Current trend

The XAG/USD pair shows mixed dynamics, holding at 24.10. Trading participants are in no hurry to open new positions, preferring to wait for new drivers to appear on the market.

The focus of investors' attention today will be the second speech by US Federal Reserve Chairman Jerome Powell in the US Congress. The day before, the official remained faithful to his previous theses about the need to wait for additional signals of easing inflationary pressure before launching a program to reduce borrowing costs. At the same time, representatives of the Fed understand the need to ease monetary policy and promise to return to "dovish" rhetoric as soon as this becomes possible.

In addition, yesterday, the data from Automatic Data Processing (ADP) was published on employment in the private sector in the United States: in February the figure increased from 111.0 thousand to 140.0 thousand, with a forecast of 150.0 thousand. In turn, JOLTS Job Openings in January decreased from 9.026 million to 8.863 million, while analysts expected a decrease to 8.900 million. Tomorrow the February report on the US labor market will be presented. The dynamics of growth in Nonfarm Payrolls is expected to slow down from 353.0 thousand to 200.0 thousand, and the Average Hourly Earnings may adjust from 4.5% to 4.4%.

There is a correction in the silver contract market: according to a report from the US Commodity Futures Trading Commission (CFTC), last week the number of net speculative positions in the precious metal decreased to 14.5 thousand from 22.4 thousand previously. The "bulls" have lost their slight advantage: from the report on positions secured by real money, their balance is 33.099 thousand versus 37.242 thousand for the "bears". Last week, buyers reduced the number of contracts by 3.457 thousand, while sellers increased it by 6.049 thousand, which indicates the priority of short positions.

