Current trend

Against positive macroeconomic data from Australia, the AUD/USD pair is developing the strong “bullish” impulse formed yesterday and is testing 0.6585 for a breakout, renewing the highs of February 22.

The Q4 gross domestic product (GDP) increased by 0.2%, matching analysts’ expectations, and the growth rate was 1.5% YoY, better than the 1.4% forecast included in the quotes. Government data showed households are increasing spending on electricity, rent, food, and health care but cutting back on cafes and restaurants, as well as new cars and clothing. Retail sales in January increased from –2.1% to 1.1%. Today’s publications were not so positive but sufficient to keep the positive dynamics: exports adjusted by 1.6%, and imports – from 4.0% to 1.3%, ensuring an increase in the trade balance from 10.743B Australian dollars to 11.027B Australian dollars.

The American dollar closed yesterday’s trading at 103.10 in USDX against statistics from Automatic Data Processing (ADP) on the nonfarm payrolls, which increased by only 140.0K, falling short of estimates of 149.0K, as well as changes in the number of open vacancies on the labor market from JOLTS from 8.889M to 8.863M in January.

The driver of the upward movement in the asset was the speech of the head of the US Federal Reserve, Jerome Powell, in the American Congress. As expected, he repeated his thesis and noted that additional evidence of inflationary pressure decrease was needed to correct the monetary policy.

Support and resistance

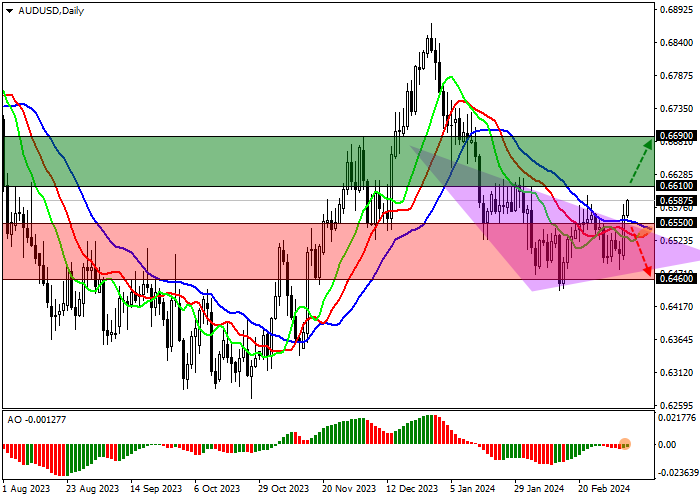

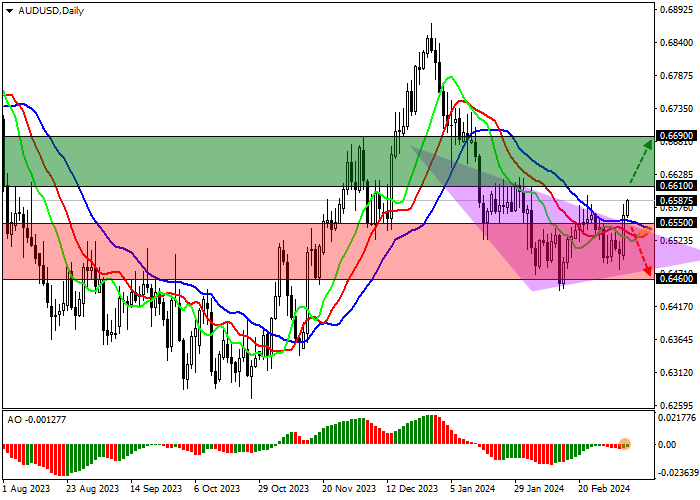

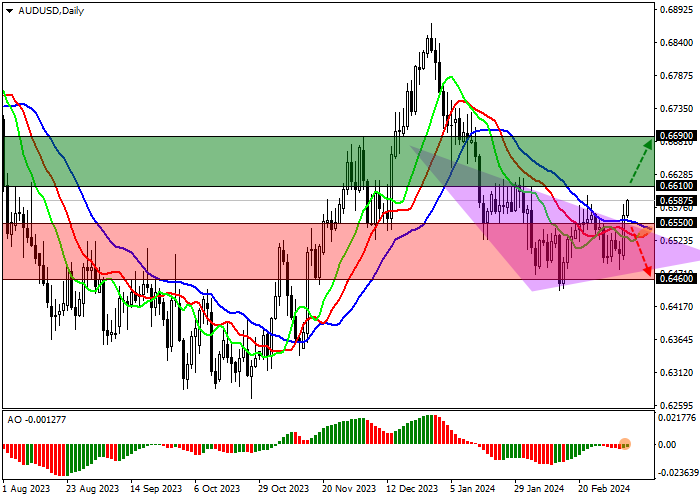

On the daily chart, the trading instrument is correcting, and a Head and shoulders reversal pattern with a Neckline around the passed level of 0.6560 may form.

Technical indicators weaken the sell signal: fast EMA on the Alligator indicator are below the signal line, approaching it and narrowing the range of fluctuations, and the AO histogram forms ascending bars in the sell zone, approaching the transition level.

Resistance levels: 0.6610, 0.6690.

Support levels: 0.6550, 0.6460.

Trading tips

Long positions may be opened after the price rises and consolidates above 0.6610, with the target at 0.6690. Stop loss – 0.6560. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 0.6550, with the target at 0.6460. Stop loss – 0.6600.

Hot

No comment on record. Start new comment.