Current trend

The AUD/USD pair is showing moderate growth, developing the "bullish" momentum formed last Wednesday, when quotes managed to retreat from the local lows of February 14. The instrument is testing 0.6630 for a breakout, and the "bulls" are updating local highs from January 16.

The Australian dollar, in addition to the further weakening of the American currency, was supported by optimistic statistics from China published on Thursday: Export volumes in February added 7.1% after an increase of 2.3% in the previous month, while analysts expected 1.9% and Imports accelerated from 0.2% to 3.5%, with a forecast of 1.5%. Such a noticeable increase in exports led to an increase in the trade surplus from 75.34 billion US dollars to 125.16 billion US dollars, with preliminary estimates of 103.7 billion US dollars.

The day before, investors assessed February data on Australian foreign trade: Export volumes adjusted from 1.5% to 1.6%, while Imports, on the contrary, slowed sharply from 4.8% to 1.3%. The trade surplus also rose from 10.74 billion Australian dollars to 11.03 billion Australian dollars, but fell short of expectations of 11.5 billion Australian dollars. Positive dynamics contribute to the strengthening of the national economy, without excluding the risks of accelerating inflation rates and the Reserve Bank of Australia (RBA) maintaining borrowing costs at peak values for a longer period of time.

Today, investors will focus on the publication of the February labor market report, which may affect the final decision of the US Federal Reserve on interest rates.

Support and resistance

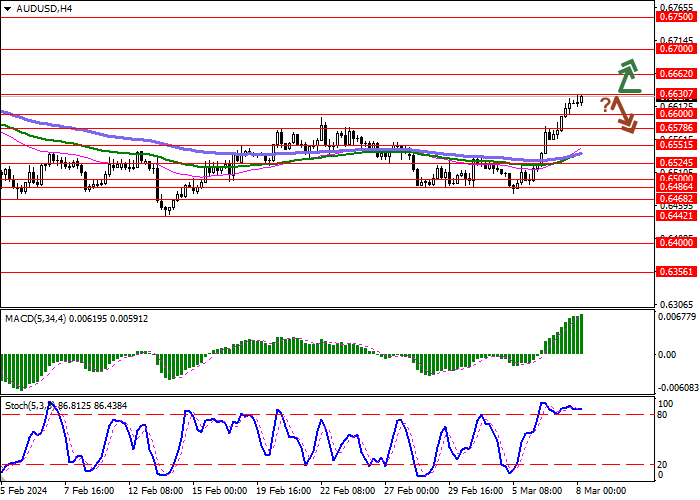

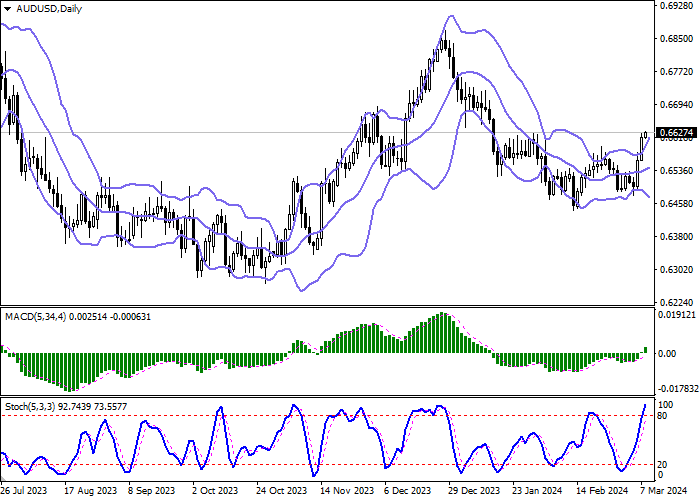

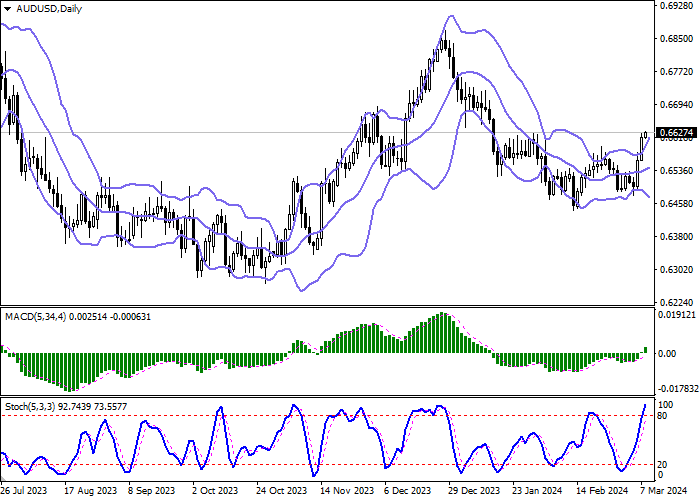

Bollinger Bands in D1 chart show moderate growth. The price range is expanding but it fails to conform to the surge of "bullish" sentiments at the moment. MACD grows, preserving a stable buy signal (located above the signal line). The indicator is also trying to consolidate above the zero level. Stochastic retains an uptrend, but is located in close proximity to its highs, which points to the risk of overbought Australian dollar in the ultra-short term.

Resistance levels: 0.6630, 0.6662, 0.6700, 0.6750.

Support levels: 0.6600, 0.6578, 0.6551, 0.6524.

Trading tips

Long positions can be opened after a breakout of 0.6630 with the target of 0.6700. Stop-loss — 0.6600. Implementation time: 1-2 days.

A rebound from 0.6630 as from resistance, followed by a breakdown of 0.6600 may become a signal for opening of new short positions with the target at 0.6524. Stop-loss — 0.6630.

Hot

No comment on record. Start new comment.