Support and resistance

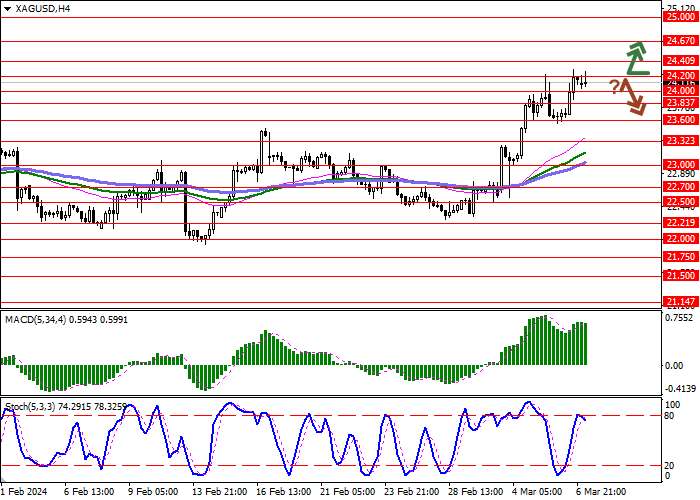

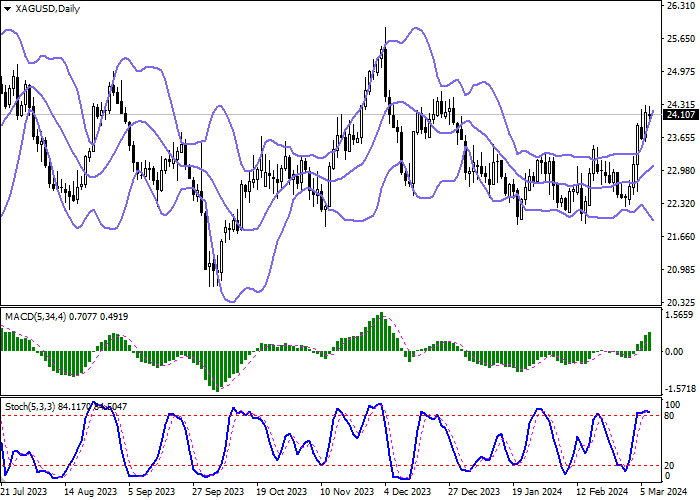

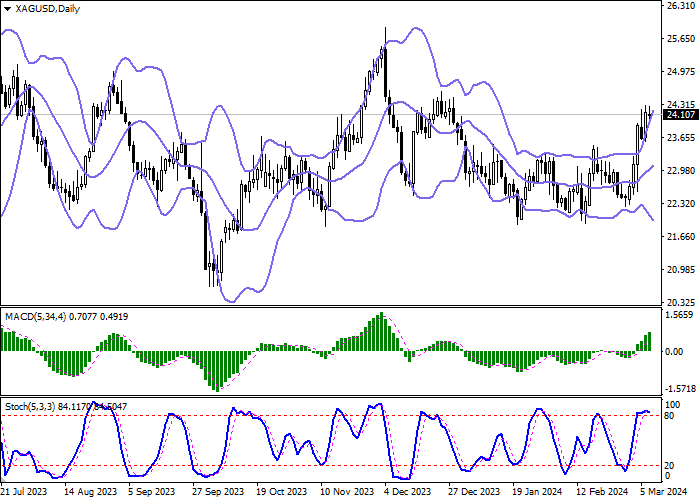

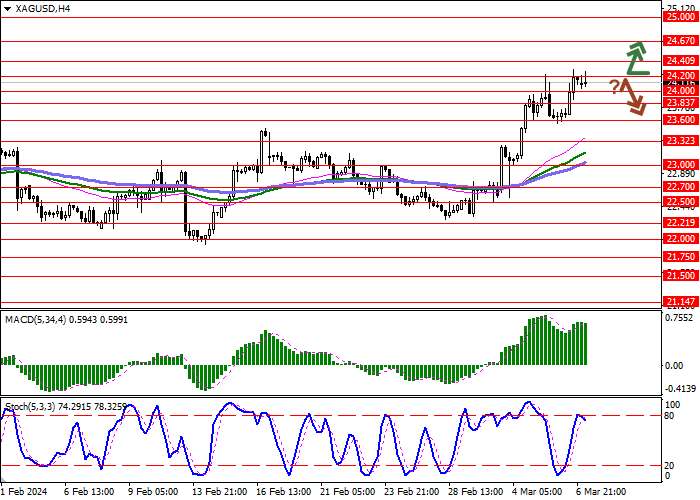

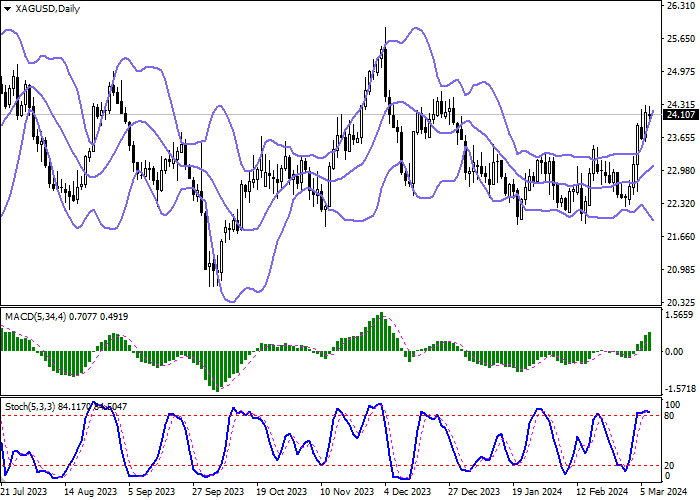

Bollinger Bands in D1 chart show moderate growth. The price range is expanding but it fails to conform to the surge of "bullish" sentiments at the moment. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic, having approached its highs, reversed horizontally, signaling the risks of the instrument being overbought in the near future.

Resistance levels: 24.20, 24.40, 24.67, 25.00.

Support levels: 24.00, 23.83, 23.60, 23.32.

Trading tips

Long positions can be opened after a breakout of 24.20 with the target of 24.67. Stop-loss — 24.00. Implementation time: 1-2 days.

A rebound from 24.20 as from resistance, followed by a breakdown of 24.00 may become a signal for opening of new short positions with the target at 23.60. Stop-loss — 24.20.

Hot

No comment on record. Start new comment.