Current trend

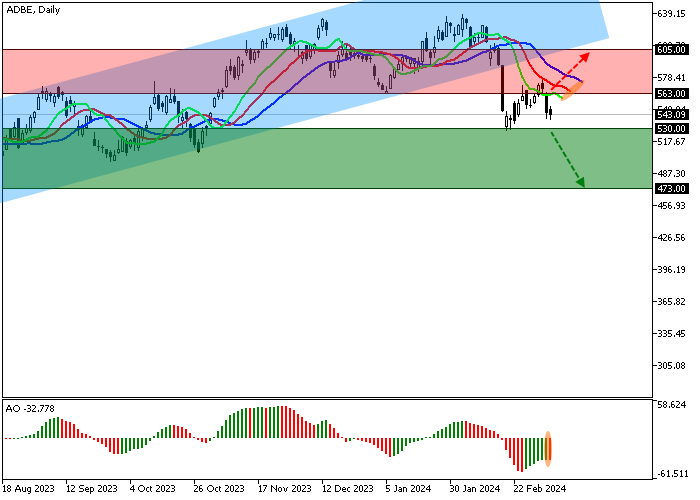

Shares of Adobe Inc., a leading American software developer, are in a corrective trend and are currently trading at 543.00.

As the date of the financial report approaches, the emitter increasingly reports on successful cooperation with other companies in the field of artificial intelligence (AI): for example, IBM Corp. noted that the first phase of testing generative AI tools from Adobe Inc. led to a significant increase in productivity, which contributes to the possible expansion of the partnership in the future. The Adobe Gen Studio solution was also appreciated by the Interpublic Group, which plans to implement it into its platforms and is confident that the product will perform "in the best way".

On March 14, the emitter's financial report for Q4 2023 and the entire fiscal year will be published: analysts expect Adobe Inc.'s revenue to grow from 5.05 billion dollars to 5.12 billion dollars, and earnings per share (EPS) will be 4.38 dollars, also higher than 4.27 dollars for the previous period.

Support and resistance

On the D1 chart, the instrument is trading in a lateral trend, holding just below the support line of the channel with the borders of 700.00–570.00 at 545.00.

Technical indicators hold a downward signal, which does not exclude the possibility of an upward movement after the current correction: the fast EMAs on the Alligator indicator are below the signal line, and the AO histogram is trading in the negative zone, forming new correction bars.

Support levels: 530.00, 473.00.

Resistance levels: 563.00, 605.00.

Trading tips

If the asset continues to decline and the price consolidates below the support level at 530.00 one can open short positions with the target of 473.00 and stop-loss of 550.00. Implementation time: 7 days and more.

If the local growth of the asset continues and the price consolidates above the resistance level at 563.00, one may open long positions with the target of 605.00 and stop-loss of 540.00.

Hot

No comment on record. Start new comment.