline, developing a strong "bearish" signal formed last Tuesday. Quotes are testing 147.80 for a breakdown, updating the local lows of February 2.

Trading participants are in no hurry to open new positions ahead of the publication of the February report on the US labor market. It is predicted that Nonfarm Payrolls will decrease from 353.0 thousand to 200.0 thousand. The Unemployment Rate may remain at 3.7%, and the Average Hourly Earnings may adjust from 4.5% to 4.4% in annual terms and from 0.6% to 0.3% in monthly terms.

Macroeconomic statistics from Japan are putting some pressure on the yen today: Overall Household Spending in January decreased by 6.3% after -2.5% in the previous month, while analysts expected -4.3%. In turn, the Leading Economic Index dropped from 110.5 points to 109.9 points, and Coincident Index went down from 116.0 points to 110.2 points. At the same time, the Japanese currency is supported by expectations of a possible abandonment of the policy of negative interest rates by the financial authorities. On March 13, representatives of large national companies and trade unions will hold negotiations on wages for 2025. Economists predict the figure will rise by an average of 3.9%, up from 3.58% in 2023, already the highest in three decades. Bank of Japan Governor Kazuo Ueda said that when deciding to change the current ultra-soft exchange rate, the key factor will be the outcome of these negotiations, which in the future will ensure sustainable consumption growth. Some investors believe that regulator officials may decide to adjust the interest rate as early as April.

Support and resistance

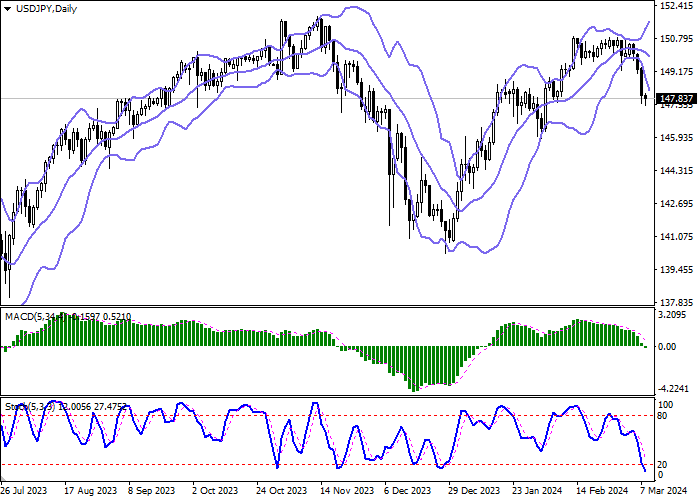

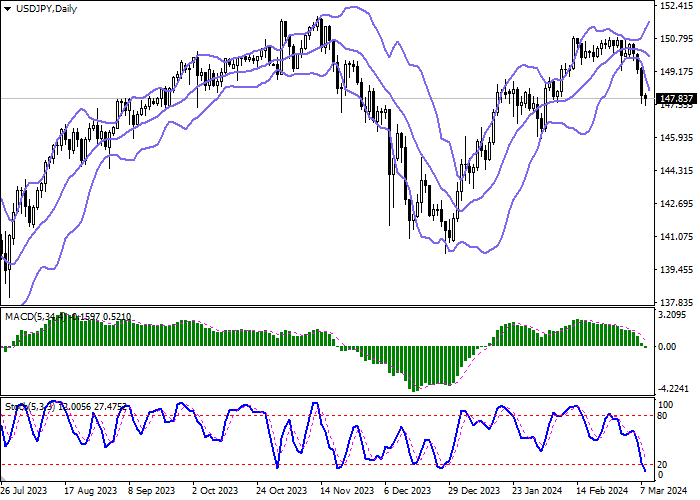

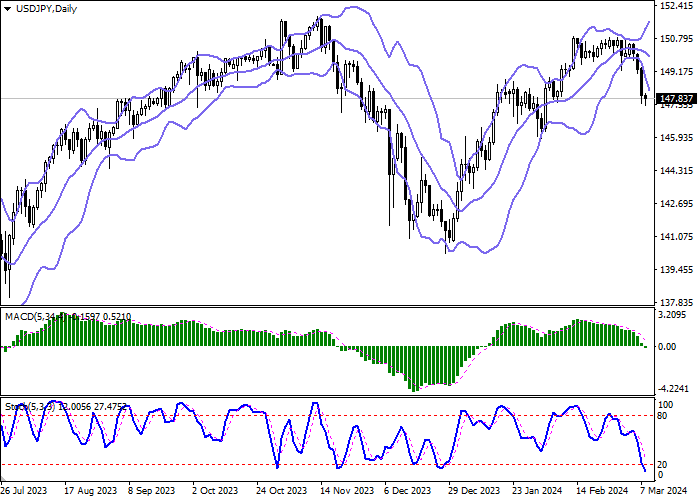

On the D1 chart Bollinger Bands are reversing into the descending plane. The price range is expanding, but at the moment it is not keeping up with the surge of "bearish" sentiment. MACD is going down preserving a stable sell signal (located below the signal line). The indicator is trying to consolidate below the zero level. Stochastic maintains its confident downward direction, but is currently located in close proximity to its lows, indicating the risks of oversold US currency in the ultra-short term.

Resistance levels: 148.00, 148.50, 148.89, 149.50.

Support levels: 147.51, 146.65, 146.00, 145.00.

Trading tips

Short positions may be opened after a breakdown of 147.51 with the target at 146.00. Stop-loss — 148.20. Implementation time: 1-2 days.

A rebound from 147.51 as from support followed by a breakout of 148.00 may become a signal for opening new long positions with the target at 149.00. Stop-loss — 147.51.

Hot

No comment on record. Start new comment.