Current trend

The EUR/GBP pair shows mixed trading, holding close to 0.8560: activity in the market remains low as investors await the emergence of new drivers in the market. In turn, the day before the single currency showed quite noticeable growth, which allowed the "bulls" to restore some of the previously lost positions.

The euro was supported the day before by the results of the speech of US Federal Reserve Chairman Jerome Powell in the US Congress. As expected, the official’s rhetoric largely repeated the points voiced earlier. Thus, according to him, the main obstacle to launching a program to reduce borrowing costs remains uncertainty about the further weakening of price pressure in the country, but the Fed hopes to receive new clear signals of a slowdown in inflation rates in the near future. Still, Powell acknowledged that the nation's economy is growing at a strong pace and interest rates, currently at a 23-year high of 5.25% to 5.50%, are unlikely to be raised again. In addition, the US Federal Reserve does not expect risks of recession in the near future. The next meeting of the regulator is scheduled for March 19-20.

Yesterday's publications from the EU did not have a noticeable impact on the dynamics of quotes for the EUR/GBP pair. Export volumes in Germany increased by 6.3% in January after -4.5% in the previous month, and Imports increased by 3.6% after a sharp decline of 6.7%. Against this background, the trade surplus increased from 23.3 billion euros to 27.5 billion euros, ahead of forecasts of 21.50 billion euros. Retail Sales in the eurozone fell 1.0% in January after falling -0.5% a month earlier, while analysts had expected -1.3%.

The day before, investors paid attention to the UK Budget Report presented by the Chancellor of the Exchequer Jeremy Hunt. In particular, the draft budget provides for a reduction in contributions to the social insurance fund by two percentage points, as well as a temporary freeze of excise taxes on alcohol and fuel. The pound was also slightly supported by macroeconomic statistics on business activity: the February Construction PMI rose from 48.8 points to 49.7 points, with preliminary estimates at 49.0 points.

Support and resistance

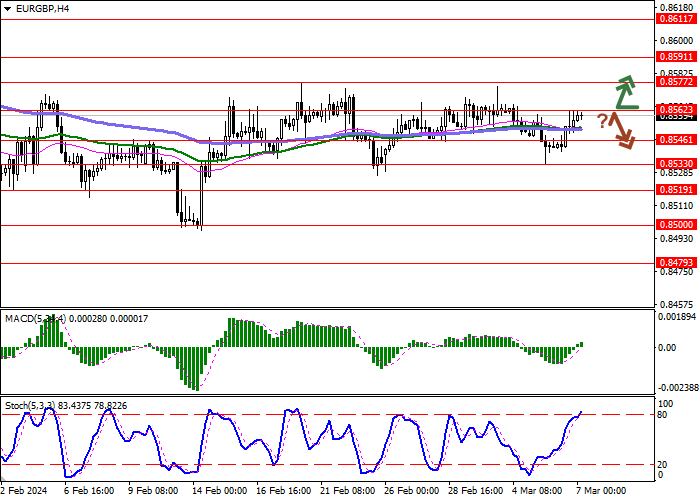

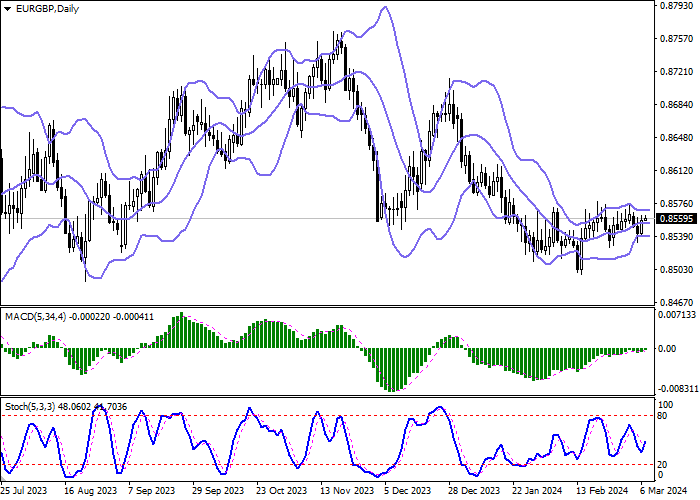

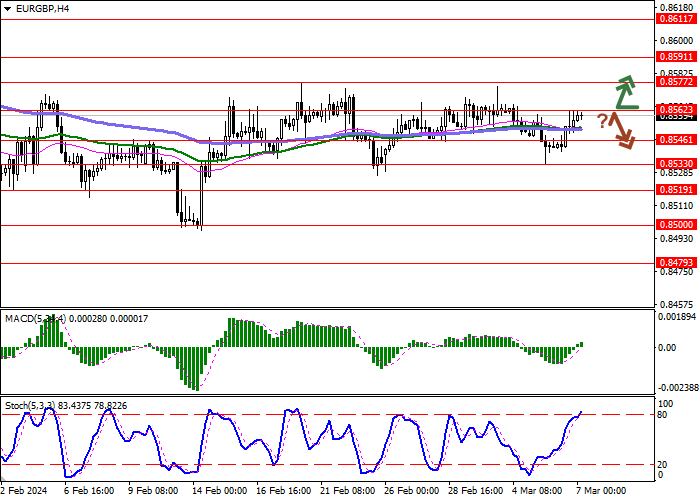

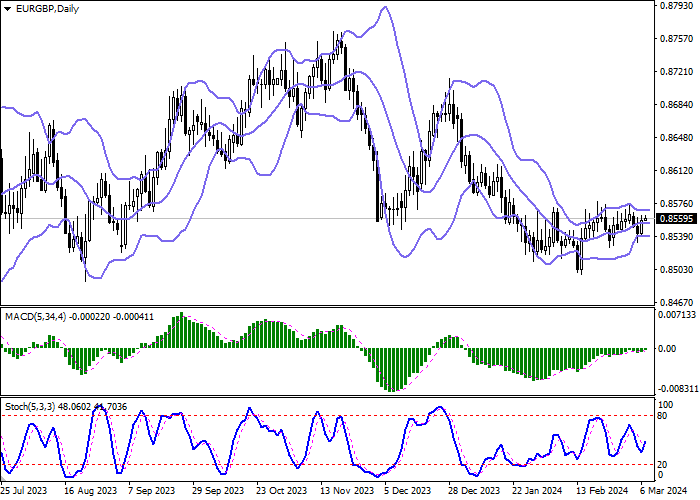

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is almost constant, remaining rather spacious for the current level of activity in the market. MACD is growing preserving a weak buy signal (located above the signal line). Stochastic shows similar dynamics, reversing upwards near the level of "20". At the moment, the indicator is located approximately in the center of its area.

Resistance levels: 0.8562, 0.8577, 0.8591, 0.8611.

Support levels: 0.8546, 0.8533, 0.8519, 0.8500.

Trading tips

Long positions can be opened after a breakout of 0.8562 with the target of 0.8591. Stop-loss — 0.8546. Implementation time: 2-3 days.

A rebound from 0.8562 as from resistance, followed by a breakdown of 0.8546 may become a signal for opening of new short positions with the target at 0.8519. Stop-loss — 0.8562.

Hot

No comment on record. Start new comment.