Current trend

During the Asian session, the NZD/USD pair shows ambiguous trading dynamics, consolidating near 0.6170 ahead of the American labor market data release.

Analyst forecasts suggest a slowdown in the February nonfarm payrolls from 353.0K to 200.0K. The unemployment rate may remain at 3.7%, and the average hourly wage will slow down from 4.5% to 4.4% YoY and from 0.6% to 0.3% MoM.

Investors continue to analyze the Reserve Bank of New Zealand’s (RBNZ) decision to leave interest rates at 5.50%. At the same time, the regulator lowered its forecast for the peak value from 5.70% to 5.60%, softening its “hawkish” position and hinting that there are no plans to tighten monetary stimulus. Chief economist Paul Conway said the core consumer price index and most measures of inflation expectations had eased, and risks had become more balanced. He noted that officials could adjust borrowing costs sooner than expected if the US Federal Reserve moves to the “dovish” rhetoric this year.

In addition, traders focus on yesterday’s publication of data on China’s foreign trade: export volumes from China in February accelerated from 2.3% to 7.1%, significantly ahead of an expected slowdown to 1.9%, and imports grew from 0.2% to 3.5%, above market expectations of 1.5%, as a result of which the trade surplus rose from 75.34B dollars to 125.16B dollars, while experts expected 103.7B dollars.

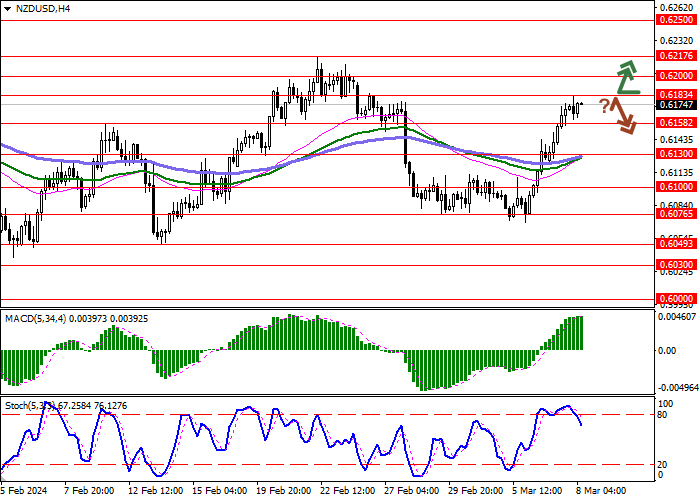

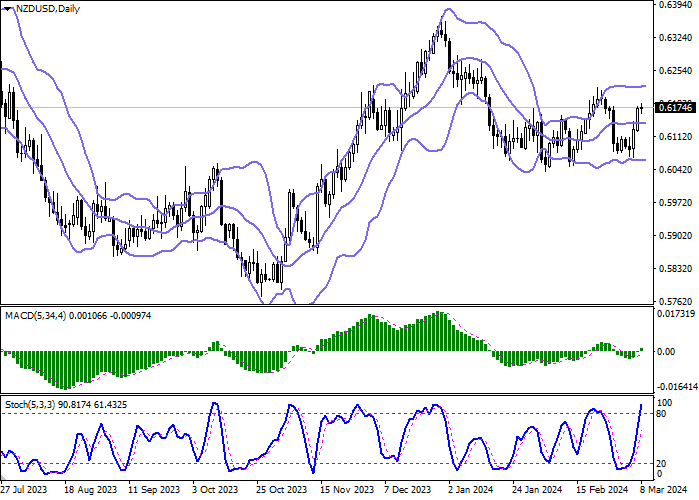

Support and resistance

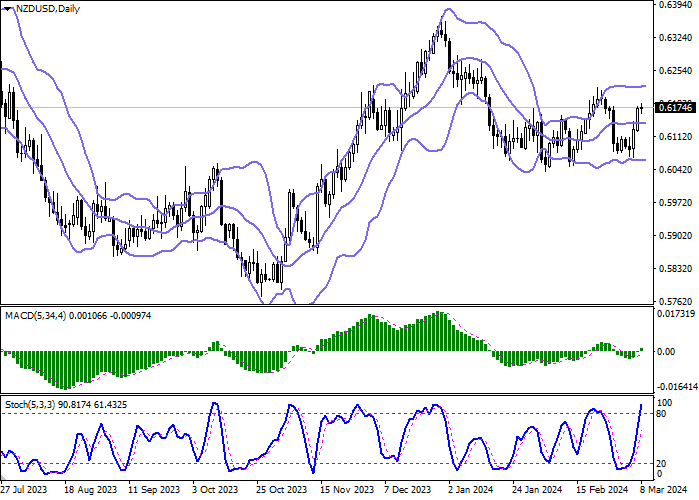

On the daily chart, Bollinger Bands are moving flat: the price range changes slightly, remaining wide enough for the current market activity. The MACD indicator is growing, maintaining a strong buy signal: the histogram is above the signal line and is trying to consolidate above the zero level. Stochastic maintains a confident upward direction but is near the highs, reflecting that the New Zealand dollar may overbought in the ultra-short-term term.

Resistance levels: 0.6183, 0.6200, 0.6217, 0.6250.

Support levels: 0.6158, 0.6130, 0.6100, 0.6076.

Trading tips

Long positions may be opened after a breakout of 0.6183, with the target at 0.6217. Stop loss – 0.6165. Implementation time: 1–2 days.

Short positions may be opened after a rebound from 0.6183 and a breakdown of 0.6158, with the target at 0.6100. Stop loss – 0.6183.

Hot

No comment on record. Start new comment.