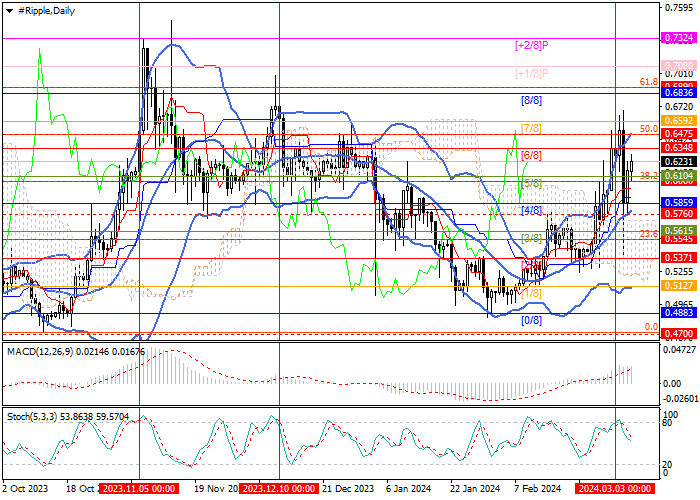

Current trend

The XRP/USD pair had ambiguous dynamics this week: at first, the price reached four-month highs around 0.6690, but then it significantly adjusted within the general market trend. The quotes fell significantly below the 0.5859–0.5760 support zone (Murrey level [4/8], the central line of Bollinger Bands), but they could not consolidate there.

Currently, XRP is actively restoring lost positions: the key for the "bulls" is the level of 0.6475 (50.0% Fibonacci retracement), the breakdown of which will lead to continued growth towards the targets of 0.6890 (Murrey level [8/8], 61.8% Fibonacci retracement) and 0.7324 (Murrey level [ 2/8]). If the price breaks down again the support zone of 0.5859–0.5760, the current uptrend may change to a downward one, and quotes may return to 0.5371 (Murrey level [2/8]) and 0.4883 (Murrey level [0/8]), however, this scenario seems less likely.

Technical indicators indicate continued price growth: Bollinger Bands are directed upwards, MACD is increasing in a positive zone, and Stochastic's reversal downwards does not exclude a repeated corrective pullback, but its potential is seen to be limited.

Support and resistance

Resistance levels: 0.6475, 0.6890, 0.7324.

Support levels: 0.5760, 0.5371, 0.4883.

Trading tips

Long positions can be opened above 0.6475 or after the price reversal around 0.5760 with targets of 0.6890, 0.7324 and stop-losses of 0.6230 and 0.5540, respectively. Implementation period: 5–7 days.

Hot

No comment on record. Start new comment.