Current trend

During the Asian session, the USD/JPY pair renews the lows of early February and tests the support level of 148.50, while analysts await the speech of US Federal Reserve Chairman Jerome Powell at the Senate Banking Committee.

Yesterday, the positive dynamics of the yen were due not only to the weakening of the American dollar but also to stable Japanese macroeconomic data. The consumer price index in February was 2.5%, the same as a year earlier, and the average wage increased from 1.0% to 2.0 %. The services PMI remains in the green zone at 52.9 points, better than the predicted 52.5 points. On Friday, the Q4 gross domestic product (GDP) will be published. Also, the January payment balance is expected to show a deficit of 330.4B yen against the surplus of 744.3B yen earlier.

The American dollar fell to 103.10 in USDX points amid poor labor market reports: according to Automatic Data Processing (ADP), February nonfarm payrolls increased to 140.0K, below the forecast of 149.0K, and the JOLTS open vacancies in the labor market decreased from 8.889M to 8.863M. The head of the US Fed has already spoken before the House Financial Services Committee, repeating his thesis that to launch a program to reduce interest rates, it is necessary to wait for the emergence of new evidence of weakening inflation, and pointed to a sufficient margin of safety in the American economy, allowing officials to maintain a wait-and-see attitude. Powell’s speech to the Senate Banking Committee is expected today: the tone of the statements will likely remain the same, and the market reaction will be restrained.

Under these conditions, a further decline in the USD/JPY pair looks most likely. However, if the dollar strengthens, a local increase in the asset is not excluded.

Support and resistance

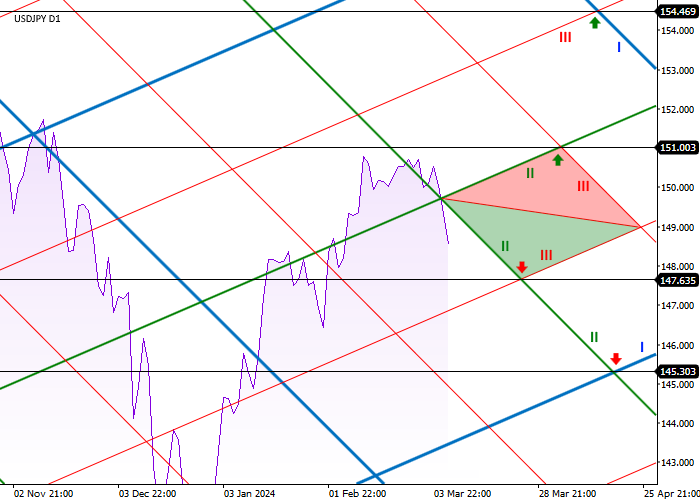

On the daily chart, the trading instrument moves between the first-order levels (I). After crossing the crosshair between the second-order levels (II) around 149.69, a downward trend develops.

Further dynamics will continue within this range, and the local crosshair of second-order left support (II) and third-order right support (III) at 147.63 will become the immediate target, and the long-term one is the crosshair between second-order left support (II) and right support of the first order (I) at 145.30.

In the event of a reversal and continuation of global growth, the price may reach the crosshairs of the left resistance of the second order (II) and the right resistance of the third order (III) around 151.00, and then – the crosshairs of the left resistance of the third order (III) and the right resistance of the first order (I) at 154.46.

Resistance levels: 151.00, 154.46.

Support levels: 147.63, 145.30.

Trading tips

Short positions may be opened after the consolidation below 147.63 with the target at 145.30. Stop loss – 148.30. Implementation period: 7 days or more.

Long positions may be opened after the consolidation above 151.00 with the target at 154.46. Stop loss – 150.00.

Hot

No comment on record. Start new comment.